Key Takeaways

- Heavy reliance on price actions, acquisitions, and upselling existing customers threatens sustainable growth as core markets mature and competitive pressures mount.

- Rising compliance costs, regulatory changes, and talent competition risk eroding profitability and compressing margins in the medium term.

- Robust organic growth, rising customer value, expanding financial services, integrated SME solutions, and international ambitions underpin Fortnox's sustained momentum and profit scalability.

Catalysts

About Fortnox- Provides smart technical products, packages, services, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations in Sweden.

- The company's revenue growth has increasingly relied on price adjustments and acquisitions, rather than net new customer additions, with customer growth now lagging initial targets. As the Swedish SME market approaches saturation, future revenue expansion from new logos is likely to decelerate, undermining the sustainability of current double-digit organic revenue growth.

- Intensifying regulatory complexity in data privacy and evolving data localization laws will raise compliance and platform adaptation costs for Fortnox, especially if international expansion is pursued. This will likely compress net margins as cloud software providers must continually invest to meet stricter government demands.

- Greater dependence on upselling existing customers and increasing usage to meet growth targets exposes Fortnox to cyclical risk should macroeconomic stagnation continue to constrain SME budgets across Europe, potentially resulting in muted ARPU growth and increased customer churn rates.

- Heightened competition from both domestic and international cloud-based accounting providers is expected to intensify as automation and AI advances accelerate, forcing Fortnox to boost research and development expenses and engage in price-based customer retention, which will likely pressure long-term earnings and dilute pricing power.

- Rapid shifts in the regulatory and industry environment, coupled with heavy exposure to SMEs, may result in revenue volatility during economic downturns and mounting operating costs from rising talent competition in the technology sector, jeopardizing the historical high EBIT margin and overall profitability in the coming years.

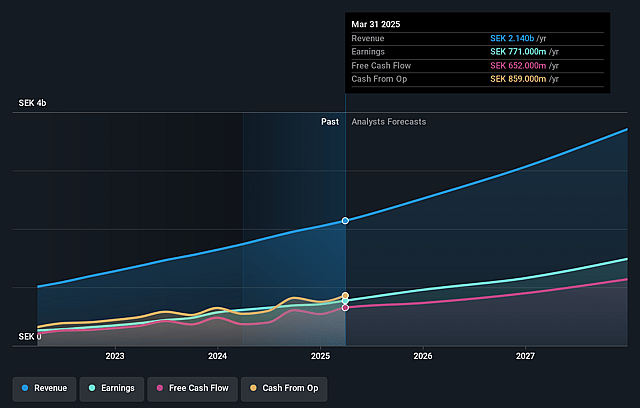

Fortnox Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Fortnox compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Fortnox's revenue will grow by 21.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 36.0% today to 41.9% in 3 years time.

- The bearish analysts expect earnings to reach SEK 1.6 billion (and earnings per share of SEK 2.64) by about July 2028, up from SEK 771.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, down from 69.7x today. This future PE is lower than the current PE for the SE Software industry at 35.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.39%, as per the Simply Wall St company report.

Fortnox Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong and consistent organic growth of 25 percent and EBIT growth of 33 percent, with 16 consecutive quarters above 60 percent on the Rule of Fortnox, indicate durable business momentum and operating leverage, supporting sustained increases in both revenue and earnings.

- The company has successfully doubled its average revenue per customer ahead of target, and continues to highlight significant potential in increasing usage among existing customers, which can drive average revenue higher and bolster both top-line growth and net margins.

- Expansion of the integrated business ecosystem, including successful growth in Financial Services (up 34 percent) and products like factoring (up 43 percent) and the business card, demonstrates Fortnox's ability to cross-sell, enhance product stickiness, and create new recurring revenue streams that support margin resilience and profit growth.

- Investments in seamless workflows and platform integration, such as Fortnox ID and the focus on embedding payments and financing into core processes, address long-term demand for unified, user-friendly SME solutions, which underlines customer retention and future revenue expansion.

- Indications of ongoing and potential international expansion, along with continuing interest in M&A, position the company to tap new markets and accelerate growth, further enhancing the long-term prospects for revenue and earnings growth beyond the Swedish market.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Fortnox is SEK40.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fortnox's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK90.0, and the most bearish reporting a price target of just SEK40.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK3.8 billion, earnings will come to SEK1.6 billion, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK88.06, the bearish analyst price target of SEK40.0 is 120.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.