Key Takeaways

- Heavy dependence on a single late-stage asset exposes Cinclus Pharma to significant clinical, regulatory, and competitive risks that may limit future earnings and margin growth.

- Sustained R&D expenses, complex approval processes, and increasing pricing pressure from generics and large pharmaceutical groups could compress profitability and constrain long-term shareholder returns.

- Heavy reliance on a single late-stage drug and risks from competition, regulatory challenges, and funding gaps threaten both revenue prospects and long-term profitability.

Catalysts

About Cinclus Pharma Holding- A clinical-stage pharmaceutical company, develops small molecules for the treatment of gastric acid-related diseases in China.

- While the global aging population and rising incidence of gastrointestinal disorders offer a substantial and expanding addressable market for Cinclus Pharma's lead candidate, future revenue growth depends heavily on the successful and timely commercialization of linaprazan glurate, which still faces clinical, regulatory, and execution risks that could delay or hinder market entry and therefore postpone or reduce revenue realization.

- Although positive Phase II data and the strategic partnership with Zentiva provide operational de-risking and create the potential for higher operating margins through specialty commercialization and attractive royalty streams in Europe, heavy reliance on a single late-stage asset means any setbacks in Phase III trial results, reimbursement hurdles, or competition from entrenched treatments may sharply limit future earnings and constrain margin expansion.

- While the company has made progress in securing development funding through upfront and milestone payments, sustained high R&D expenses and protracted development timelines-compounded by increasing regulatory requirements and complexities in multinational trials-could erode cash reserves and force dilution or greater debt intake, impacting net margins and long-term shareholder returns.

- Despite unique clinical differentiation and blockbuster potential positioning, the growing prevalence of generic and biosimilar competition, as well as the push for drug price controls and value-based reimbursement models across major healthcare markets, could restrict future pricing power and significantly compress net sales and profitability over the product lifecycle.

- While Cinclus benefits from long-term trends in healthcare spending and a focus on unmet needs in gastroenterology, mounting industry barriers such as slower clinical recruitment, stringent approval processes, and stronger bargaining power held by large pharmaceutical groups in out-licensing negotiations may dilute the financial upside from commercialization deals and constrain overall earnings growth.

Cinclus Pharma Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cinclus Pharma Holding compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cinclus Pharma Holding's revenue will grow by 44.1% annually over the next 3 years.

- The bearish analysts are not forecasting that Cinclus Pharma Holding will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cinclus Pharma Holding's profit margin will increase from -447.1% to the average SE Pharmaceuticals industry of 22.6% in 3 years.

- If Cinclus Pharma Holding's profit margin were to converge on the industry average, you could expect earnings to reach SEK 26.2 million (and earnings per share of SEK 0.57) by about September 2028, up from SEK -172.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 101.5x on those 2028 earnings, up from -4.1x today. This future PE is greater than the current PE for the SE Pharmaceuticals industry at 77.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.92%, as per the Simply Wall St company report.

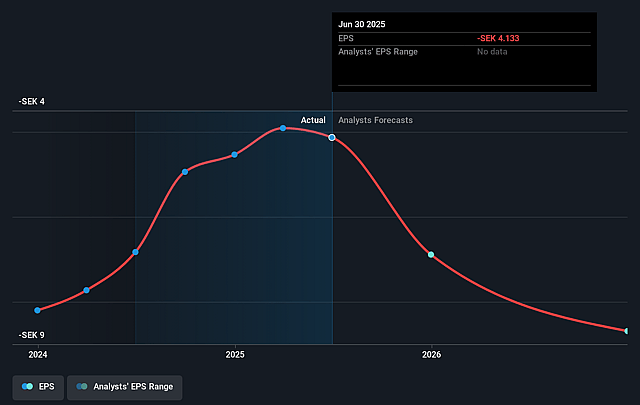

Cinclus Pharma Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cinclus Pharma Holding is heavily dependent on a single late-stage asset, linaprazan glurate, so any disappointing Phase III results or regulatory setbacks would severely hurt future revenue generation and could lead to large, negative impacts on both earnings and market valuation.

- The company faces intensifying competition from established and first-mover PCAB drugs like Voquezna (Phathom Pharmaceuticals), which are already in the market and gaining specialist traction; this could limit Cinclus's market share and put sustained pressure on future revenues and operating margins after launch.

- Although strategic partnerships like the Zentiva licensing deal bring short-term funding, Cinclus remains reliant on further successful out-licensing or commercialization efforts to fund development and operations; delays in securing such deals, especially in the US, would risk cash flow shortages and possibly lead to shareholder dilution and reduced earnings per share.

- Regulatory and pricing pressures across major markets, including increased scrutiny by European and US authorities and the risk of future drug price controls, could limit the pricing power of linaprazan glurate, reducing long-run revenue forecasts and squeezing profit margins.

- Rising global focus on cost-effective healthcare and a potential future shift to generic or biosimilar alternatives, even before Cinclus can fully commercialize its product, could result in lower-than-projected revenues and weaker long-term earnings growth for the company.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cinclus Pharma Holding is SEK50.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cinclus Pharma Holding's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK75.0, and the most bearish reporting a price target of just SEK50.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK115.6 million, earnings will come to SEK26.2 million, and it would be trading on a PE ratio of 101.5x, assuming you use a discount rate of 4.9%.

- Given the current share price of SEK15.34, the bearish analyst price target of SEK50.0 is 69.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.