Key Takeaways

- Broadwind's investments in innovative technologies aim to reduce costs and improve profitability, potentially increasing net margins.

- Expansion into high-margin markets and aerospace diversification suggests potential for increased revenue and stability.

- Broadwind faces declining revenues across segments, with significant reductions in wind tower demand impacting growth and increased borrowings leading to higher interest expenses.

Catalysts

About Broadwind- Manufactures and sells structures, equipment, and components for clean tech and other specialized applications primarily in the United States.

- Broadwind has invested in innovative technology to improve process capabilities, such as a new portable milling system and portable laser scanning, which should reduce costs and improve profitability, likely increasing net margins.

- The company has undertaken significant actions to align its cost structure with current demand, which will contribute to more than $4 million in annualized cost savings and position it for improved operating leverage, positively impacting net margins and earnings.

- Increased demand across all segments, particularly in Heavy Fabrication for wind turbine adapters and Gearing for power generation and infrastructure markets, signals potential for future revenue growth.

- Expansion into higher-margin adjacent markets and elevated quoting activity, particularly in Heavy Fabrications and Industrial Solutions, suggest increased future revenue as they capitalize on improved demand in non-wind markets.

- Entry into the aerospace market with AS9100 quality certification and broadened sales mix into less cyclical markets for the Gearing segment signal potential future revenue diversification and stability.

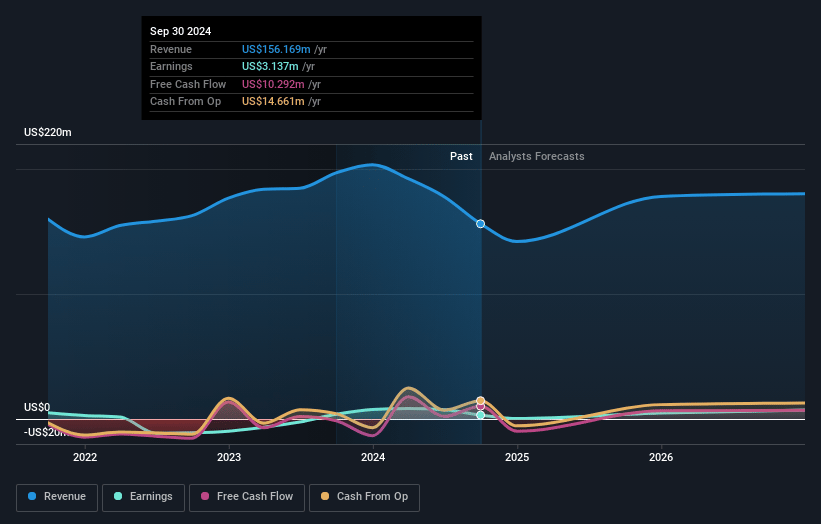

Broadwind Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Broadwind's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.0% today to 5.3% in 3 years time.

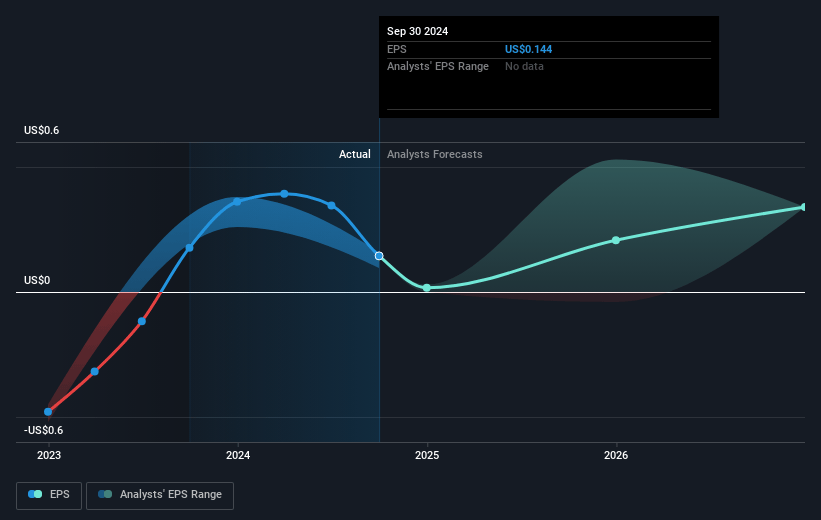

- Analysts expect earnings to reach $10.6 million (and earnings per share of $0.49) by about January 2028, up from $3.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, down from 12.1x today. This future PE is lower than the current PE for the US Electrical industry at 23.4x.

- Analysts expect the number of shares outstanding to decline by 0.95% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.67%, as per the Simply Wall St company report.

Broadwind Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Broadwind reported a significant 46% year-over-year decline in revenue for its Heavy Fabrications segment, primarily due to decreased demand for wind towers. This decline could impact overall revenue growth prospects if wind demand does not recover.

- The company experienced a 19.6% reduction in Gearing revenue, attributed to softness in the oil and gas market, which could continue to negatively affect net margins if this sector does not rebound.

- Industrial Solutions segment revenue declined 22.8% year-over-year due to the absence of a large international project that did not repeat. This suggests reliance on such projects for growth, potentially impacting revenues if not replaced with similar scale orders.

- The Q3 EBITDA of $3.4 million represents a significant decrease from $7.6 million in the prior year, driven largely by reduced wind tower sales. This decline in earnings could affect the company's ability to reinvest in growth initiatives.

- Anticipated temporary increases in borrowings due to higher working capital needs for holding finished goods could lead to increased interest expenses, affecting net margins and financial flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.58 for Broadwind based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $2.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $198.8 million, earnings will come to $10.6 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 9.7%.

- Given the current share price of $1.72, the analyst's price target of $4.58 is 62.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives