Key Takeaways

- Rapid adoption of Cinclus Pharma's therapy, plus strategic U.S. deals, could deliver accelerated revenue growth, robust earnings, and significant cash generation above market expectations.

- Favorable market trends, specialty biotech efficiency, and industry consolidation position Cinclus for premium pricing, sustained profitability, and a major increase in valuation potential.

- Heavy reliance on a single product, challenging reimbursement, and limited commercialization capabilities expose Cinclus Pharma to significant risk from regulatory, operational, and market pressures.

Catalysts

About Cinclus Pharma Holding- A clinical-stage pharmaceutical company, develops small molecules for the treatment of gastric acid-related diseases in China.

- Analysts broadly agree that linaprazan glurate's best-in-class 24-hour acid control creates blockbuster potential, but this likely underestimates its ability to quickly displace not just PPIs but existing PCABs-especially as clinical data points to near-total healing in severe patients, which could drive faster and greater-than-expected adoption and rapid revenue acceleration after launch.

- While the consensus view sees strong non-dilutive income from licensing deals like the one with Zentiva, the market is massively undervaluing the possibility that a U.S. commercialization or licensing agreement-especially one struck with Phase III data in hand and against a backdrop of robust PCAB global growth-could unlock multiples of the current revenue projections and deliver step-change increases to both earnings and cash reserves.

- Cinclus Pharma's operation as a specialty-focused, capital-efficient late-stage biotech, combined with derisked clinical and regulatory progress, positions it to deliver net margins far in excess of typical pharmaceutical peers, particularly as specialty-oriented launches can support premium pricing, focused promotional spend, and sustained profitability over time.

- The growing global prevalence of lifestyle-related gastrointestinal disorders, aligned with population aging, is expanding the addressable market just as Cinclus's next-generation therapy debuts-a powerful confluence that could drive years of double-digit revenue growth and sustained top-line outperformance.

- The industry's increased prioritization of patent-protected, precision-oriented therapies creates a fertile M&A and partnership environment, placing Cinclus in pole position to benefit from sector consolidation or attract multiple acquirers, which could result in a substantial valuation re-rating well ahead of actual commercialization.

Cinclus Pharma Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cinclus Pharma Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cinclus Pharma Holding's revenue will grow by 104.4% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Cinclus Pharma Holding will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cinclus Pharma Holding's profit margin will increase from -447.1% to the average SE Pharmaceuticals industry of 22.6% in 3 years.

- If Cinclus Pharma Holding's profit margin were to converge on the industry average, you could expect earnings to reach SEK 74.7 million (and earnings per share of SEK 1.62) by about September 2028, up from SEK -172.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 53.3x on those 2028 earnings, up from -4.0x today. This future PE is lower than the current PE for the SE Pharmaceuticals industry at 79.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.92%, as per the Simply Wall St company report.

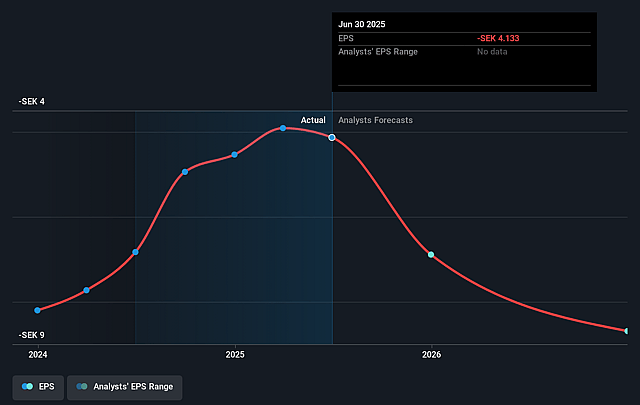

Cinclus Pharma Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent high R&D expenses and a heavy reliance on a single late-stage asset (linaprazan glurate) expose the company to significant pipeline risk; if Phase III trials fail or reimbursement is limited, projected revenue and long-term earnings could drop sharply, leading to impairment losses and negative cash flow.

- Increasing global cost-containment and pricing scrutiny in healthcare, particularly in Europe, may limit Cinclus Pharma's ability to secure premium prices for its flagship product, putting downward pressure on projected net margins and potentially eroding future earnings.

- Despite recent licensing deals, Cinclus Pharma lacks extensive commercialization infrastructure and is dependent on partnerships for market access; any failure to secure deals, delays in commercial launches, or underperformance by its partners could lead to shortfalls in expected revenue and profit realization.

- Geopolitical tensions and ongoing fragmentation in global supply chains threaten to raise manufacturing and distribution costs, posing operational risks that could reduce profitability and further impact net margins, especially given the company's small scale.

- The rapid pace of innovation in biotech-such as the rise of personalized medicine and gene therapies-could render traditional gastrointestinal drugs less attractive, risking product obsolescence, declining market share, and ultimately jeopardizing long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cinclus Pharma Holding is SEK75.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cinclus Pharma Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK75.0, and the most bearish reporting a price target of just SEK50.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK330.2 million, earnings will come to SEK74.7 million, and it would be trading on a PE ratio of 53.3x, assuming you use a discount rate of 4.9%.

- Given the current share price of SEK14.82, the bullish analyst price target of SEK75.0 is 80.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.