Key Takeaways

- Expanding enterprise adoption, regulatory-driven demand, and new subscription models could rapidly accelerate recurring revenue and position Yubico for substantial upside growth.

- Industry-leading margins, deep cloud integration, and leadership in passwordless authentication support sustainable premium pricing and strengthen Yubico's status as a key infrastructure provider.

- Mainstream device integration of authentication technologies, margin pressures, and increasing compliance costs all threaten Yubico's growth, profitability, and pricing power amid rising competition.

Catalysts

About Yubico- Provides authentication solutions for use in computers, networks, and online services.

- Analyst consensus highlights the vast opportunity to increase penetration within existing Global 2000 and Fortune 500 customers, but this may be dramatically understated-given that Yubico's current estimated penetration is merely 6%, a concerted focus on enterprise-wide mandates tied to surging regulatory and compliance pressure could trigger an S-curve in revenue growth, potentially leading to outsized upside surprise in both sales and recurring revenue as hardware-backed MFA becomes a regulatory requirement.

- Analysts broadly agree that geographic expansion and channel development will underpin growth, but they underestimate the likelihood of a step-function revenue jump as Yubico unlocks vast untapped demand driven by accelerating digital identity proliferation in both the public sector and non-traditional verticals, supported by mounting cyber threats and a global regulatory push for robust authentication.

- The pivot to multi-year subscription and managed services models from traditional perpetual sales could unlock significant recurring revenue, drive lifetime customer value higher, and ultimately lead to higher and more stable earnings multiples as the mix shifts toward software-enhanced offerings with high visibility and renewal rates.

- With an industry-leading 80%-plus gross margin profile and a growing focus on usability, integration, and ecosystems (including full device interoperability and seamless cross-platform use), Yubico is uniquely positioned to command premium pricing and capture outsized share as zero-trust and passwordless adoption curves steepen, feeding directly into margin expansion and sustainable net earnings growth.

- Yubico's deep integration with leading cloud platforms, its proven "zero account takeovers" track record among deployed customers, and the accelerating adoption of passwordless and FIDO standards are positioning the company as the de facto infrastructure provider for the next wave of digital transactions, creating the potential for exponential revenue growth as both regulations and user experience demands drive the adoption of hardware-backed security at scale.

