Last Update01 May 25Fair value Decreased 5.22%

Key Takeaways

- Improved net interest margins and strategic loan origination are expected to drive future earnings and revenue growth.

- Merger with Evergreen Bank Group and potential stock buybacks could enhance profitability and shareholder value.

- Unforeseen costs and credit risk concerns, coupled with declining loan demand, could impede revenue growth and affect future earnings stability.

Catalysts

About Old Second Bancorp- Operates as the bank holding company for Old Second National Bank that provides community banking services in the United States.

- Old Second Bancorp is expected to benefit from improved net interest margins due to favorable deposit acquisition and reduced interest expenses, which will likely enhance future earnings.

- The strategic focus on building commercial loan origination capabilities and repositioning the balance sheet towards more loans and fewer securities is anticipated to drive future revenue growth.

- The successful remediation and focus on reducing classified and substandard loans could lead to stronger credit quality, positively impacting net margins and earnings.

- The upcoming merger with Evergreen Bank Group, combined with a robust liquidity position, presents opportunities for stronger profitability and potentially higher earnings.

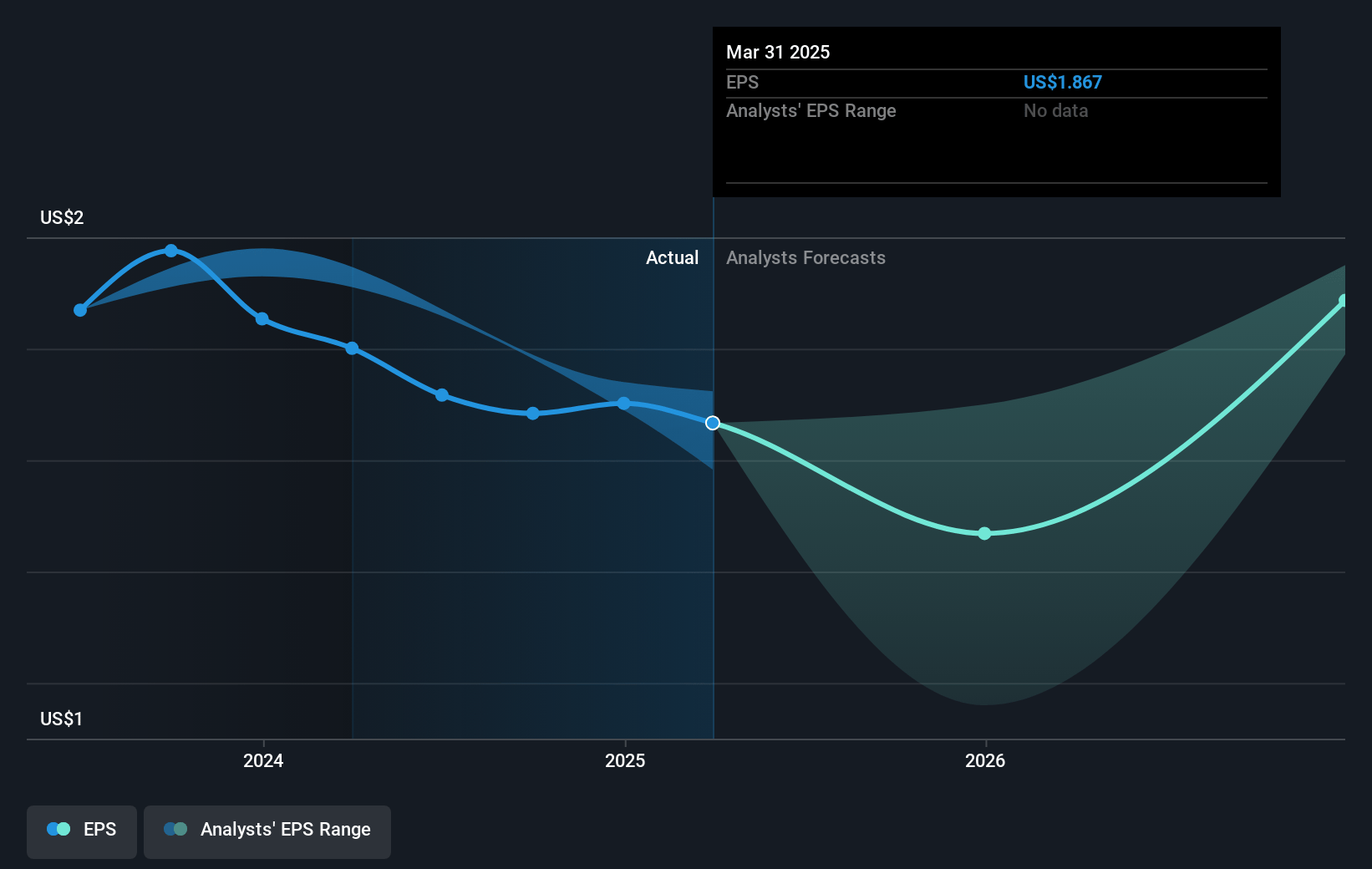

- The potential for future stock buybacks post-merger could be a catalyst for earnings per share growth, enhancing shareholder value.

