Last Update 26 Mar 25

Key Takeaways

- Geographic expansion and strategic investments are set to drive significant revenue growth and improve profitability by optimizing product offerings and market penetration.

- AI-backed joint ventures and cost optimization strategies are enhancing competitive advantage and margins, supporting sustained earnings growth.

- Decreased margins, high operating expenses, and a stagnant market threaten FGI Industries' profitability and future revenue, raising concerns about financial stability and investor confidence.

Catalysts

About FGI Industries- FGI Industries ltd. supplies kitchen and bath products in the United States, Canada, Europe, and internationally.

- FGI Industries is focusing on geographic expansion in Europe and India, which are promising regions for driving future revenue growth. This expansion is expected to significantly enhance revenue by tapping into new markets.

- The company's shift towards lower-priced Bath Furniture offerings and alignment with market pricing and design trends are driving substantial revenue growth, benefiting net margins by increasing market share and optimizing product mix.

- Strategic investments in the Shower Systems and custom kitchen cabinetry segments, like Covered Bridge, which reported strong revenue increases, are expected to boost future earnings by capitalizing on positive demand trends and solidifying customer relationships.

- The Isla Porter joint venture leveraging an AI-backed digital sales platform is establishing significant relationships with the premium design community, likely providing a competitive advantage that could drive revenue growth and potentially improve net margins.

- FGI is working on reengineering assortments to better meet market pricing and trends, which, along with expectations of reducing freight costs and promotional expenses, is likely to improve gross margins and enhance profitability in the future, thereby supporting better earnings.

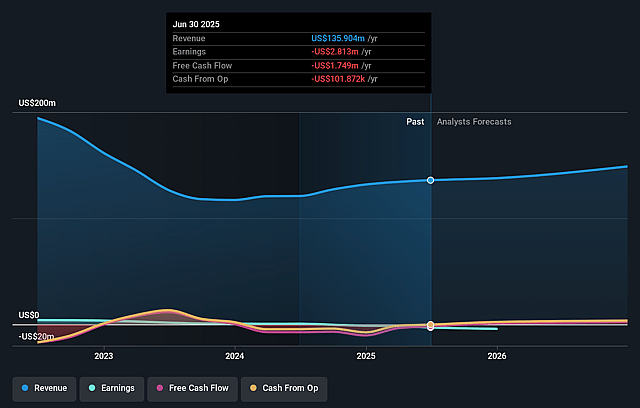

FGI Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming FGI Industries's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.2% today to 1.5% in 3 years time.

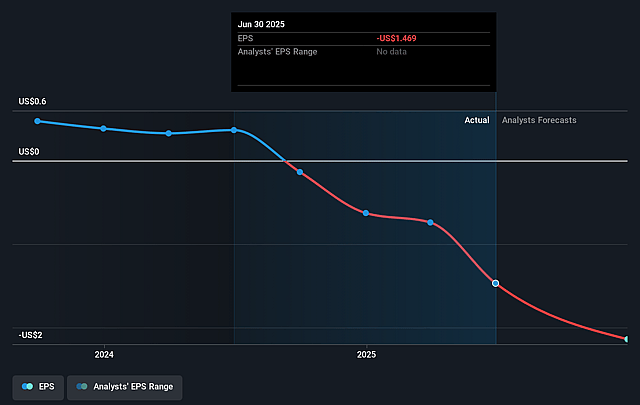

- Analysts expect earnings to reach $2.3 million (and earnings per share of $0.23) by about March 2028, up from $-259.8 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, up from -32.8x today. This future PE is lower than the current PE for the US Trade Distributors industry at 19.8x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

FGI Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in gross margin from 26.2% to 25.8% due to a higher mix of Sanitaryware and Bath Furniture and increased freight costs could continue to compress margins and affect profitability if not addressed.

- The operating expenses increased by 27.6%, contributing to a GAAP operating loss, indicating that investment in growth initiatives like Cover Bridge and Isla Porter may not yield immediate returns and negatively impact net margins and earnings.

- FGI's updated guidance forecasts negative or breakeven operating and net income for the year, which suggests potential ongoing financial challenges that could impact future earnings and investor confidence.

- With the industry outlook remaining flat and customers forecasting minimal growth in 2024, there is a risk that FGI's revenue growth may not be sustainable in a stagnant market, affecting future revenue projections.

- The cautious optimism about industry growth and the impact of fluctuating freight rates and promotional costs indicate uncertainty in the market, which could lead to unpredictable earnings and a volatile financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.5 for FGI Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $156.9 million, earnings will come to $2.3 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of $0.89, the analyst price target of $2.5 is 64.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on FGI Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.