Key Takeaways

- The launch of the R2 model and strategic cost reductions are expected to drive significant revenue growth and improve net margins.

- Investments in self-driving technology and expanded manufacturing facilities aim to boost production capacity and create high-margin revenue streams, enhancing long-term profitability.

- Rivian faces revenue and profitability risks from regulatory changes, manufacturing shutdowns, production challenges, and potential execution issues in cost reduction.

Catalysts

About Rivian Automotive- Designs, develops, manufactures, and sells electric vehicles and accessories.

- Rivian expects to see significant revenue growth from the launch of the R2 model in the first half of 2026, with a price point around $45,000, which is expected to appeal to a more mass-market audience and drive up sales volume.

- The company is targeting substantial reductions in both bill of materials and non-bill of materials costs for the R2, which are projected to be about half of those for the R1, creating a robust cost structure that is expected to improve net margins.

- The joint venture with the Volkswagen Group is anticipated to contribute around $2 billion in revenue over the next four years, providing a pure profit stream that enhances Rivian's earnings outlook.

- Rivian is aggressively investing in its Rivian Autonomy Platform, aiming to offer advanced self-driving features by 2026. This investment is expected to yield new high-margin revenue streams from software upgrades and subscriptions, improving long-term earnings potential.

- Expansion of manufacturing facilities in Normal, Illinois, and the development of a new plant in Georgia are expected to significantly scale production capacity, allowing Rivian to meet future demand and leading to higher revenue and operational efficiencies.

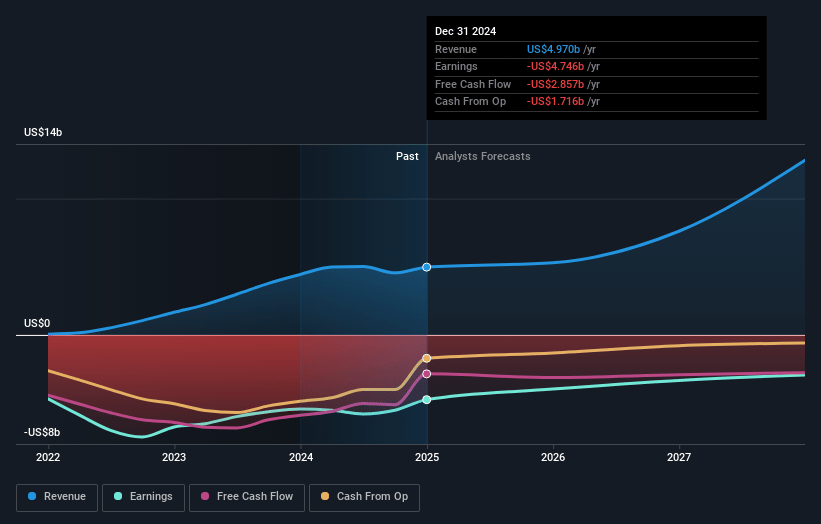

Rivian Automotive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Rivian Automotive compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Rivian Automotive's revenue will grow by 51.2% annually over the next 3 years.

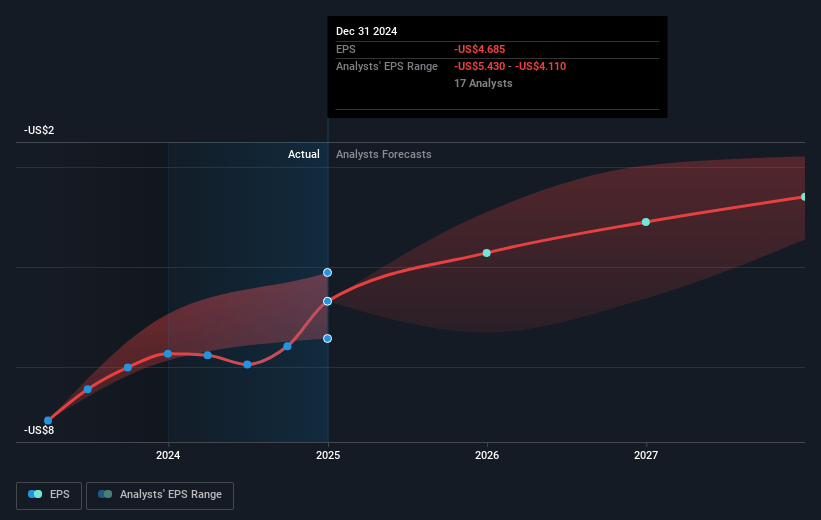

- Even the bullish analysts are not forecasting that Rivian Automotive will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Rivian Automotive's profit margin will increase from -95.5% to the average US Auto industry of 5.6% in 3 years.

- If Rivian Automotive's profit margin were to converge on the industry average, you could expect earnings to reach $963.6 million (and earnings per share of $0.7) by about April 2028, up from $-4.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 35.3x on those 2028 earnings, up from -2.8x today. This future PE is greater than the current PE for the US Auto industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Rivian Automotive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rivian's future revenue and profits could be impacted by the fluid policy and regulatory environment, which includes potential changes to incentives, regulations, and tariff structures that management acknowledges could affect EBITDA by hundreds of millions of dollars.

- There is risk associated with the manual shutdown of both consumer and commercial manufacturing lines for approximately one month in 2025, which could affect production volumes and thus impact revenue.

- The planned production decrease in Q1 of 2025, due to seasonality and demand challenges, including the impact of fires in one of its largest markets, Los Angeles, presents a risk of decreased revenue.

- Rivian's reliance on regulatory credits, which contributed nearly $300 million in revenue in Q4 2024 and are projected similarly for 2025, exposes the company to potential revenue volatility should there be adverse changes in regulations.

- While Rivian has shared plans for substantial cost reductions, there are execution risks involved in achieving the projected cost targets for its Gen 2 platform, which, if not realized, could compromise its net margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Rivian Automotive is $17.77, which represents one standard deviation above the consensus price target of $14.46. This valuation is based on what can be assumed as the expectations of Rivian Automotive's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $6.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $17.2 billion, earnings will come to $963.6 million, and it would be trading on a PE ratio of 35.3x, assuming you use a discount rate of 11.4%.

- Given the current share price of $11.91, the bullish analyst price target of $17.77 is 33.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:RIVN. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.