Narratives are currently in beta

Key Takeaways

- Expansion into U.S. offshore wind market and efficient new dredges could enhance margins and diversify growth opportunities.

- Strong government support and improved financial flexibility bolster revenue growth potential and investment capability.

- Project execution risks, regulatory challenges, and market conditions could affect revenue growth, net margins, and future opportunities for Great Lakes Dredge & Dock.

Catalysts

About Great Lakes Dredge & Dock- Provides dredging services in the United States.

- The company secured a record backlog of $1.2 billion and additional pending awards, providing visibility for revenue growth into 2026. This backlog indicates robust future revenue prospects.

- Delivery and deployment of new efficient dredges like Galveston Island and Amelia Island are expected to improve project performance and margins due to their efficiency, particularly in beach renourishment projects.

- Expansion into the U.S. offshore wind market with the vessel Acadia, which already has contracts and vessel reservation agreements, presents significant long-term growth opportunities and potential revenue diversification.

- Strong support from U.S. government funding for dredging projects ensures a stable bid market, enhancing revenue growth potential and supporting sustained business operations.

- The company's improved liquidity and stronger credit position after securing cash availability and not having debt maturities until 2029 provide financial flexibility for growth investments, potentially improving earnings over time.

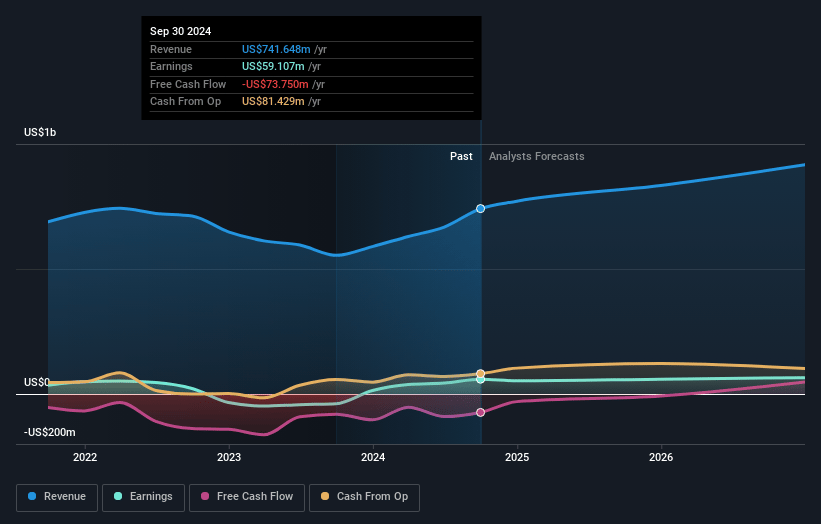

Great Lakes Dredge & Dock Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Great Lakes Dredge & Dock's revenue will grow by 9.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.0% today to 6.9% in 3 years time.

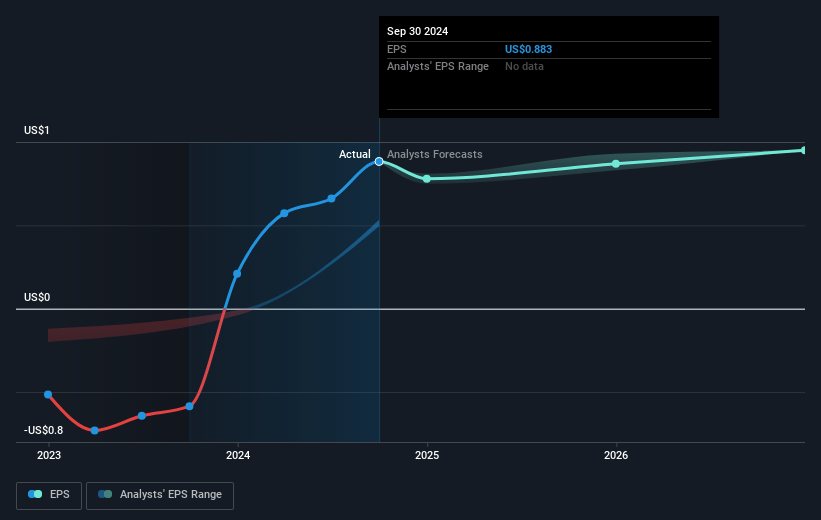

- Analysts expect earnings to reach $67.4 million (and earnings per share of $0.99) by about January 2028, up from $59.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, up from 12.2x today. This future PE is lower than the current PE for the US Construction industry at 31.2x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.36%, as per the Simply Wall St company report.

Great Lakes Dredge & Dock Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Biden administration's temporary pause on approving new LNG export licenses could impact Great Lakes Dredge & Dock's awarded projects if extended or expanded, potentially affecting future revenue growth.

- The company's significant backlog comes with project execution risks, including potential delays or cost overruns on large projects, which could affect net margins if project costs increase beyond current estimates.

- The construction and delivery timelines of new vessels like the Amelia Island and the subsea installation vessel Acadia could face challenges, especially with changes in ownership at Philly Shipyard, risking increased capital expenditure and subsequent cash flow impacts.

- The increase in general and administrative expenses driven by higher incentive pay due to this year's financial results may not sustain if future financial performance does not meet expectations, affecting net margins in such cases.

- Future growth in the offshore wind market and potential expansion into international projects for Acadia depends on regulatory approvals and market conditions, which could impact revenue realization if these anticipated opportunities do not materialize as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.67 for Great Lakes Dredge & Dock based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $980.1 million, earnings will come to $67.4 million, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of $10.76, the analyst's price target of $14.67 is 26.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives