Key Takeaways

- Shifting authentication technologies and native platform solutions threaten the long-term demand and margin sustainability of Yubico's proprietary hardware products.

- Price sensitivity and dependence on volatile enterprise contracts could constrain growth, posing challenges to recurring revenue and market expansion, particularly in emerging markets.

- Customer hesitation, currency headwinds, and a shift toward software-based authentication threaten growth, margin improvement, and predictability, while investment needs may further pressure profitability.

Catalysts

About Yubico- Provides authentication solutions for use in computers, networks, and online services.

- Despite underlying drivers such as growing regulatory mandates and accelerating digitization that increase baseline demand for strong authentication, Yubico faces the risk that broader technology shifts like increased use of biometric authentication at the device or OS level may reduce the addressable market for discrete security keys, potentially dampening long-term revenue growth.

- While rapid expansion in advanced authentication markets and strong penetration into enterprise and government sectors suggest substantial room for growth, price sensitivity-especially in emerging markets-could limit hardware adoption, constraining top-line expansion and challenging gross margin sustainability over time.

- Although the company has demonstrated a loyal and expanding customer base and is seeing growing recurring subscription revenue, Yubico's dependence on large enterprise and government contracts introduces material volatility; delays in major customer deployments or renegotiation of large contracts could weigh on net sales and recurring earnings, especially if sales cycles remain extended.

- While Yubico's 80% gross margin reflects the value of its software integration, long-term trends toward open-source, software-only, and decentralized authentication could erode the value proposition of proprietary hardware, eventually putting pressure on both margin levels and market share.

- Even with ongoing sector tailwinds from increasing enterprise cybersecurity budgets and Zero Trust adoption, the rapid evolution of authentication technologies-such as the potential mainstreaming of passwordless protocols natively in platforms-could shorten the product relevance cycle, requiring high, ongoing R&D and compressing net margins if not matched by sustained top-line acceleration.

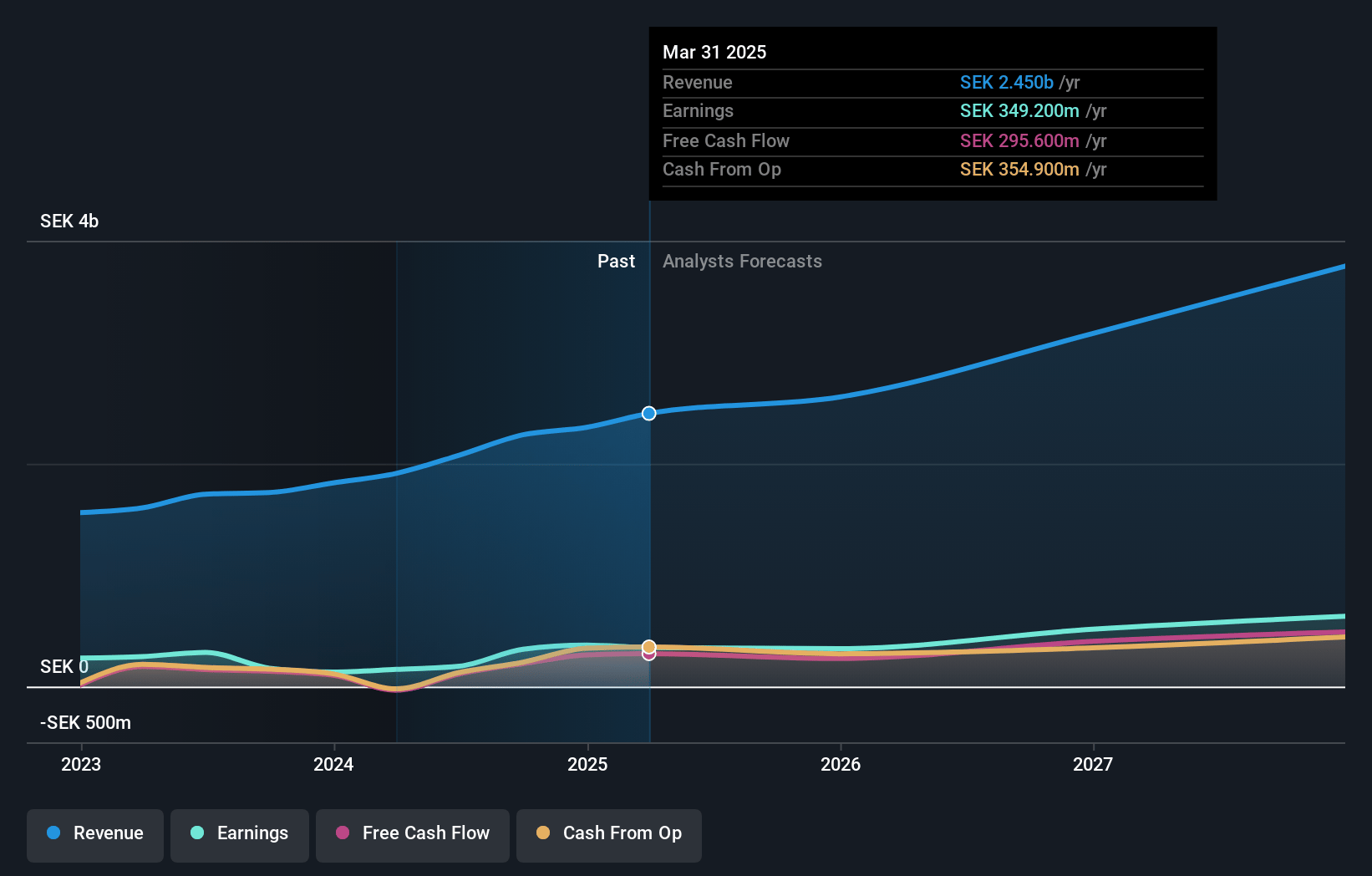

Yubico Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Yubico compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Yubico's revenue will grow by 17.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 14.3% today to 15.9% in 3 years time.

