Last Update 31 Jul 25

With consensus forecasts for Home Bancorp’s revenue growth (-2.8% per annum) and net profit margin (33.47%) both essentially unchanged, the analyst price target remains stable at $62.25.

What's in the News

- Net charge-offs for the second quarter were $335,000, down from $510,000 a year ago.

- Repurchased 138,315 shares (1.75%) for $6.05 million, completing the buyback of 405,000 shares (5.04%) for $17.32 million under the October 2023 program.

- Repurchased 8,928 shares (0.11%) for $0.39 million, completing the buyback announced in April 2025.

- Closed its buyback plan in the second quarter of 2025.

- Declared a quarterly cash dividend of $0.29 per share.

Valuation Changes

Summary of Valuation Changes for Home Bancorp

- The Consensus Analyst Price Target remained effectively unchanged, at $62.25.

- The Consensus Revenue Growth forecasts for Home Bancorp remained effectively unchanged, at -2.8% per annum.

- The Net Profit Margin for Home Bancorp remained effectively unchanged, at 33.47%.

Key Takeaways

- Expansion in high-growth markets and investing in digital platforms drive revenue growth, efficiency, and improved customer experience.

- Focus on core deposits, prudent risk management, and selective acquisitions strengthens earnings stability and supports long-term market share gains.

- Geographic concentration, asset quality concerns, deposit competition, and digital banking gaps could constrain growth, compress margins, and challenge Home Bancorp's long-term competitiveness.

Catalysts

About Home Bancorp- Operates as the bank holding company for Home Bank, National Association that provides various banking products and services in Louisiana, Mississippi, and Texas.

- Sustained population growth and urbanization in secondary/tertiary markets, coupled with targeted expansion in high-growth areas like Houston, support continued loan and deposit growth, driving future revenue increases.

- Ongoing investment in digital banking platforms and process automation is poised to improve efficiency and customer experience, positioning the company to widen net margins and lower expense ratios over time.

- Strategic focus on core deposit growth-demonstrated by shifting incentives and a rising share of noninterest-bearing deposits-lowers funding costs and boosts net interest margins, supporting higher earnings.

- Prudent risk management and strong asset quality, with consistently low net charge-offs and conservative underwriting, reduce the risk of credit losses and provide more stable long-term earnings.

- Improving M&A environment, combined with Home Bancorp's strong capital and track record, creates catalysts for disciplined acquisitions, potentially expanding market share and accelerating revenue and EPS growth.

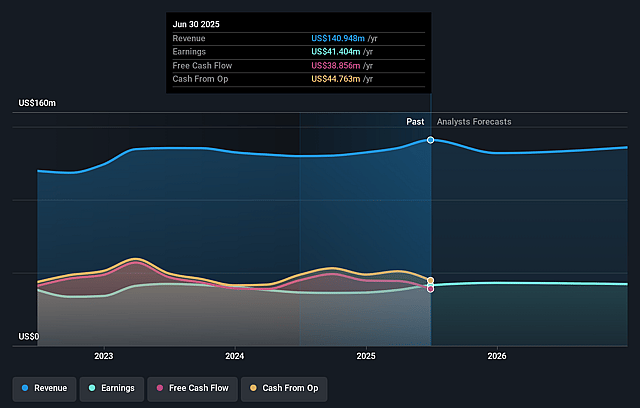

Home Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Home Bancorp's revenue will decrease by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 29.4% today to 33.5% in 3 years time.

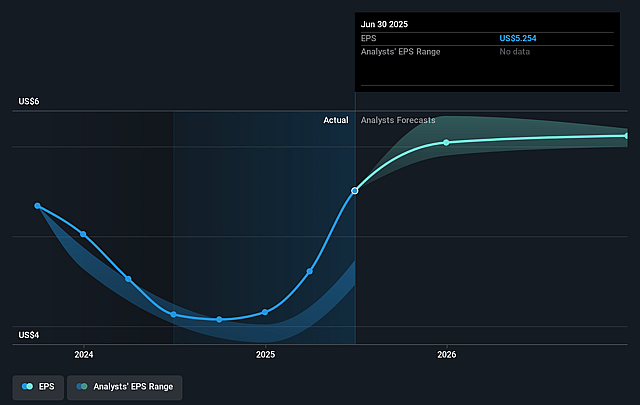

- Analysts expect earnings to reach $43.3 million (and earnings per share of $5.91) by about September 2028, up from $41.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 10.6x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 3.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Home Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Home Bancorp's limited geographic diversification, with loan growth and M&A considerations concentrated in the Gulf South (primarily Louisiana and Texas), exposes the company to localized economic downturns or competitive pressures, which could restrict future revenue growth and earnings resilience.

- Slower-than-expected loan growth-recent quarters have seen increased loan paydowns and a reliance on lower interest rates to stimulate demand-signals sensitivity to broader macroeconomic factors such as rate cuts and construction activity, raising the risk of muted revenue expansion if economic conditions stall.

- A notable uptick in classified and criticized loans, especially in the CRE segment (Houston and New Orleans), could indicate early signs of asset quality deterioration; if trends worsen, credit losses may rise, pressuring net margins and future earnings.

- Increasing competition for core deposits, as alluded to in the call, could drive up funding costs over time, especially if deposit growth strategies are not sustainable or if industry-wide competition intensifies-potentially squeezing net interest margins and profitability.

- The lack of commentary or concrete evidence of significant investment or leadership in digital banking and technology, especially compared to larger or fintech-enabled competitors, raises long-term concerns about customer retention, operational efficiency, and competitive positioning, all potentially impacting future revenue and margin growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $62.25 for Home Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $129.3 million, earnings will come to $43.3 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $56.06, the analyst price target of $62.25 is 9.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.