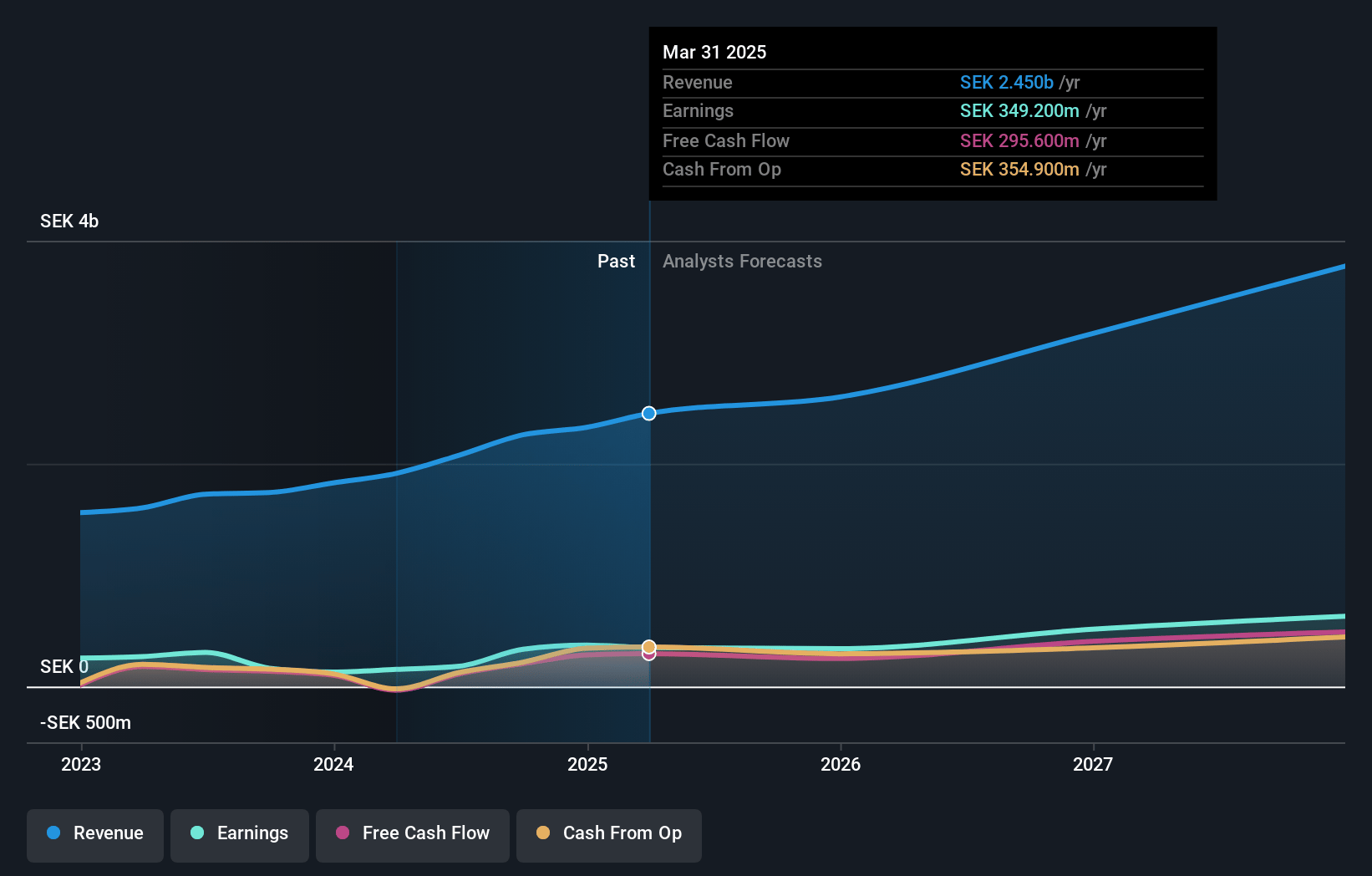

Yubico Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Yubico compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Yubico's revenue will grow by 20.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.3% today to 19.2% in 3 years time.

