Key Takeaways

- Strategic financial maneuvers have improved net interest margins, capital flexibility, and earnings potential, aiding expansion and defense strategies.

- Loan growth and strategic hirings in key markets enhance revenue prospects and operational capacity, strengthening market presence and service offerings.

- Margin pressures and economic risks could negatively impact SouthState's revenue, net interest margins, and overall earnings amidst competitive challenges and slow balance sheet growth.

Catalysts

About SouthState- Operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies in the United States.

- The successful closing of the Independent Financial transaction, alongside a series of strategic financial maneuvers, has notably increased SouthState's net interest margin to 3.85%, thereby enhancing earnings potential and eventually benefiting revenue and net margins.

- An increase in capital ratios, higher than initially modeled, provides SouthState with the flexibility to allocate surplus capital towards offensive strategies (such as expansion and growth opportunities) or defensive measures as needed, which could positively impact future earnings.

- The pipeline for new loans is reportedly up 44% since the beginning of the year, indicating encouraging prospects for loan growth in subsequent quarters, specifically within thriving markets like Atlanta and Florida, which is expected to boost future revenue streams.

- Recent strategic hirings in various markets, including Nashville, Tampa, and Raleigh, aim to bolster the bank’s operational capacity post-conversion, setting the stage for enhanced revenue growth through expanded market presence and service offerings.

- The accretive yield benefits from the ongoing repricing of Independent's loans and securities are projected to maintain a stable loan yield, supporting sustained NII performance in a stable rate environment, thereby favorably impacting the bank’s earnings profile.

