Narratives are currently in beta

Key Takeaways

- Renewable energy goals and community support initiatives may enhance M&T Bank's reputation and reduce expenses, potentially boosting revenue and net margins.

- Diversification in loan portfolios and share repurchase programs indicate stronger earnings potential and improved net income stability.

- Economic conditions and market fluctuations pose risks to loan demand, deposit growth, and net interest margins, impacting M&T Bank's revenue and earnings stability.

Catalysts

About M&T Bank- Operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association that engages in the provision of retail and commercial banking products and services in the United States.

- Launching the third phase of the $25 million program to support nonprofits may drive future growth in community engagement and customer loyalty, thereby potentially boosting revenue.

- The strategy to offset 100% of electricity use with renewable energy by 2030 can enhance the company's reputation and reduce operating expenses, positively impacting net margins.

- The reduction in CRE concentration, coupled with growth in C&I and consumer loans, supports a stronger and more diversified loan portfolio, likely leading to an increase in net interest income and earnings.

- The continuation of share repurchase programs indicates potential for increased earnings per share (EPS), benefiting shareholders through capital return strategies.

- Improving asset quality with a reduction in nonaccrual balances and criticized loans may lead to lower credit costs and enhance net income stability.

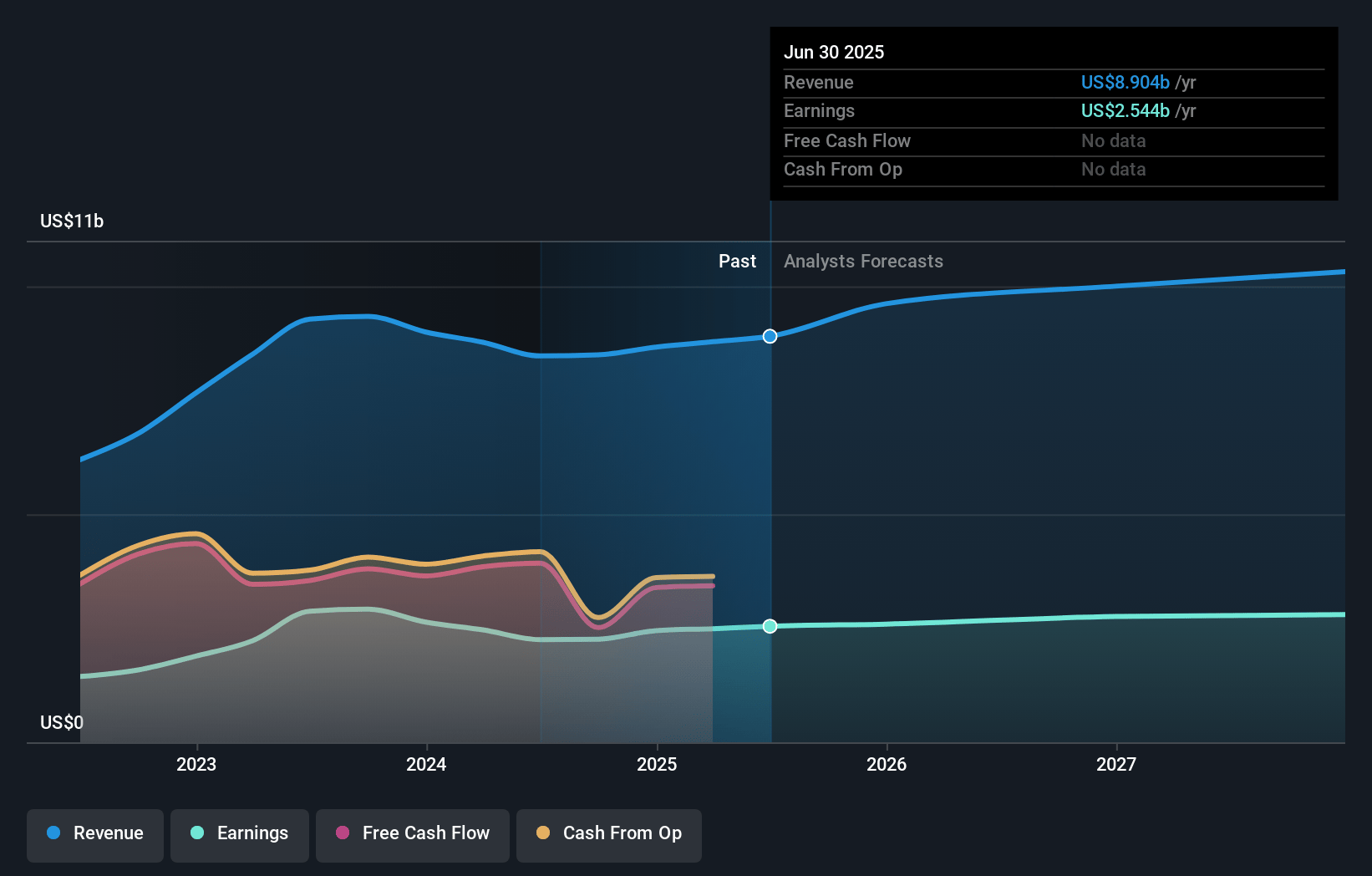

M&T Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming M&T Bank's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.6% today to 28.2% in 3 years time.