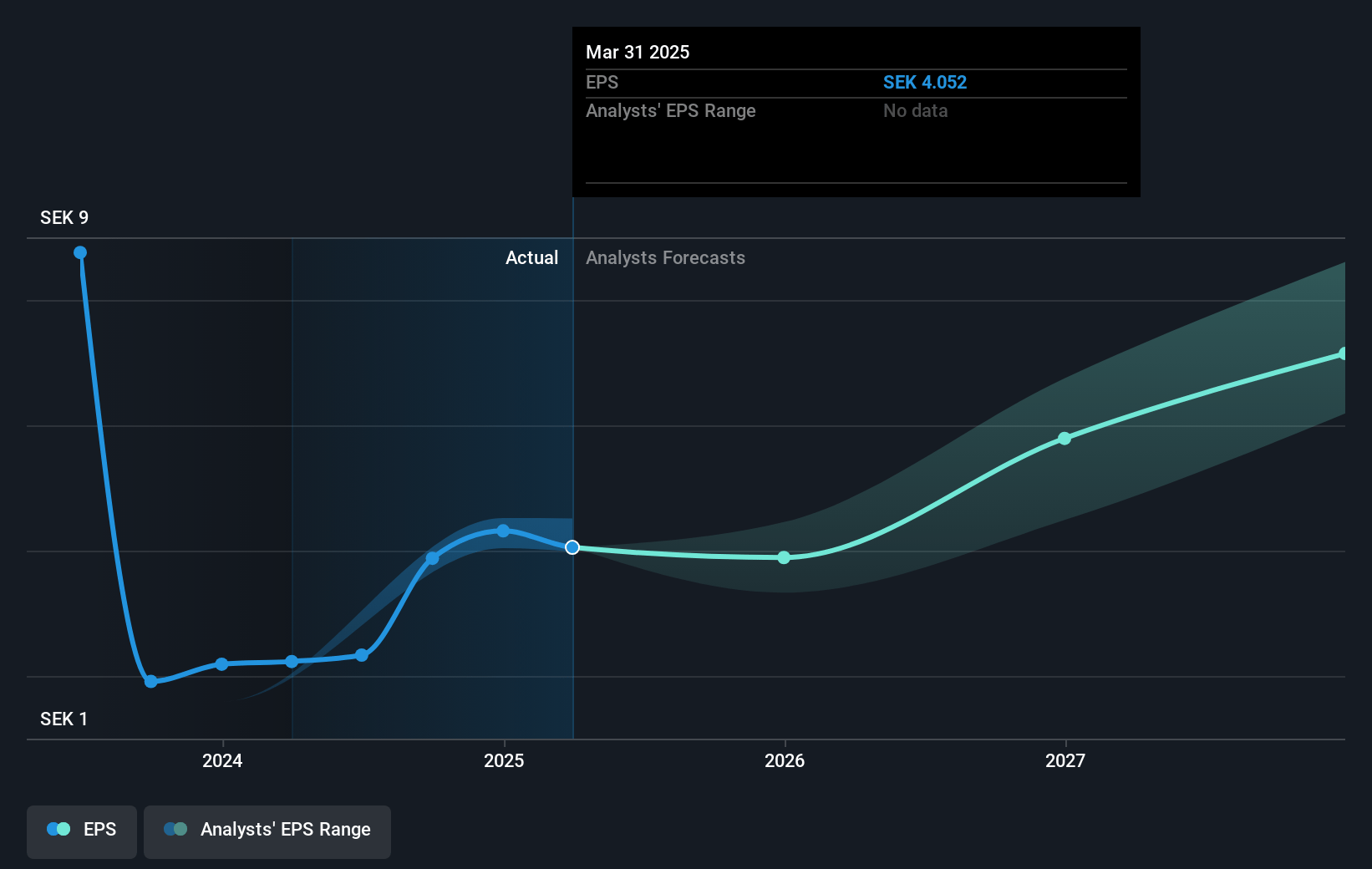

- The bearish analysts expect earnings to reach SEK 623.3 million (and earnings per share of SEK 6.88) by about July 2028, up from SEK 349.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, down from 32.4x today. This future PE is lower than the current PE for the SE Software industry at 33.4x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Yubico Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing macroeconomic uncertainty and customer caution are causing delays in large-scale deployments and investment decisions among both existing and new clients, potentially dampening revenue growth and resulting in unpredictable earnings in the short to medium term.

- The slowdown in closing large customer deals, particularly from major enterprise or government clients, heightens the company's exposure to the risk of underperformance in net sales if these hesitations persist, especially given past reliance on a few big swing contracts.

- Heavy foreign exchange rate volatility, particularly with a strengthening Swedish krona against the US dollar, has negatively impacted gross margins and is likely to cause further pressure on profitability if such currency fluctuations continue.

- Growing customer preference for less cumbersome and more easily deployed software-based authentication solutions, paired with recognition that rollout and maintenance of hardware keys are perceived as a hassle, could slow market penetration and limit addressable market expansion, thereby restraining both topline revenue and margin improvement.

- Substantial additional investment required to build out global sales channels and transition toward more recurring software and service revenues may increase costs faster than revenue growth in the near term, potentially squeezing EBIT margins if execution is slower than anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Yubico is SEK160.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Yubico's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK250.0, and the most bearish reporting a price target of just SEK160.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK3.9 billion, earnings will come to SEK623.3 million, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK131.0, the bearish analyst price target of SEK160.0 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.