Last Update21 Aug 25Fair value Increased 5.26%

Despite a notable reduction in revenue growth expectations, analysts see improved profitability as net profit margins rise, leading to a higher fair value estimate with the price target increasing from SEK57.00 to SEK60.00.

What's in the News

- Proposed dividend increase to 1.35 SEK per share from 1.20 SEK.

- Opening a flagship brand store on Kungsgatan, central Stockholm, in fall 2025, following an outlet opening in Barkarby in April 2025.

- Strengthened logistics setup by extending its partnership with Shelfless and moving the Nordic warehouse to a new automated facility in Rosersberg, with go-live in spring 2026; largest warehouse in Germany unaffected.

Valuation Changes

Summary of Valuation Changes for RVRC Holding

- The Consensus Analyst Price Target has risen from SEK57.00 to SEK60.00.

- The Consensus Revenue Growth forecasts for RVRC Holding has significantly fallen from 10.4% per annum to 5.7% per annum.

- The Net Profit Margin for RVRC Holding has significantly risen from 13.63% to 15.50%.

Key Takeaways

- Strength in key European markets and strong brand loyalty underpin ongoing growth, aided by a robust digital and retail presence.

- Investments in logistics automation and prudent financial management enhance scalability, margins, and position the company for sustainable long-term expansion.

- Heavy dependence on D2C e-commerce, currency volatility, regional expansion challenges, ongoing price competition, and shifting consumer trends could all limit future revenue and profitability.

Catalysts

About RVRC Holding- Engages in the e-commerce outdoor clothing business in Germany, Sweden, Finland, and internationally.

- The company continues to capture market share and drive revenue growth in key European regions (Nordics, Austria, Switzerland, UK) significantly outperforming industry peers, indicating future top-line growth as these regions benefit from increased consumer prioritization of outdoor recreation and wellness.

- Investments in logistics automation (new automated warehouses in Stockholm and Germany) are expected to support higher sales volumes, operational scalability, and improved efficiency, which should enhance margins and underlying earnings over time.

- RVRC's digital-first direct-to-consumer model, complemented by expanding physical presence in flagship retail locations, is well-positioned to capture accelerated consumer shift to e-commerce and digital channels, supporting both revenue and gross margin expansion.

- Strong customer engagement (over 2.2 million social followers and high review scores) reflects brand loyalty and positions the company to benefit from the long-term trend toward specialty outdoor activity and adventure travel, underpinning long-term demand and revenue resilience.

- The company's healthy balance sheet, prudent inventory management, and ongoing commitment to sustainable growth (dividends and share buybacks) provide capital flexibility and support net margin expansion, positioning RVRC to capitalize on a growing global middle class and increased market participation.

RVRC Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RVRC Holding's revenue will grow by 5.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.7% today to 15.5% in 3 years time.

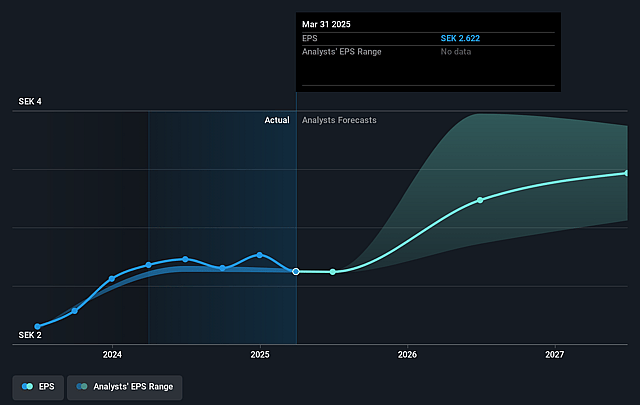

- Analysts expect earnings to reach SEK 353.0 million (and earnings per share of SEK 3.25) by about September 2028, up from SEK 283.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, up from 17.1x today. This future PE is lower than the current PE for the SE Specialty Retail industry at 23.7x.

- Analysts expect the number of shares outstanding to decline by 2.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.12%, as per the Simply Wall St company report.

RVRC Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on the D2C e-commerce model exposes RVRC Holding to risks from digital marketing cost inflation, changes to SEO/web traffic patterns (e.g., AI reshaping consumer search behavior), and potential platform dependency, which could pressure revenue growth and net margins over time.

- Currency fluctuations, particularly exchange rate volatility between the Swedish krona, euro, and U.S. dollar, continue to pose a structural risk as 90% of revenues are generated outside Sweden while a higher proportion of costs are SEK-denominated, leading to unpredictable impacts on reported revenue, gross margin, and operating profit.

- The company's international expansion outside core markets faces regional challenges, evident in mixed results (e.g., slow/uncertain growth in Germany and declining Rest of World segment), and could be hindered by strong local competition or differing consumer preferences, potentially limiting medium

- to long-term revenue growth and earnings.

- Intense and persistent promotional pressure across the outdoor apparel sector may become the "new normal," eroding average selling prices, and if price competition intensifies further, will put sustained pressure on gross margins and profitability for RVRC Holding.

- Demand for new outdoor apparel may be constrained over time by consumer trends toward recommerce/second-hand goods and a secular shift in discretionary spending from goods to experiences, leading to stunted volume growth and long-term threats to revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK60.0 for RVRC Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK68.0, and the most bearish reporting a price target of just SEK52.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK2.3 billion, earnings will come to SEK353.0 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 6.1%.

- Given the current share price of SEK45.5, the analyst price target of SEK60.0 is 24.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.