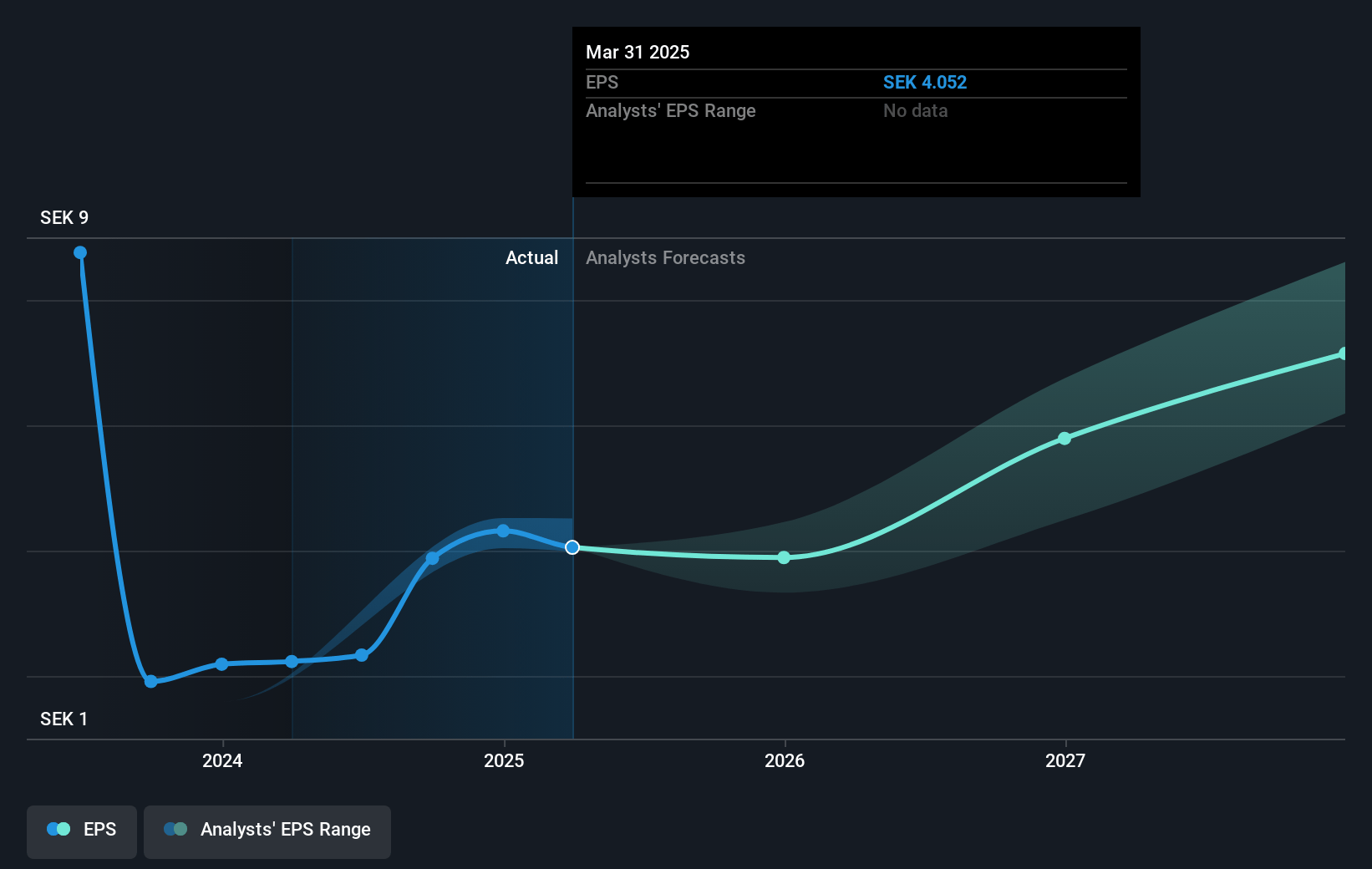

- The bullish analysts expect earnings to reach SEK 825.1 million (and earnings per share of SEK 9.55) by about July 2028, up from SEK 349.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.4x on those 2028 earnings, down from 32.8x today. This future PE is lower than the current PE for the SE Software industry at 33.9x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.39%, as per the Simply Wall St company report.

Yubico Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of passwordless and biometric authentication technologies built into mainstream consumer devices could erode demand for standalone hardware keys, reducing Yubico's addressable market and thereby threatening long-term revenue trajectories.

- Over-reliance on sales to large enterprise and public sector customers, with slow procurement cycles and hesitancy to commit to major rollouts during periods of macroeconomic uncertainty, increases Yubico's revenue volatility and could directly impact both near-term and long-term sales growth.

- Ongoing pressure on gross margins from currency fluctuations, rising R&D costs, and the need to build and maintain extensive integrations and inventories may constrain net margins, especially if sales growth does not keep pace with these increasing expenses.

- The trend toward standardized open authentication protocols and the commoditization of security hardware-particularly as large tech firms integrate authentication features into their devices-could intensify competition, lowering Yubico's pricing power and negatively impacting profitability.

- Increasing regulatory demands for privacy, environmental sustainability, and local data sovereignty may force Yubico to adapt products for fragmented global markets and manage hardware lifecycle concerns, raising compliance and operational costs, potentially reducing future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Yubico is SEK250.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Yubico's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK250.0, and the most bearish reporting a price target of just SEK160.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK4.3 billion, earnings will come to SEK825.1 million, and it would be trading on a PE ratio of 31.4x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK132.35, the bullish analyst price target of SEK250.0 is 47.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.