Key Takeaways

- Persistent post-acquisition integration issues and reliance on a few hit AAA titles threaten earnings stability, profitability, and margin predictability.

- Structural industry shifts, higher production costs, and regulatory risks undermine growth prospects and pressure Embracer's large, acquisition-focused strategy.

- Strong financial flexibility, robust game release pipeline, operational improvements, and valuable IPs underpin long-term revenue growth, margin expansion, and earnings diversification.

Catalysts

About Embracer Group- Develops and publishes PC, console, mobile, VR, and board games for the games market worldwide.

- Intensifying integration challenges from Embracer's rapid history of acquisitions have led to persistent operational inefficiencies, with poor average ROI on game investments (only two times capital out compared to prior peaks above three), signaling recurring potential for project delays, cost overruns and future impairment of goodwill-structural issues likely to further erode both earnings stability and net margin profiles as amortizations from underperforming titles linger.

- Despite a headline pipeline of 76 game releases, the company's earnings are exceptionally dependent on an unpredictable handful of successful AAA launches, as evidenced by Kingdom Come: Deliverance II accounting for almost all profit contribution in the quarter while other releases were break-even or loss-making; this reliance increases exposure to shifting consumer preferences for free-to-play and subscriptions, jeopardizing both top-line revenue growth and margin predictability.

- The strategy to pursue further M&A, spin-offs and potential divestments under a high cash reserve environment faces increasing risk from higher global interest rates and a structurally more expensive and competitive acquisition landscape, which can reduce return on invested capital, limit scale benefits, and pressure long-term earnings growth.

- Intensifying global regulatory scrutiny-especially around digital distribution and data privacy in major markets-poses rising compliance costs and operational uncertainties, which could disproportionately impact Embracer's sprawling, diversified structure and undermine any margin gains from operational restructuring.

- The growing trend of longer and costlier production cycles for AAA titles-paired with stiffening competition from both incumbent giants and agile indie studios-results in elevated break-even points for Embracer's pipeline, increasing the risk of failed launches and market saturation in core PC/console and mobile markets, placing sustained pressure on both revenue growth and the company's ability to maintain or expand profitability.

