Key Takeaways

- Seamless integration of financial services and automation positions Fortnox for accelerated, high-margin growth and outsized market share gains among SMEs transitioning to the cloud.

- Emerging as a key compliance partner, Fortnox can drive customer retention and explore M&A or international expansion, providing long-term revenue streams overlooked by the market.

- Heavy reliance on upselling to a saturated customer base, limited international exposure, regulatory headwinds, and rising competition threaten future growth, pricing power, and profitability.

Catalysts

About Fortnox- Provides smart technical products, packages, services, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations in Sweden.

- Analyst consensus expects future revenue growth from upselling to existing customers and expanding financial services, but this likely understates the compounding effect as Fortnox seamlessly integrates payments, factoring, and spend management into SME workflows, unlocking an ecosystem-driven surge in ARPC and sustainable high-margin revenue that can accelerate well beyond current projections.

- While analysts broadly recognize margin expansion from cost controls and financial services adoption, the operational leverage from increasing automation and AI in core processes, combined with scaling across a dominant national network, could drive EBIT margins into structurally higher territory-enabling a multi-year outperformance in earnings growth.

- Fortnox is uniquely positioned to capitalize on fast-growing regulatory complexity among SMEs, cementing itself as the indispensable compliance backbone and potentially driving a step-change in customer retention and consistent subscription revenue growth.

- As cloud migration in the SME sector accelerates, Fortnox's fully cloud-native platform is set to capture significant market share from legacy software providers, unlocking a wave of new customer acquisition that can power organic revenue growth to levels not yet imputed by the market.

- The company's recurring free cash flow growth-up 57% year-over-year and fueled by rising proportions of high-margin financial and transaction-based services-positions Fortnox to pursue selective M&A or strategic international expansion, creating new long-term earnings engines that current valuations fail to consider.

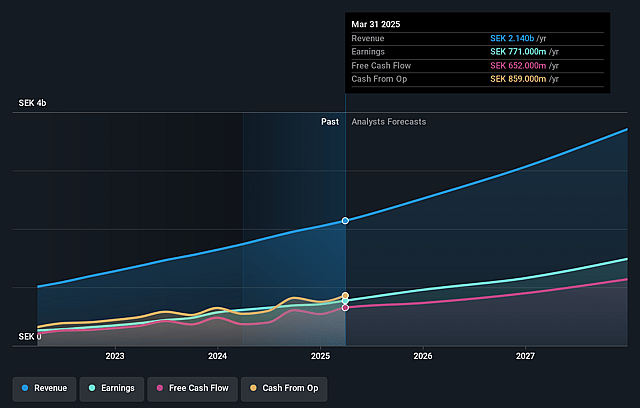

Fortnox Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fortnox compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fortnox's revenue will grow by 25.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 36.0% today to 40.0% in 3 years time.

- The bullish analysts expect earnings to reach SEK 1.7 billion (and earnings per share of SEK 2.8) by about July 2028, up from SEK 771.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 38.7x on those 2028 earnings, down from 69.7x today. This future PE is greater than the current PE for the SE Software industry at 35.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.39%, as per the Simply Wall St company report.

Fortnox Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fortnox's growth is increasingly reliant on upselling additional products and increasing usage among an already large base of existing customers, which could lead to diminishing returns over time and pressure on net margin if customer fatigue or cannibalization of core revenues sets in.

- The company's customer growth in the most recent quarter lagged behind previous years, suggesting that core Swedish SME market saturation is emerging, and making it more challenging to sustain high revenue growth or justify premium valuation multiples in the long run.

- Heavily concentrated operations in Sweden, with no concrete international expansion plans detailed, leave Fortnox vulnerable to localized economic downturns or changes in Swedish regulation, which could significantly impair future earnings stability.

- Secular risks such as increasing regulatory scrutiny over data privacy and cloud-based financial services could drive up compliance costs and limit Fortnox's ability to quickly innovate new offerings, thus potentially eroding earnings and revenue growth.

- Intensifying competition from global SaaS platforms and big tech ecosystem players, as well as the trend toward embedded finance and commoditized cloud accounting tools, threatens to reduce pricing power and differentiation, which may drive down both future revenues and operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fortnox is SEK90.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fortnox's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK90.0, and the most bearish reporting a price target of just SEK40.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK4.3 billion, earnings will come to SEK1.7 billion, and it would be trading on a PE ratio of 38.7x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK88.06, the bullish analyst price target of SEK90.0 is 2.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.