Narratives are currently in beta

Key Takeaways

- Axon's AI and VR innovations, coupled with key acquisitions, are driving revenue growth and increasing market adoption in public safety and international sectors.

- Strong bookings and economies of scale suggest robust demand, higher margins, and potential for enhanced future earnings and shareholder value.

- Reliance on AI and new tech adoption, potential TASER production constraints, and international regulatory challenges could impact Axon's growth and revenue.

Catalysts

About Axon Enterprise- Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

- Axon's investment in AI innovation and their new AI Era bundle is expected to offer customers an ever-evolving suite of solutions, enhancing product value and increasing future software revenue growth.

- The TASER 10 and virtual reality training continue to disrupt public safety de-escalation practices, driving steady growth in both revenue and widespread adoption in various segments and international markets.

- Recent acquisitions, like Dedrone for drones and robotics, are accelerating Axon's capabilities and market penetration, indicating potential future revenue streams and higher operating leverage.

- Axon's strong Q3 bookings, reaching over $1 billion, and record international bookings reflect robust demand across sectors, bolstering expectations for continued revenue growth and increasing margins.

- Axon's ability to achieve economies of scale with significant revenue growth while expanding its adjusted EBITDA margins signifies potential future earnings growth and enhanced shareholder value.

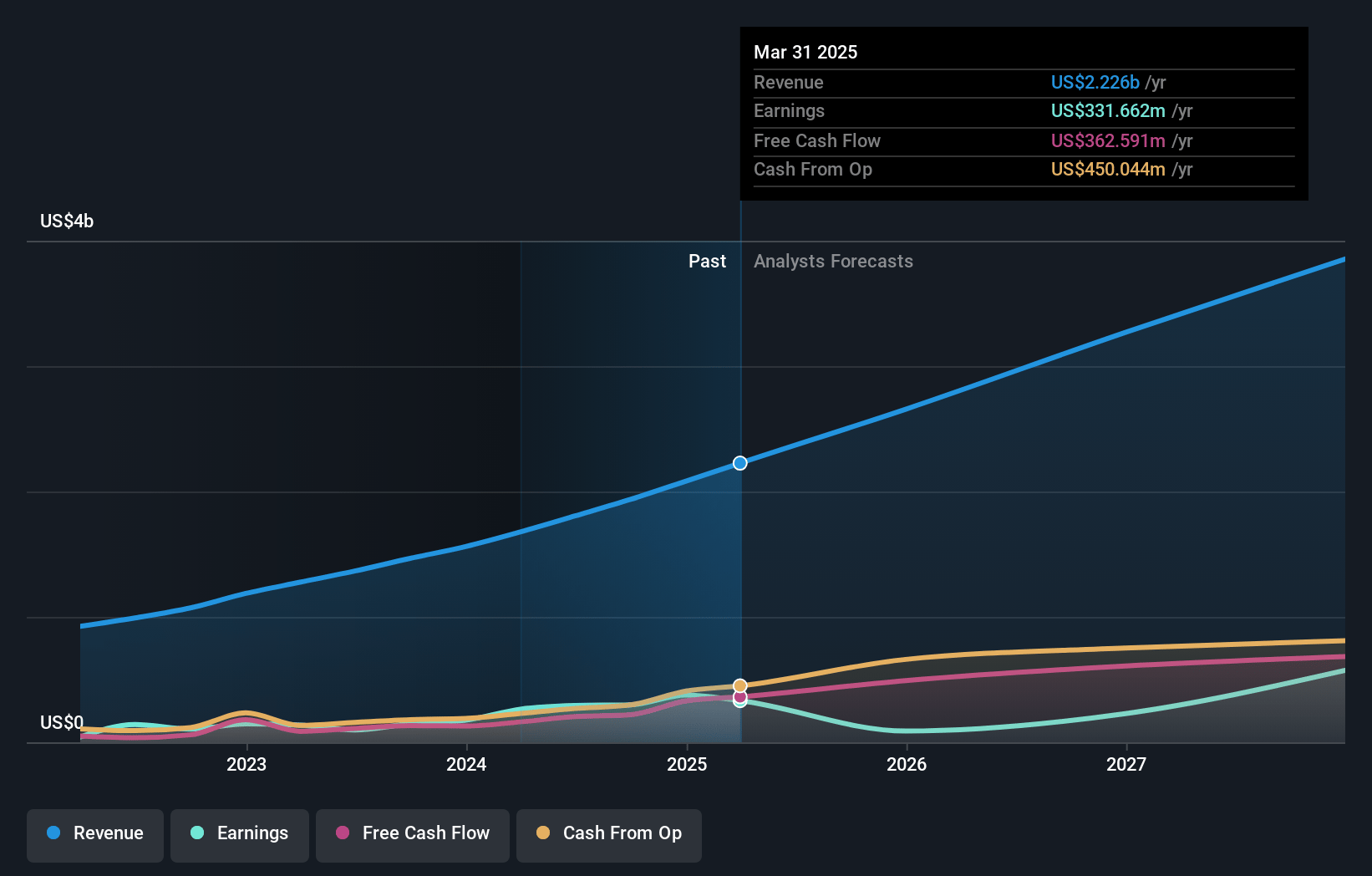

Axon Enterprise Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Axon Enterprise's revenue will grow by 22.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.3% today to 13.7% in 3 years time.

