Narratives are currently in beta

Key Takeaways

- Strategic investments in bid proposals and production capacity expansion are aimed at driving revenue growth and improving future earnings through efficiency gains.

- Strong backlog and advancements in jet engines and tactical drones position Kratos to capture market share in the evolving defense sector.

- Disruptions in the commercial satellite business and reliance on uncertain contracts and investments could hinder Kratos' profitability and growth amidst staffing and budget challenges.

Catalysts

About Kratos Defense & Security Solutions- Kratos Defense & Security Solutions, Inc.

- Kratos is strategically investing in internally funded bid proposals and targeting large single award programs, such as a $1.5 billion opportunity, which, if secured, could significantly increase future revenue growth above the current 10% base case forecast for 2026. This is expected to drive revenue growth.

- The ongoing investments and expansion in Kratos' production capacity, including a new small turbo-fan engine production facility and expanded manufacturing facilities in Israel and India, are designed to meet increased customer demand. This is positioned to improve future earnings and margins through economies of scale and operational efficiencies.

- Kratos’ record backlog in the microwave electronics business, supported by strong demand from strategic partners like the Israeli Defense Forces, Rafael, and Elbit, is expected to sustain strong revenue and margin performance into 2025.

- Kratos' development of low-cost jet engines and tactical drones, particularly the Valkyrie and Athena systems, positions it advantageously to capture market share in a rapidly evolving defense landscape focused on affordability and increased demand for unmanned systems, which could lead to higher revenue and potentially transformative growth.

- The recent success of Kratos' Zeus 1 and Zeus 2 solid rocket motor system test flights and the expected increase in launch activities point to substantial revenue growth opportunities in the rocket systems business, forecasting increased year-over-year revenue contributions driven by demand for strategic defense and hypersonic systems.

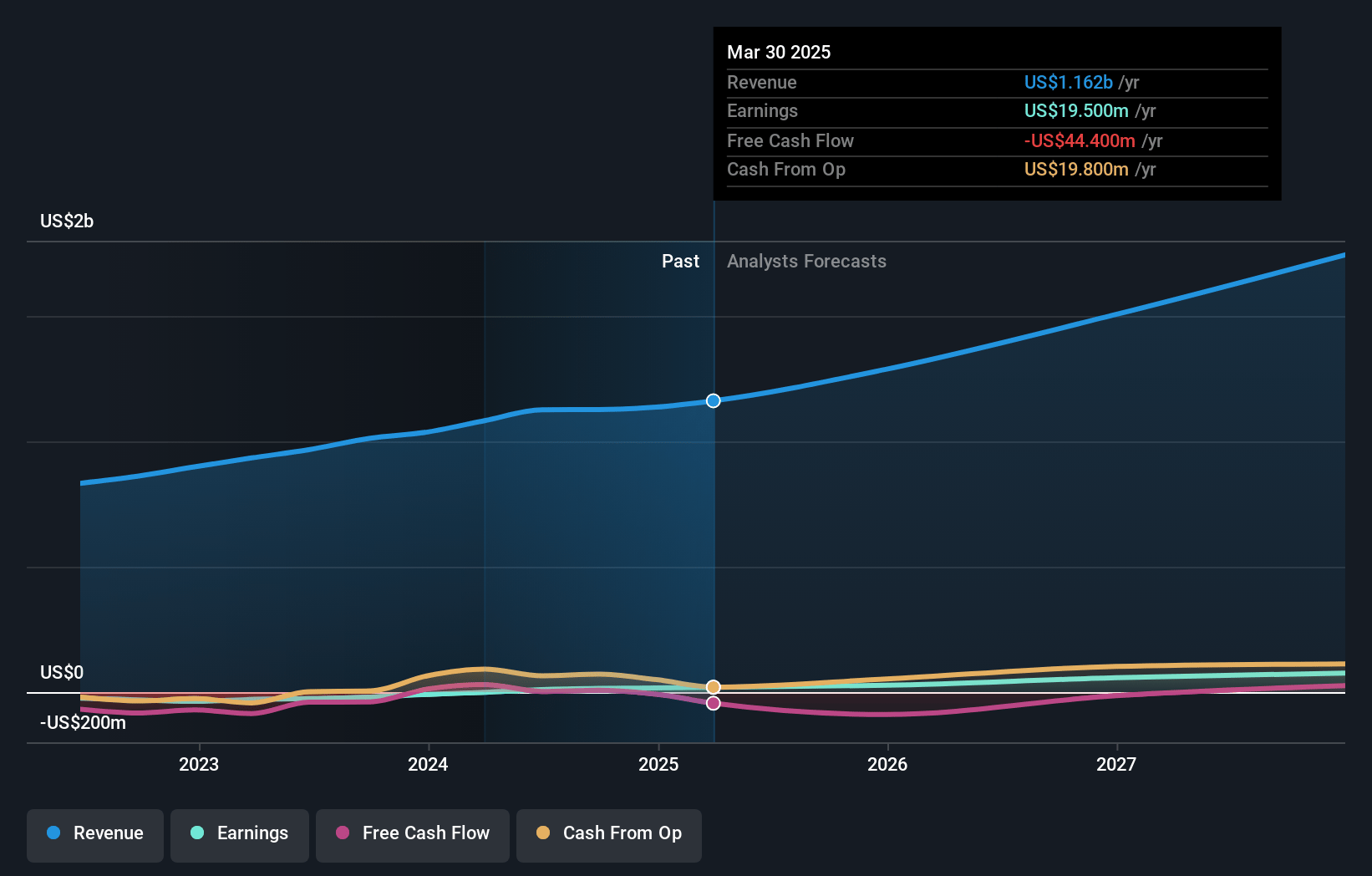

Kratos Defense & Security Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kratos Defense & Security Solutions's revenue will grow by 14.3% annually over the next 3 years.

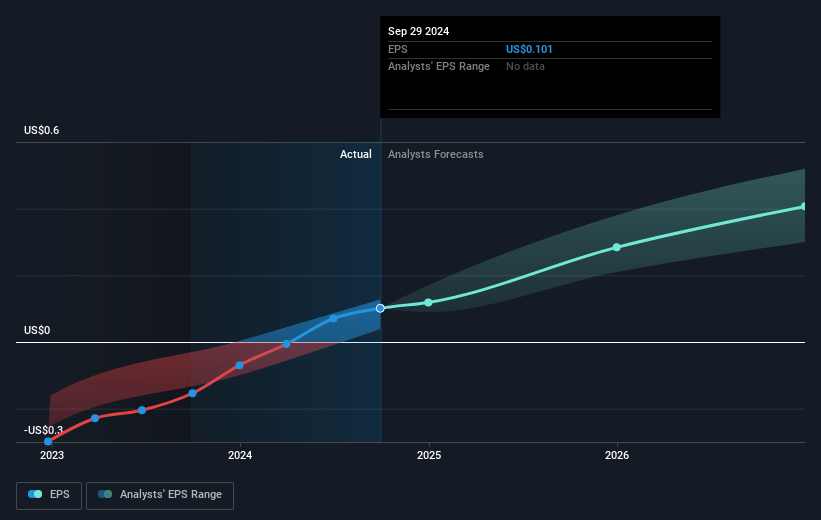

- Analysts assume that profit margins will increase from 1.3% today to 3.6% in 3 years time.

- Analysts expect earnings to reach $59.9 million (and earnings per share of $0.39) by about January 2028, up from $14.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $102.4 million in earnings, and the most bearish expecting $37.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 97.4x on those 2028 earnings, down from 346.4x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.0x.

- Analysts expect the number of shares outstanding to grow by 0.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.26%, as per the Simply Wall St company report.

Kratos Defense & Security Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kratos' commercial satellite business continues to face disruption and challenges due to new software-defined satellite system issues, which could lead to setbacks in revenue and profit contributions from this segment.

- The company is planning significant investments in large single award programs in pursuit of new contracts, which might impact near-term profitability and EBITDA if they do not win these opportunities, thereby affecting net margins.

- Kratos' growth plans heavily rely on internal investments to increase production capacity, such as the new manufacturing facilities in India and Israel, creating financial risk if the anticipated demand does not materialize, affecting both revenue and margins.

- The ongoing challenge of obtaining and retaining qualified personnel could lead to increased operational costs and impact profit margins due to the scarcity of resources in critical areas of operation.

- Despite the strong outlook for defense spending, the company faces uncertainties related to the U.S. government's budget and timing issues, which might delay new program awards and affect revenue continuity and growth projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.36 for Kratos Defense & Security Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $59.9 million, and it would be trading on a PE ratio of 97.4x, assuming you use a discount rate of 6.3%.

- Given the current share price of $33.48, the analyst's price target of $31.36 is 6.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives