Key Takeaways

- Acquisition of Haemimont Games and focus on DLCs are expected to expand the portfolio and boost revenue growth while supporting higher profit margins.

- Emphasis on user-generated content and innovative methods aims to increase engagement and revenue, while risk management strategies improve earnings stability.

- Project execution challenges and dependence on a few key franchises pose risks to Paradox Interactive's revenue consistency and long-term growth potential.

Catalysts

About Paradox Interactive- Develops and publishes strategy and management games on PC and consoles in North and Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

- The acquisition of Haemimont Games, which specializes in management games, is expected to expand Paradox's strategic fit and strengthen its portfolio, potentially boosting future revenue growth.

- The focus on releasing DLCs and expansions for established, successful franchises like Hearts of Iron IV and Stellaris supports higher profit margins due to more favorable amortization models, positively impacting net margins.

- The company is emphasizing user-generated content and innovative production methods, potentially leading to increased engagement and revenue streams in the future.

- Paradox's adaptation of risk management strategies in game development, focusing on quicker project evaluations and avoiding high upfront costs, is aimed at improving earnings stability and reducing financial volatility.

- The solid performance without relying on major new game releases highlights the strength of the existing portfolio's contribution to revenue and profit, setting a robust baseline for future revenue expectations.

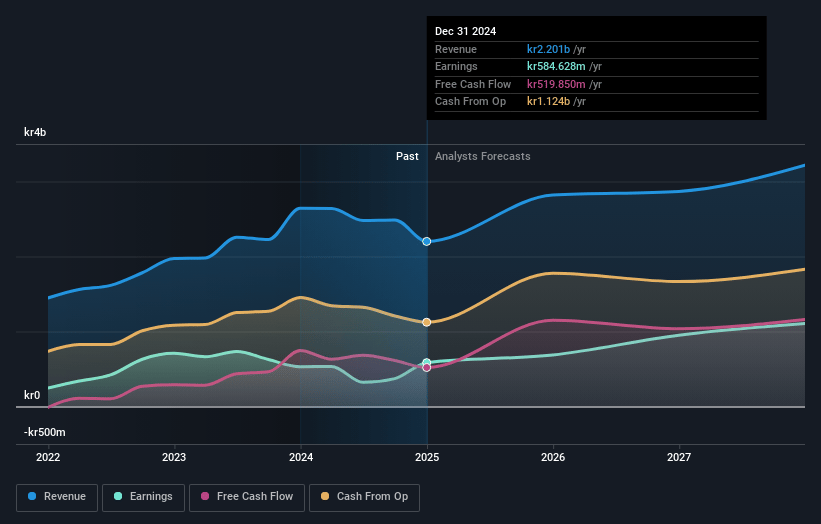

Paradox Interactive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Paradox Interactive's revenue will grow by 13.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.6% today to 34.5% in 3 years time.

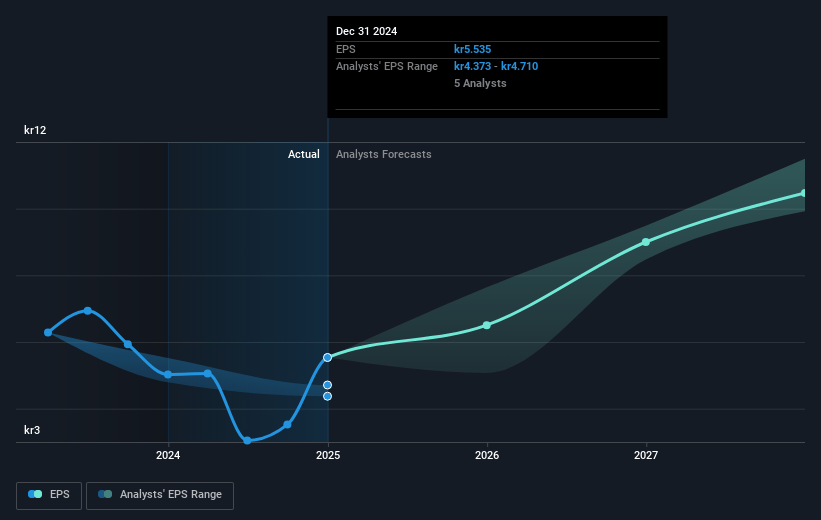

- Analysts expect earnings to reach SEK 1.1 billion (and earnings per share of SEK 10.39) by about March 2028, up from SEK 584.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as SEK1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, down from 34.4x today. This future PE is greater than the current PE for the SE Entertainment industry at 25.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.38%, as per the Simply Wall St company report.

Paradox Interactive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Project delays, such as with Prison Architect 2 and Bloodlines 2, and issues like write-downs, notably Life by You, could impact future revenue and margins as they indicate challenges in project execution and pipeline management.

- Dependence on DLCs and expansions for mature franchises, while currently profitable, could lead to stagnation in long-term revenue growth if new successful IPs are not developed or existing ones lose player interest.

- The company's volatility in revenue, driven by release schedules and the current lack of major game launches, suggests a risk of inconsistent earnings if new game development does not pace out successfully.

- External economic factors, such as currency fluctuations, impact financial results significantly, indicating financial sensitivity to currency markets that could affect reported profitability.

- The high reliance on a few key franchises could present financial risks if any major changes in market dynamics or player preferences diminish the appeal of these franchises, affecting Paradox Interactive's revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK231.0 for Paradox Interactive based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK280.0, and the most bearish reporting a price target of just SEK160.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK3.2 billion, earnings will come to SEK1.1 billion, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK190.5, the analyst price target of SEK231.0 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.