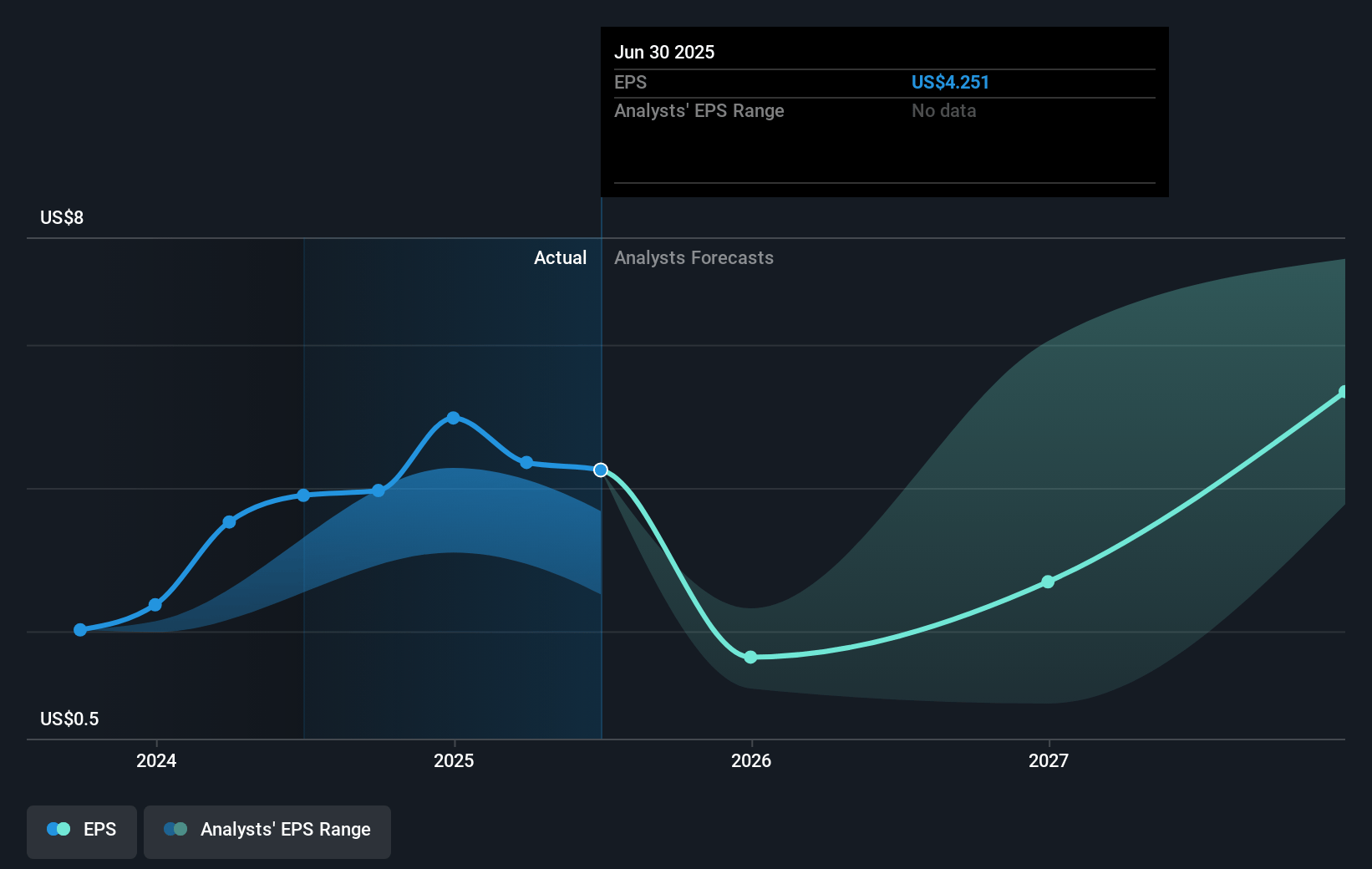

- Analysts expect earnings to reach $488.1 million (and earnings per share of $4.18) by about November 2027, up from $297.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $616.1 million in earnings, and the most bearish expecting $341.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 154.8x on those 2027 earnings, up from 152.6x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 35.9x.

- Analysts expect the number of shares outstanding to grow by 15.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.04%, as per the Simply Wall St company report.

Axon Enterprise Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s growth strategy is heavily reliant on broad adoption of AI and new technologies, which are inherently uncertain and could be outpaced by competitor innovations or shifts in customer needs, potentially impacting future revenue and earnings.

- There is a risk of capacity constraints impacting TASER production, which could hinder the ability to meet growing demand and slow revenue growth in this key segment.

- The international expansion strategy for TASER and other products is contingent upon navigating complex regulatory environments and establishing new customer relationships in diverse markets, which could slow anticipated growth and impact future revenues.

- Adjusted EBITDA margins are expected to slightly decline in the next quarter due to timing issues with expenses and the integration costs of recent acquisitions like Dedrone, which could pressure net margins.

- There is execution risk associated with maintaining high growth rates across all business segments while scaling operations, as any missteps could lead to missed targets and negatively affect earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $546.15 for Axon Enterprise based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $650.0, and the most bearish reporting a price target of just $385.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.6 billion, earnings will come to $488.1 million, and it would be trading on a PE ratio of 154.8x, assuming you use a discount rate of 6.0%.

- Given the current share price of $595.18, the analyst's price target of $546.15 is 9.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives