Narratives are currently in beta

Key Takeaways

- Restructuring in key regions and operational efficiency efforts are driving improved profitability and enhancing net margins and cash flow.

- Innovation in EVs and hybrid vehicles, along with Ford Pro's high-margin software services, is set to boost revenue and earnings stability.

- Ford faces risks to margins and revenue from EV price wars, warranty costs, rising competition, pricing pressures, inflation, and supply chain issues.

Catalysts

About Ford Motor- Develops, delivers, and services a range of Ford trucks, commercial cars and vans, sport utility vehicles, and Lincoln luxury vehicles worldwide.

- Ford has restructured its international operations in key regions like Europe, South America, India, and China, transforming previously loss-making areas into profitable ventures. This focus on lean operations and cost control is expected to positively impact net margins and free cash flow.

- The company's electric vehicle (EV) strategy includes cost reductions, product profitability within the first year, and the launch of a next-generation midsized electric pickup. This proactive approach and innovation in EVs are anticipated to boost future revenue and improve earnings.

- Ford's commercial vehicle segment, Ford Pro, combines products with software and services, increasing recurring high-margin revenue. The growth in software-driven revenue and Pro services is expected to enhance net margins and earnings.

- The strong performance and expansion of Ford's hybrid vehicles, with significant market share and doubled sales over two years, position the company to capitalize on this trend, thereby supporting revenue growth and stabilizing earnings.

- Ongoing improvements in manufacturing efficiency, material cost reductions, and warranty cost management are central to Ford's strategy to enhance margins. These operational efficiencies are expected to drive significant financial upside as they are realized over time.

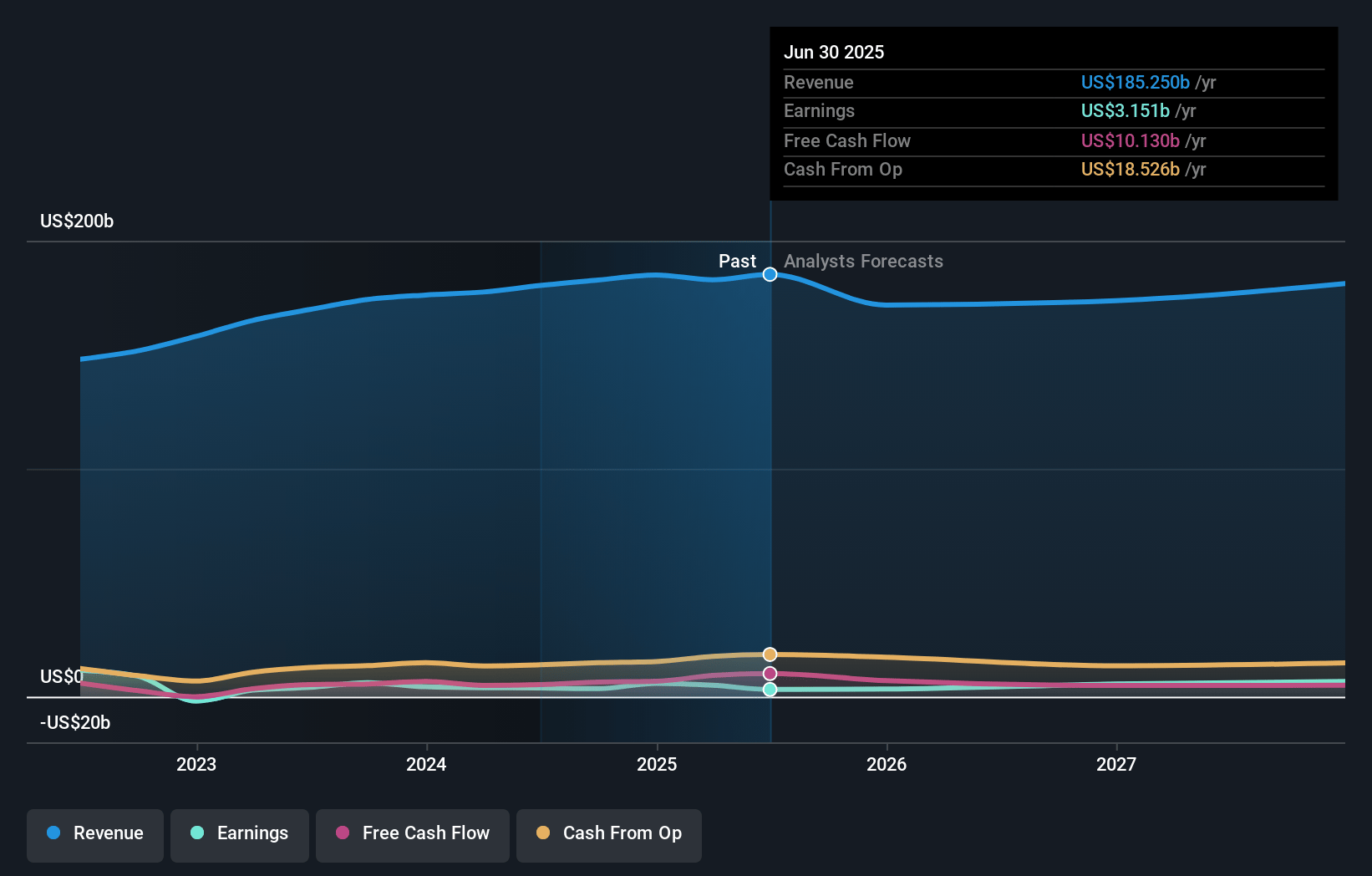

Ford Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ford Motor's revenue will decrease by 0.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.9% today to 4.7% in 3 years time.