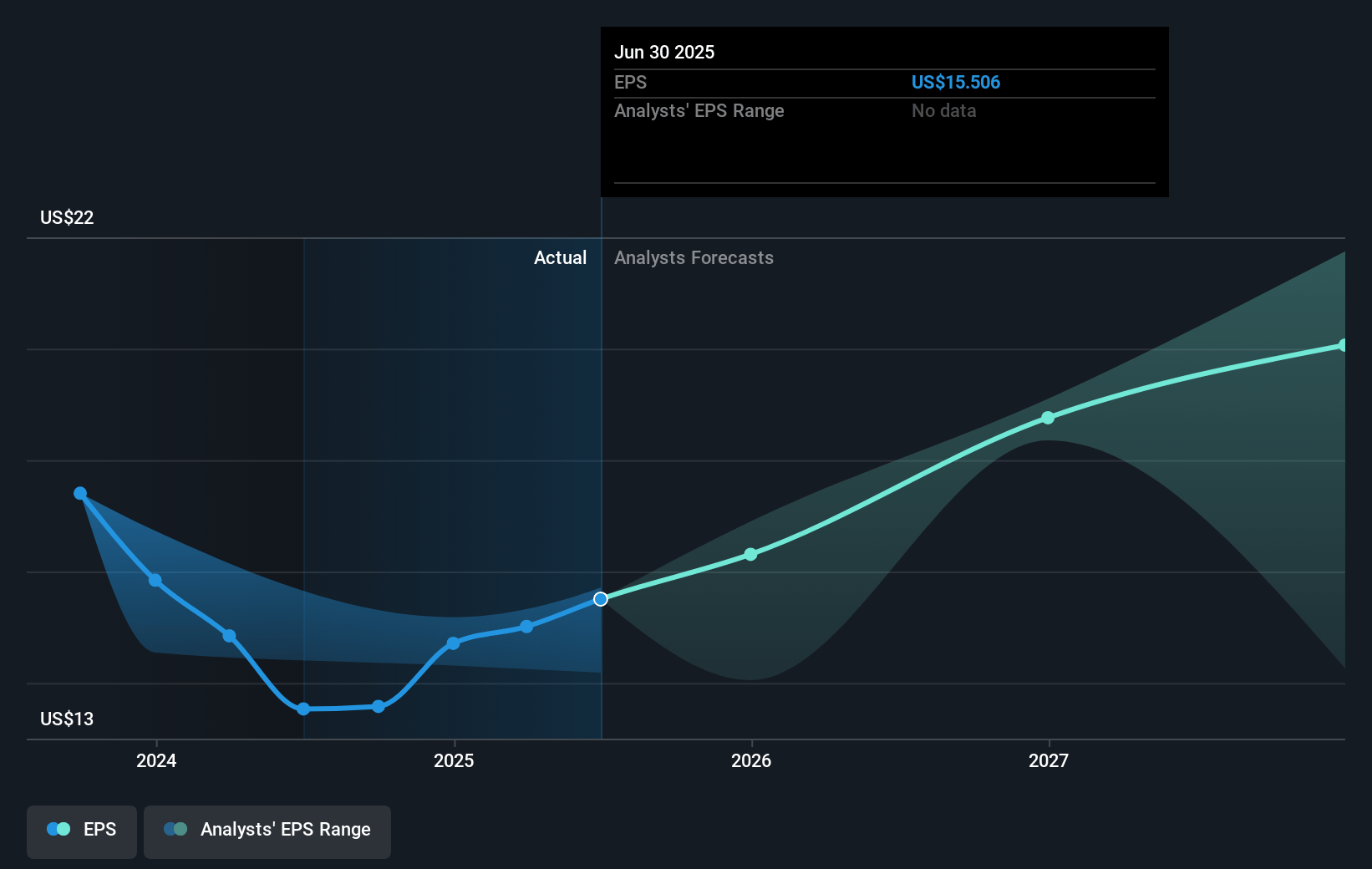

- Analysts expect earnings to reach $2.8 billion (and earnings per share of $18.19) by about January 2028, up from $2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.7x on those 2028 earnings, up from 14.1x today. This future PE is greater than the current PE for the US Banks industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 1.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.02%, as per the Simply Wall St company report.

M&T Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slowdown in consumer spending and the potential for a mild recession could negatively impact loan demand and interest income growth. This risk affects revenue and net interest margin.

- Continued decline in commercial real estate (CRE) loans, which could result in decreased loan portfolio growth and impacts revenue and net interest income.

- Potential future credit loss increases due to the mix shift towards consumer loans, which typically have higher charge-off rates, impacting net margins and earnings.

- The declining noninterest-bearing deposits trend represents a risk to overall deposit growth, affecting funding costs and net interest margin.

- Interest rate fluctuations and uncertainty around the Fed's actions could cause variance in net interest income projections, impacting earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $224.98 for M&T Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $269.0, and the most bearish reporting a price target of just $170.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.1 billion, earnings will come to $2.8 billion, and it would be trading on a PE ratio of 14.7x, assuming you use a discount rate of 6.0%.

- Given the current share price of $192.04, the analyst's price target of $224.98 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives