Key Takeaways

- Premium product focus, strategic partnerships, and green technology adoption position Innolux for substantial margin expansion and industry-leading profitability.

- Diversified solutions, capital flexibility, and advanced manufacturing drive long-term revenue growth and operational resilience across emerging markets and next-gen verticals.

- Lagging innovation and reliance on core LCD business, along with customer concentration and regulatory pressures, threaten profitability and increase vulnerability to market volatility.

Catalysts

About Innolux- Provides electronic components in Taiwan, Hong Kong, the United States, Europe, China, and internationally.

- Analysts broadly agree that Innolux's value-added manufacturing shift and premium product focus will drive revenue growth, but with the scale and pace of adoption in both automotive and AI-integrated devices, margin expansion and topline acceleration could be significantly higher and more rapid than consensus currently projects.

- While the consensus recognizes the impact of OLED collaboration and eLEAP technology on margins, the broadening regulatory and consumer preference for green solutions, and Innolux's unique supply agreements with high-end automotive manufacturers, could position it to dominate industry profit pools, pushing net margins well above sector norms.

- The confluence of digital lifestyle expansion and the global upsurge in advanced infrastructure, paired with Innolux's diversified ODM/solution model, can cement its position as a default supplier for next-generation smart devices, unlocking a multi-year, compounding revenue stream from emerging markets and urban digitalization projects.

- Innolux's strong net cash balance, lean CapEx approach, and aggressive capital recycling into next-generation technologies and markets, give it outsized strategic flexibility; this could lead to opportunistic M&A, faster scale-up in high-growth verticals, and potentially raise both ROE and long-term earnings power far beyond what is modeled by the market.

- Ongoing digitization and automation of manufacturing, coupled with proprietary advances like Fan-Out PLP and microLED, are likely to boost operational leverage and yield rates, resulting in sustainable cost-down advantages and net profit growth even in cyclical downturns, supporting premium valuation multiples.

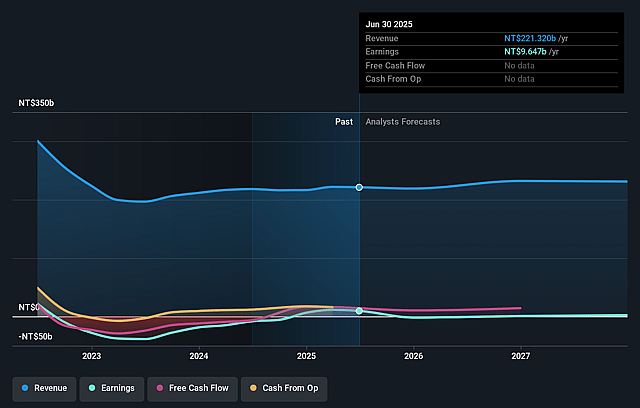

Innolux Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Innolux compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Innolux's revenue will grow by 2.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 4.4% today to 0.3% in 3 years time.

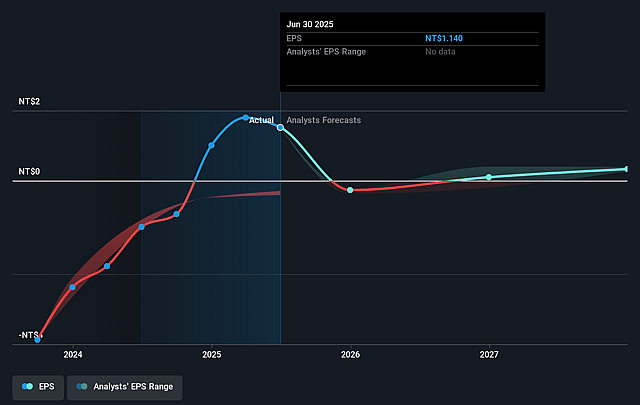

- The bullish analysts expect earnings to reach NT$756.6 million (and earnings per share of NT$0.11) by about September 2028, down from NT$9.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 195.2x on those 2028 earnings, up from 11.2x today. This future PE is greater than the current PE for the TW Electronic industry at 22.8x.

- Analysts expect the number of shares outstanding to decline by 5.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

Innolux Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The core LCD business remains highly exposed to declining global demand as consumers and customers increasingly shift toward OLED, microLED, and next-generation display technologies, which could erode Innolux's primary revenue streams and pressure overall top-line growth.

- Despite investments in microLED and Fan-Out PLP, Innolux's slow progress in catching up with leading competitors in next-generation display and packaging technologies raises the risk of technological obsolescence, ultimately threatening future revenue growth and resulting in margin deterioration.

- Persistent industry-wide overcapacity and aggressive price competition in the display panel sector are likely to continue exerting downward pressure on average selling prices, which could significantly squeeze Innolux's gross margins and restrict earnings growth.

- Increasing customer concentration-particularly reliance on a few major clients for significant portions of sales-exposes Innolux to heightened revenue and profit volatility in the event of key relationship losses or unexpected volume declines.

- Heightened global sustainability standards and ESG expectations, combined with rising regulatory scrutiny over traditional manufacturing, could increase Innolux's operational and compliance costs, leading to reduced profitability and undermining long-term net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Innolux is NT$17.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Innolux's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$17.5, and the most bearish reporting a price target of just NT$11.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NT$236.9 billion, earnings will come to NT$756.6 million, and it would be trading on a PE ratio of 195.2x, assuming you use a discount rate of 7.4%.

- Given the current share price of NT$13.55, the bullish analyst price target of NT$17.5 is 22.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.