Key Takeaways

- Structural shifts toward newer display technologies and pressure from major buyers threaten traditional revenue streams and further compress profitability.

- Heightened regulatory, supply chain, and competitive risks increase costs and volatility, undermining long-term earnings stability and financial flexibility.

- Strategic diversification, investment in advanced display technologies, and operational discipline are positioning Innolux for enhanced margin stability, premium market growth, and long-term earnings expansion.

Catalysts

About Innolux- Provides electronic components in Taiwan, Hong Kong, the United States, Europe, China, and internationally.

- The ongoing shift in the display technology ecosystem toward OLED and emerging microLED solutions threatens to erode Innolux's core LCD panel revenues, especially as global adoption of these alternatives accelerates and large customers transition away from legacy products-this structural decline could lead to persistent top-line contraction.

- Mounting global environmental regulations and stronger ESG scrutiny are likely to significantly increase manufacturing costs for energy-intensive legacy production lines, forcing Innolux to undertake expensive sustainability investments, which will weigh on gross margins and profitability over the coming years.

- Intensifying global trade tensions and growing fragmentation in supply chains, particularly across China, the US, and Taiwan, expose Innolux's operations and key input sourcing to heightened risk of delays, higher logistics costs, and potential market access barriers, introducing ongoing volatility to revenue and cost structures.

- Despite efforts to move up the value chain and invest in advanced technologies, Innolux remains heavily reliant on commoditized LCD panels in markets characterized by chronic oversupply and aggressive price competition, driving ongoing margin compression and undermining long-term earnings growth.

- The power of major electronics brands and original equipment manufacturers continues to strengthen, leading these consolidated buyer groups to exert downward pricing pressure, negotiate longer payment terms, and demand higher customization-further compressing working capital, eroding net margins, and constraining free cash flow for Innolux.

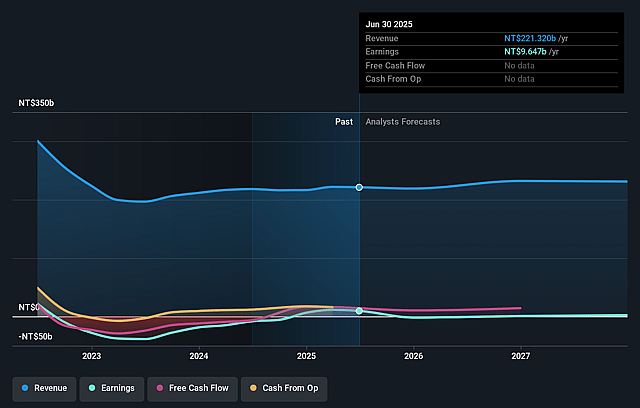

Innolux Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Innolux compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Innolux's revenue will grow by 1.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 4.4% today to 0.3% in 3 years time.

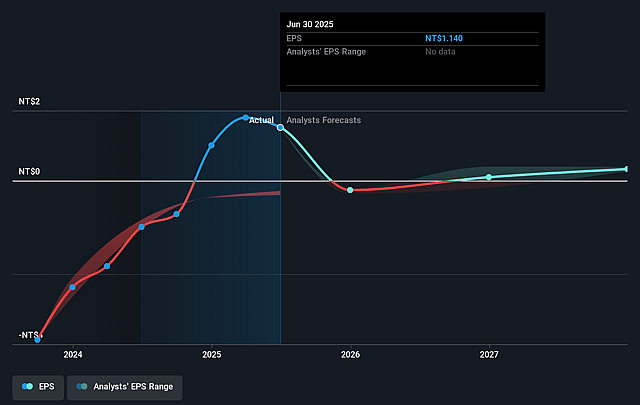

- The bearish analysts expect earnings to reach NT$756.5 million (and earnings per share of NT$0.07) by about September 2028, down from NT$9.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 126.0x on those 2028 earnings, up from 11.2x today. This future PE is greater than the current PE for the TW Electronic industry at 22.8x.

- Analysts expect the number of shares outstanding to decline by 5.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

Innolux Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Innolux is rapidly expanding into higher-margin, application-specific areas such as automotive, medical, and semiconductor packaging with Fan-Out PLP technology, which is already showing strong customer interest and operational synergy with legacy panel facilities; this diversification is likely to enhance both revenue stability and long-term net margins.

- The company's substantial investment and leadership in next-generation panel technologies-including OLED, microLED, and transparent displays-along with ownership of a top-three global microLED IP portfolio, positions Innolux to capture meaningful share in premium product segments with higher average selling prices, directly supporting future earnings growth.

- Strong execution of asset optimization, process automation, and disciplined capital allocation-including lean CapEx and capital reduction strategies-have resulted in a sustained net cash position, rising gross margins (from 1.5% to 6.5% year over year), and improved EBITDA margins, demonstrating potential for ongoing improvements to earnings and shareholder returns.

- The surge in demand related to AI, electric vehicles, IoT, and digital healthcare is fueling increased adoption of advanced and large-format displays and display-driven sensing platforms, placing Innolux at the center of several fast-growing secular end-markets that can support revenue expansion over the long term.

- InnoCare, the group's healthcare technology arm, is experiencing record revenues and outsized growth by leveraging proprietary X-ray sensor and detector technologies with strong cost advantages and penetration of emerging markets, which is translating into higher gross margins (approaching 28 percent) and solid EPS growth for the consolidated group.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Innolux is NT$11.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Innolux's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$17.5, and the most bearish reporting a price target of just NT$11.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be NT$233.0 billion, earnings will come to NT$756.5 million, and it would be trading on a PE ratio of 126.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of NT$13.55, the bearish analyst price target of NT$11.3 is 19.9% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.