Key Takeaways

- RVRC's digital scaling, automation, and strong brand community enable operating leverage, positioning it for superior earnings growth and sustained profitability.

- Alignment with consumer trends in sustainability and wellness allows RVRC to capitalize on premiumization, unlocking pricing power and long-term margin expansion.

- Heavy reliance on core products, regional concentration, and sector saturation expose RVRC Holding to demand, competition, and margin risks amid evolving consumer and digital trends.

Catalysts

About RVRC Holding- Engages in the e-commerce outdoor clothing business in Germany, Sweden, Finland, and internationally.

- While analyst consensus highlights international expansion as a positive driver, current market share gains and outperformance versus competitors suggest that RVRC could capture growth far exceeding expectations, especially as markets like Germany and the UK recover, enabling double-digit topline growth well above the category average.

- The consensus sees the D2C model as supportive of high operating margins, but RVRC's rapid digital scaling, inventory automation, and untapped pricing power position it to expand EBIT margins towards best-in-class levels, delivering operating leverage that could drive outsized earnings growth.

- RVRC's operational investments into automated logistics centers and robotics in key distribution hubs are set to yield ongoing cost efficiencies and improved scalability, directly boosting net margins and supporting sustained profit growth as volumes increase.

- With an exceptionally strong brand community-2.2 million social media followers and over 730,000 product reviews-RVRC is primed to benefit from industry-wide shifts toward health, wellness, and outdoor activity, supporting elevated customer lifetime value and multi-year recurring revenue expansion.

- The company's established reputation for sustainability and product innovation aligns closely with a consumer pivot to ethical, versatile apparel, positioning RVRC to tap into the premiumization trend in outdoor retail and unlock pricing power, margin expansion, and higher average order values over the long term.

RVRC Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on RVRC Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming RVRC Holding's revenue will grow by 9.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.7% today to 16.2% in 3 years time.

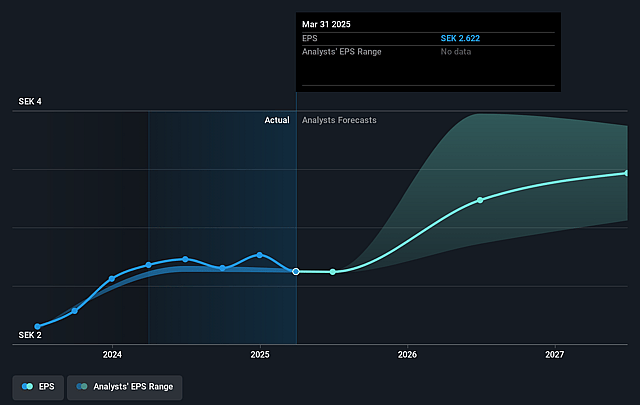

- The bullish analysts expect earnings to reach SEK 409.3 million (and earnings per share of SEK 4.17) by about September 2028, up from SEK 283.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, up from 17.7x today. This future PE is lower than the current PE for the SE Specialty Retail industry at 24.7x.

- Analysts expect the number of shares outstanding to decline by 2.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.12%, as per the Simply Wall St company report.

RVRC Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- RVRC Holding remains heavily reliant on continued strong demand for new outdoor products, yet the long-term rise in environmental consciousness and anti-consumption sentiment may steadily erode demand for discretionary outdoor apparel, hindering sustainable sales growth over the coming years. This could pressure long-term revenue expansion.

- The company's overdependence on its core pants product range carries the risk of brand fatigue and stagnation in product innovation, making repeat purchases and customer loyalty vulnerable, and threatening revenue and margin stability if consumer preferences shift.

- With most sales concentrated in the Nordics and DACH region, and relatively slow international expansion elsewhere, RVRC Holding remains exposed to regional macroeconomic and currency volatility. The recent strengthening of the Swedish krona already negatively impacted reported revenues and margins, and similar trends could compress future topline and profitability.

- Persistently high market saturation in the outdoor apparel sector, combined with ongoing discounting and promotional intensity, risks creating a "new normal" of heavier price competition. This dynamic could further erode gross margins and net earnings for RVRC Holding, as noted by management's commentary on stabilized but elevated promotional activities.

- The acceleration of digital transformation and growing dominance of e-commerce giants pose margin and market share threats to RVRC Holding's primarily D2C model. Rising digital marketing costs and the need to keep up with fast-evolving consumer search behaviors driven by AI could elevate customer acquisition costs and reduce operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for RVRC Holding is SEK68.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of RVRC Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK68.0, and the most bearish reporting a price target of just SEK52.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK2.5 billion, earnings will come to SEK409.3 million, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 6.1%.

- Given the current share price of SEK47.16, the bullish analyst price target of SEK68.0 is 30.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.