Key Takeaways

- Intensifying competition from major e-commerce players and evolving digital marketing could compress RVRC's margins and challenge its direct-to-consumer model.

- Geographic concentration and potential shifts in outdoor activity trends risk exposing RVRC to slowing growth, while regulatory demands may increase costs.

- Exposure to currency risk, limited geographic expansion, margin pressure from promotions, risks from physical retail, and digital marketing uncertainty threaten growth and profitability.

Catalysts

About RVRC Holding- Engages in the e-commerce outdoor clothing business in Germany, Sweden, Finland, and internationally.

- While RVRC Holding benefits from increasing global demand for health-focused, active lifestyles and a shift toward sustainable, long-lasting outdoor products that align with its core strengths, the company faces the risk that the dominance of e-commerce giants such as Amazon and Alibaba could further intensify, making it more difficult to preserve its direct-to-consumer model's favorable gross margins and potentially leading to margin compression over the long term.

- Although RVRC is leveraging continued expansion into new territories-such as strong growth outside the Nordics in Austria, Switzerland, and the U.K.-there remains a structural risk of overreliance on its home Nordic market, which exposes it to geographic concentration. Should regional macro conditions soften, topline revenue and earnings growth could stagnate, especially if international diversification fails to accelerate quickly enough.

- Despite operational investments in logistics automation and physical retail to support omnichannel distribution and build brand power, the rapid change in digital marketing landscapes-for example, the evolution of AI-driven search-could reduce the effectiveness of online customer acquisition and raise the cost of digital advertising, thus putting pressure on sales growth and net margins.

- While rising outdoor recreation participation supports a broadening customer base, demographic changes such as ongoing urbanization or declining outdoor engagement in key developed markets could steadily shrink the company's addressable market, leading to structurally slower revenue growth despite robust near-term trends.

- While RVRC's solid balance sheet and commitment to returning capital via dividends and share buybacks enhance shareholder value, future tightening of environmental regulation and consumer expectations around sustainable supply chains could result in higher compliance costs and logistical complexity, weighing on profitability and making maintenance of current high net margins and cash flows more difficult over the long run.

RVRC Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on RVRC Holding compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming RVRC Holding's revenue will grow by 6.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 14.7% today to 15.5% in 3 years time.

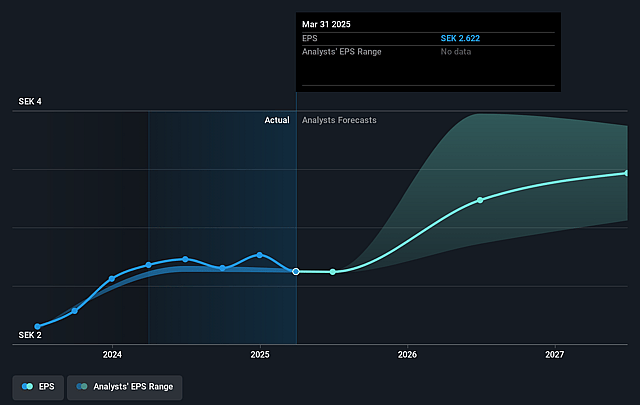

- The bearish analysts expect earnings to reach SEK 357.3 million (and earnings per share of SEK 3.29) by about September 2028, up from SEK 283.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.9x on those 2028 earnings, down from 17.1x today. This future PE is lower than the current PE for the SE Specialty Retail industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 2.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.12%, as per the Simply Wall St company report.

RVRC Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces significant currency risk due to reporting in Swedish krona while generating about 90 percent of its revenues outside Sweden and having a cost base with a higher share of SEK expenses, which has already resulted in margin and operating profit volatility and may continue to impact net margins and reported earnings.

- Growth outside core Nordic and DACH markets appears limited, with Rest of World declining and less management focus on these smaller, less mature markets, indicating a potential long-term cap on geographic revenue diversification and limiting sustained growth in overall revenue.

- Intensifying promotional activity and price pressure in the outdoor apparel segment, including ongoing high promotional levels from competitors as noted by management, could erode RVRC Holding's pricing power and lead to increased discounting, thereby compressing gross margins and adversely impacting profitability.

- Expansion into physical retail channels introduces a risk of increased operating expenses and capital allocation inefficiency, especially if store traffic or conversion underperforms relative to digital channels, which could weigh on net margins and cash flow over time.

- The shift of consumer search and marketing patterns due to emerging technologies like AI-driven search poses a potential risk to the efficiency and returns on RVRC Holding's digital marketing spend, which is a primary growth lever for the company, possibly impairing customer acquisition, sales growth, or return on marketing investment, and consequently, revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for RVRC Holding is SEK52.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of RVRC Holding's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK68.0, and the most bearish reporting a price target of just SEK52.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK2.3 billion, earnings will come to SEK357.3 million, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 6.1%.

- Given the current share price of SEK45.5, the bearish analyst price target of SEK52.0 is 12.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.