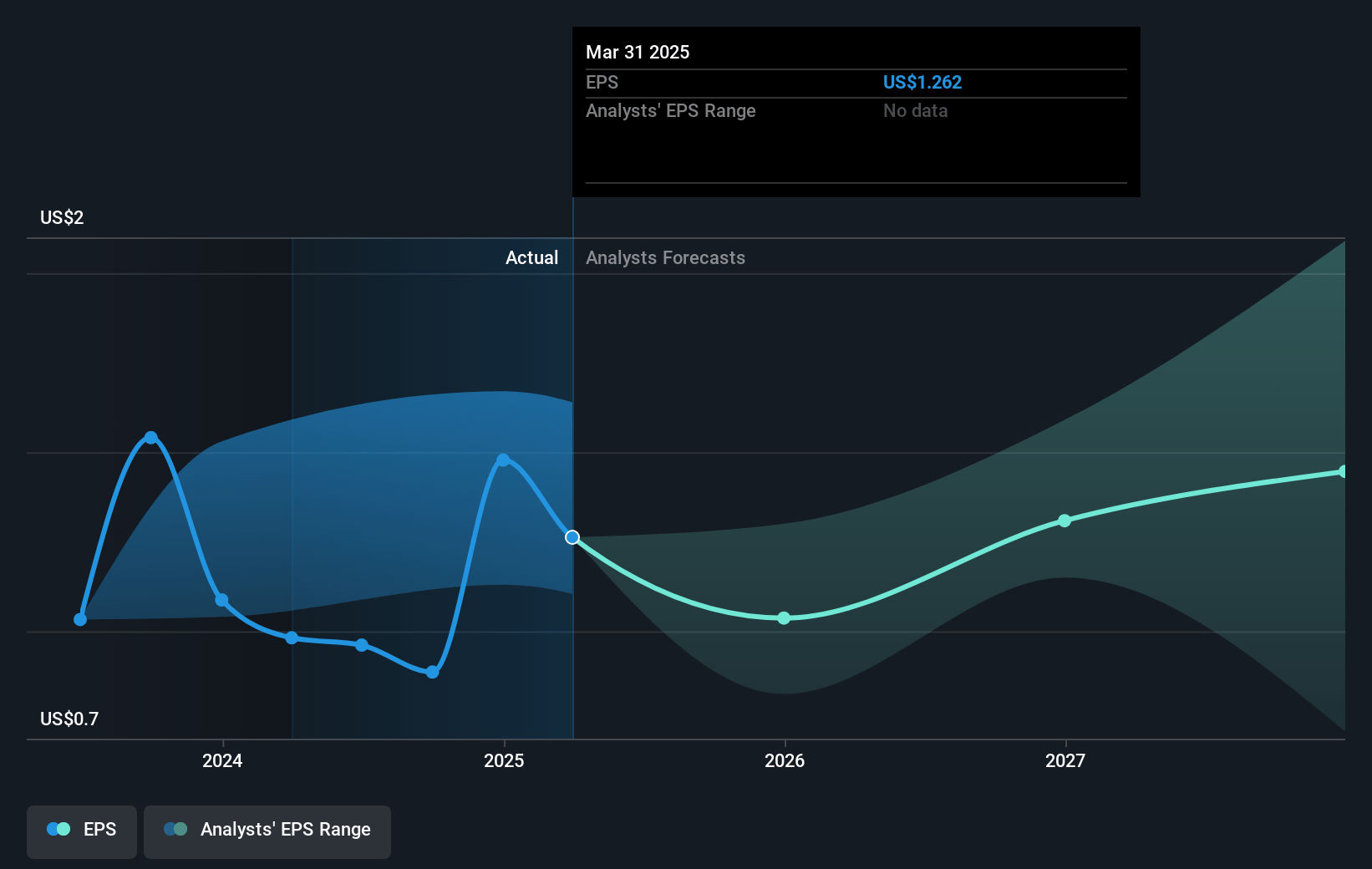

- Analysts expect earnings to reach $8.6 billion (and earnings per share of $2.15) by about November 2027, up from $3.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $6.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.7x on those 2027 earnings, down from 12.5x today. This future PE is lower than the current PE for the GB Auto industry at 15.8x.

- Analysts expect the number of shares outstanding to grow by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

Ford Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing global price war in the EV market, fueled by overcapacity and new EV nameplates, presents a risk to Ford's pricing power and profit margins, potentially affecting revenue growth.

- Ford's warranty costs remain a significant concern, as ongoing high expenses could impact net margins and earnings, especially given the uncertainty surrounding future warranty issues.

- The rising competition from Chinese manufacturers, particularly in regions like Asia and possibly impacting future Ranger revenues, could threaten Ford's market share and revenue in those regions.

- Potential pricing pressures, especially in the EV and commercial vehicle sectors, could impact Ford's future top-line revenue and margins if consumer preferences shift or competitors engage in aggressive pricing strategies.

- Inflationary pressures and supply chain disruptions, particularly relevant for operations in regions like Turkey, could increase manufacturing and material costs, affecting Ford’s overall cost structure and net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.18 for Ford Motor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $184.6 billion, earnings will come to $8.6 billion, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 10.9%.

- Given the current share price of $11.1, the analyst's price target of $12.18 is 8.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$9.70

FV

13.5% overvalued intrinsic discount3.50%

Revenue growth p.a.

6users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

12 days ago author updated this narrative