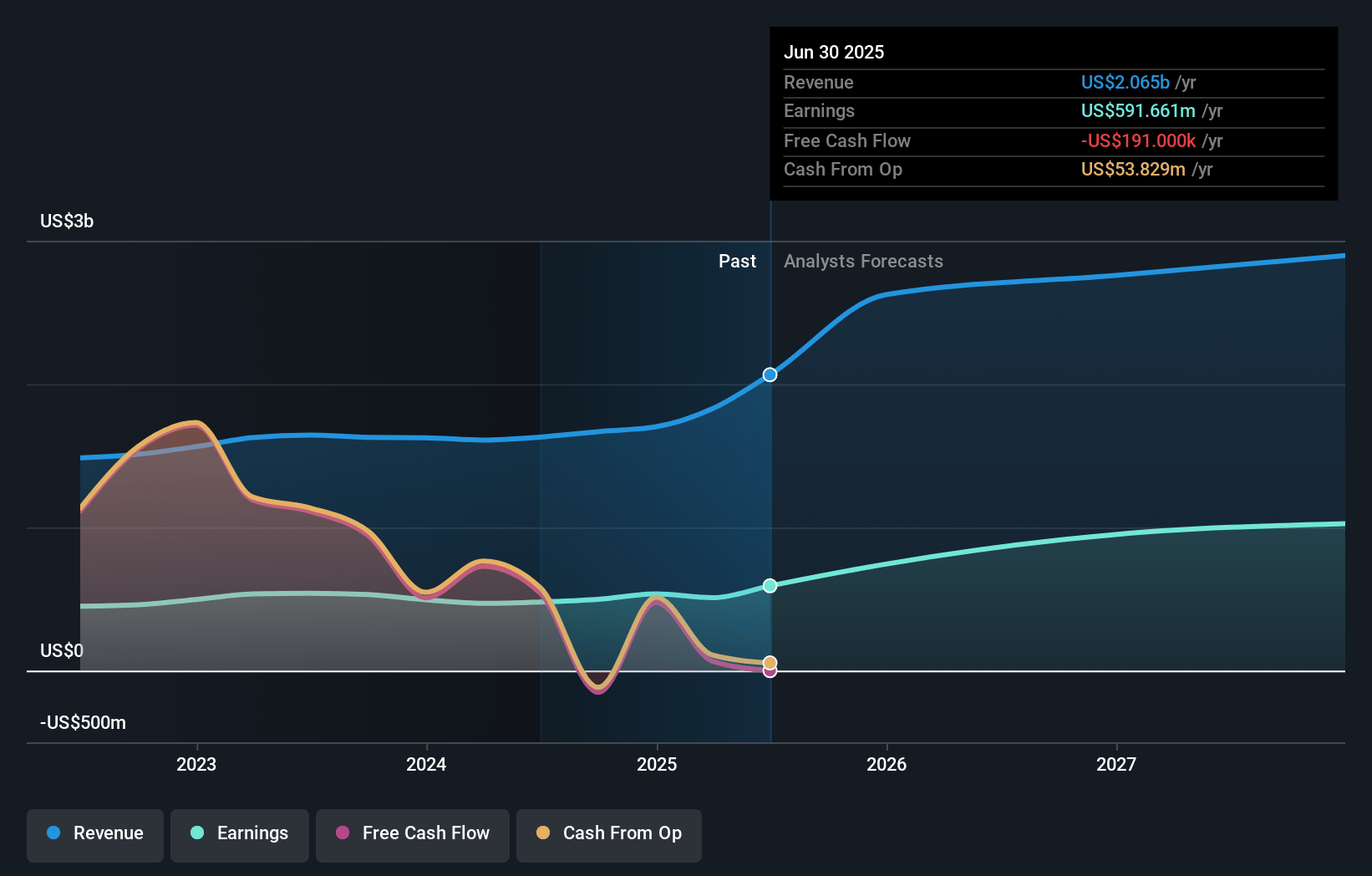

SouthState Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SouthState's revenue will grow by 21.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 27.8% today to 37.7% in 3 years time.

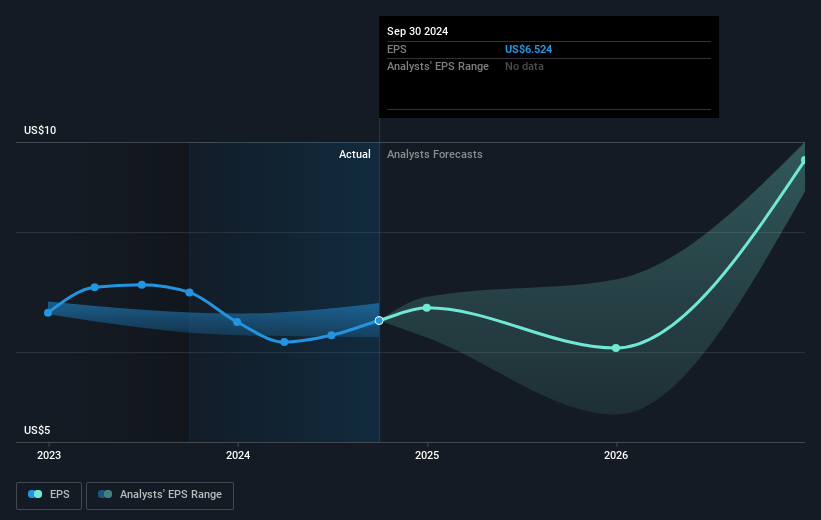

- Analysts expect earnings to reach $1.2 billion (and earnings per share of $9.96) by about July 2028, up from $508.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, down from 19.6x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

SouthState Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slowdown in balance sheet growth, partly due to a slowing general economy and stiff competition on loan pricing, could impact SouthState's revenue growth prospects.

- Concerns about the impact of tariffs on the growth trajectory, with clients pausing capital projects, could lead to reduced loan demand and subsequently lower interest income.

- Margin pressures from a strong competitive environment, highlighted by pricing challenges for loans, might negatively affect net interest margins and overall earnings.

- The possibility of an economic recession or downturn cited as a risk, which could lead to increased credit losses or reduced loan growth, adversely impacting net margins and earnings.

- The conversion of banking systems following the IBTX transaction could potentially lead to inefficiencies or errors, affecting operational costs and net margins if not managed smoothly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $113.909 for SouthState based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 6.4%.

- Given the current share price of $98.35, the analyst price target of $113.91 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.