Key Takeaways

- Innovative drug formulation, strong market demand, and strategic partnerships position Cinclus Pharma for significant revenue and margin growth in both domestic and international markets.

- Retention of global commercial rights enables flexible licensing or direct launch strategies, supporting long-term earnings potential through multiple income streams.

- Heavy reliance on a single late-stage asset, high R&D costs, and intense competition create major risks to future revenue, profitability, and market adoption.

Catalysts

About Cinclus Pharma Holding- A clinical-stage pharmaceutical company, develops small molecules for the treatment of gastric acid-related diseases in China.

- Cinclus Pharma's lead product, linaprazan glurate, addresses the rapidly growing prevalence of severe erosive GERD, driven in part by an aging population and broader recognition and diagnosis of acid-related gastrointestinal diseases, positioning the company to capture significant future revenue growth from expanding patient pools.

- Strong recent momentum in the PCAB drug class, with robust sales and guideline inclusion in major markets, signals increasing global healthcare funding and access, potentially boosting Cinclus Pharma's international licensing opportunities and future earnings streams.

- Strategic alliances, such as the partnership with Zentiva in Europe, bring upfront payments, de-risk product commercialization, and enable more cost-effective market entry, improving both near-term cash position and longer-term net margin prospects through attractive milestone and royalty structures.

- The company's innovation in drug formulation-offering superior 24-hour acid control and faster healing than both standard PPIs and competing PCABs-could drive premium pricing, specialist uptake, and market share wins, supporting above-average revenue and gross margin expansion if Phase III results confirm Phase II data.

- Retainment of full commercial rights for linaprazan glurate in the U.S. and other ex-Asia markets sets up Cinclus Pharma for potentially lucrative partnerships or direct launches in the world's largest pharmaceutical market, with the possibility of significant milestone, royalty, and/or direct sales income, supporting long-term earnings growth.

Cinclus Pharma Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cinclus Pharma Holding's revenue will grow by 86.2% annually over the next 3 years.

- Analysts are not forecasting that Cinclus Pharma Holding will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cinclus Pharma Holding's profit margin will increase from -447.1% to the average SE Pharmaceuticals industry of 22.2% in 3 years.

- If Cinclus Pharma Holding's profit margin were to converge on the industry average, you could expect earnings to reach SEK 55.3 million (and earnings per share of SEK 1.2) by about August 2028, up from SEK -172.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 58.8x on those 2028 earnings, up from -4.3x today. This future PE is lower than the current PE for the SE Pharmaceuticals industry at 79.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.92%, as per the Simply Wall St company report.

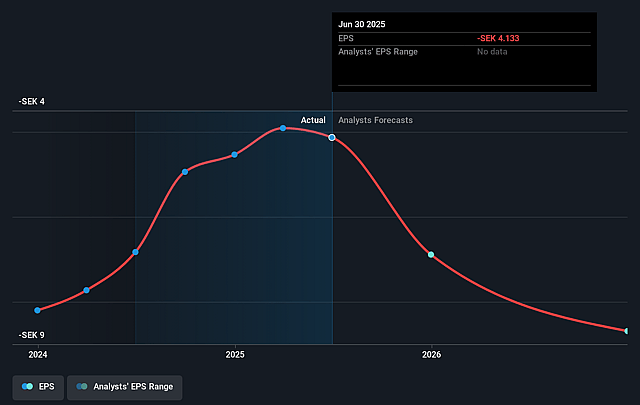

Cinclus Pharma Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cinclus Pharma's financials reveal ongoing high R&D expenses and a negative EBIT/net profit, largely driven by costly late-stage clinical trials without guaranteed Phase III or regulatory approval, which could sustain margin pressure and heighten cash burn into the medium and long term.

- The revenue recognized this quarter is primarily from upfront licensing payments (not product sales), with future earnings dependent on development milestones, royalty streams, and successful commercialization, introducing significant risk to both near

- and long-term revenue predictability.

- The company's business model remains heavily reliant on a single late-stage asset-linaprazan glurate-leaving it exposed to clinical or regulatory failure, suboptimal Phase III results, or poor market adoption, which would materially impact future revenues and earnings potential.

- The industry is experiencing increased pricing pressure and payer scrutiny-especially in Europe-potentially limiting reimbursement rates and pricing power for new gastroenterology therapies like linaprazan glurate, which could cap long-term revenue growth and profitability even if commercialized.

- Competition from established PCABs (like Phathom's vonoprazan/Voquezna) is intensifying, with first-mover advantages and potential for market entrenchment before Cinclus's projected launch (2029/2030 in Europe), risking slower market uptake and lower-than-expected market share, directly impacting future revenue streams and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK61.25 for Cinclus Pharma Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK75.0, and the most bearish reporting a price target of just SEK50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK249.6 million, earnings will come to SEK55.3 million, and it would be trading on a PE ratio of 58.8x, assuming you use a discount rate of 4.9%.

- Given the current share price of SEK16.06, the analyst price target of SEK61.25 is 73.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.