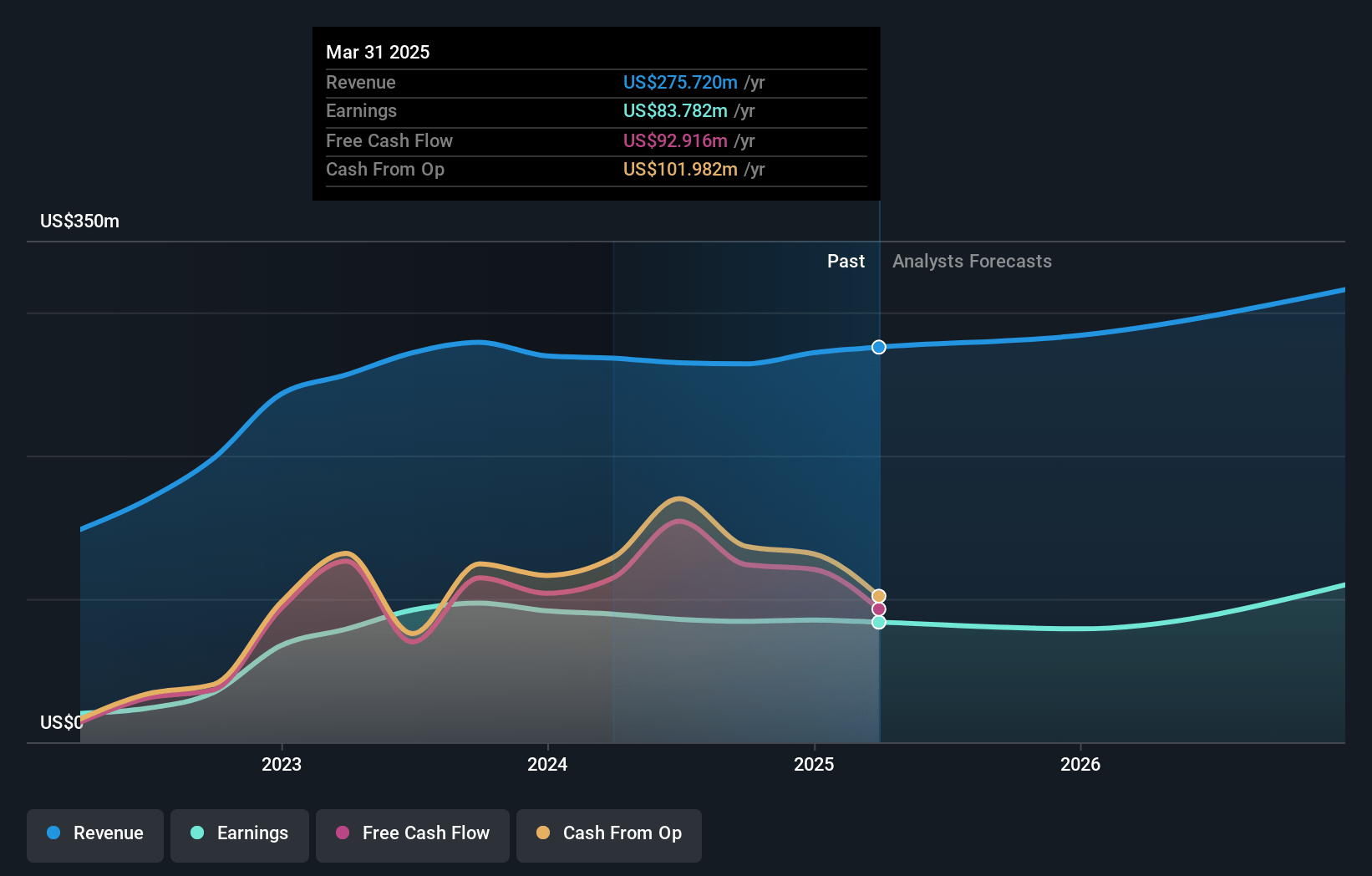

Old Second Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Old Second Bancorp's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 30.4% today to 35.0% in 3 years time.

- Analysts expect earnings to reach $116.5 million (and earnings per share of $2.02) by about May 2028, up from $83.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.7x on those 2028 earnings, up from 8.7x today. This future PE is lower than the current PE for the US Banks industry at 11.0x.

- Analysts expect the number of shares outstanding to grow by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Old Second Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The occurrence of significant mark-to-market losses and merger-related expenses suggests that unforeseen costs could impact earnings negatively, thereby impacting net margins.

- A $2.4 million provision for credit losses in the absence of significant loan growth indicates potential credit risk concerns, which could negatively affect after-tax earnings if similar situations persist.

- A decrease in total loans, particularly driven by reductions in commercial real estate owner-occupied and multifamily portfolios, might indicate demand issues, potentially affecting future revenue growth.

- The cautious approach towards loan growth due to market volatility, interest rate changes, and uncertainties around global tariffs could limit revenue growth opportunities.

- Although deposit growth is strong, concerns about credit deterioration in C&I loans and past issues with criticized assets point to potential risks that might affect future earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.0 for Old Second Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $332.6 million, earnings will come to $116.5 million, and it would be trading on a PE ratio of 9.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $16.14, the analyst price target of $21.0 is 23.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.