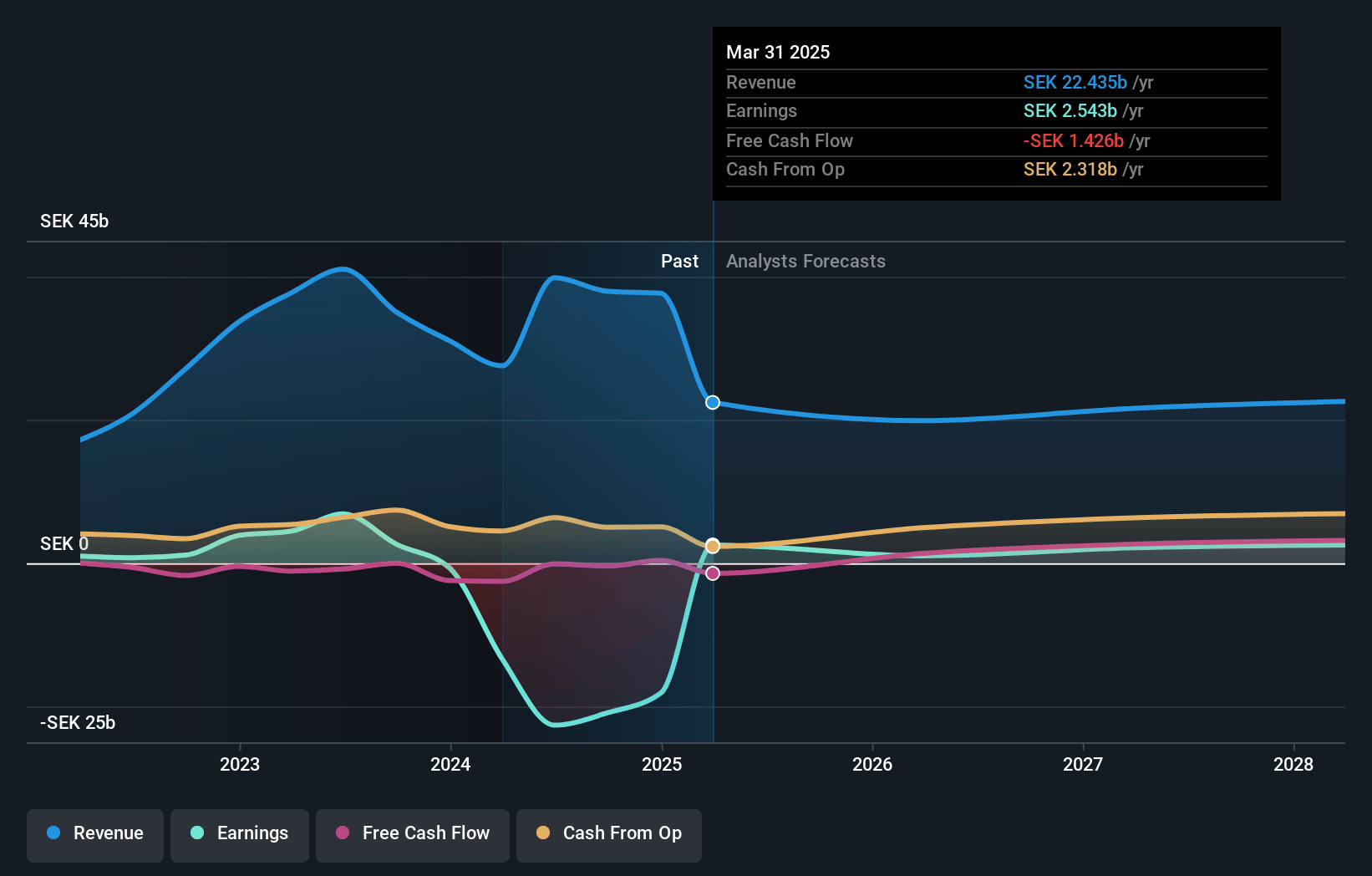

Embracer Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Embracer Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Embracer Group's revenue will decrease by 1.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.3% today to 12.3% in 3 years time.

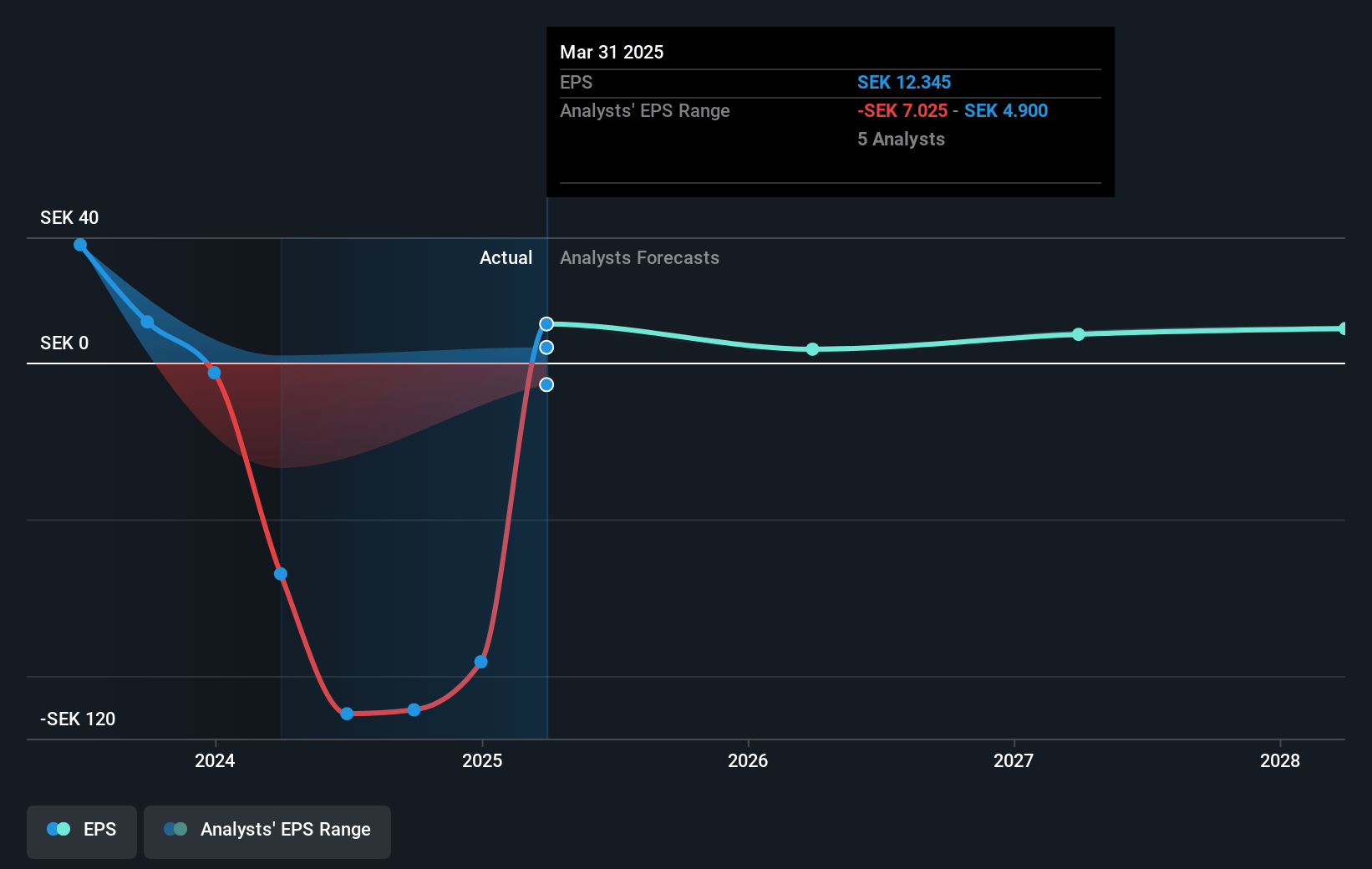

- The bearish analysts expect earnings to reach SEK 2.7 billion (and earnings per share of SEK 11.58) by about July 2028, up from SEK 2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.7x on those 2028 earnings, up from 9.5x today. This future PE is lower than the current PE for the SE Entertainment industry at 20.1x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

Embracer Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Embracer's strong net cash position of SEK 5.4 billion and SEK 13 billion in available funds offers significant financial flexibility, enabling investment in growth initiatives, acquisitions, or possible shareholder returns, which can support future revenue growth and provide downside protection for earnings.

- The upcoming slate of game releases includes 76 new games with two AAA titles for the current year and 9 additional AAA games slated over the next two financial years, indicating a sizeable and potentially value-accretive pipeline that could increase revenue and improve net margins as these games launch.

- The significant pro forma organic growth reported in both PC/Console (driven by Kingdom Come: Deliverance II) and Mobile (30% organic growth excluding divestments) demonstrates robust underlying demand and operating leverage in key segments, which can support sustained or increased earnings in the long term.

- The successful spin-off of highly profitable and stable divisions such as Coffee Stain Group, with EBIT margins over 50%, along with continued cost control and operational restructuring, has materially improved company-wide profitability, as reflected in margin expansion and improved free cash flow, boosting long-term net margin prospects.

- Embracer's ownership of valuable and globally recognized IPs (including Lord of the Rings, Metro, Tomb Raider, and others), along with an active transmedia and licensing strategy, provides a strong foundation for recurring high-margin revenue streams through games, film, TV, comics, and merchandise, supporting long-term revenue diversification and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Embracer Group is SEK93.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Embracer Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK170.0, and the most bearish reporting a price target of just SEK93.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK21.7 billion, earnings will come to SEK2.7 billion, and it would be trading on a PE ratio of 9.7x, assuming you use a discount rate of 7.3%.

- Given the current share price of SEK107.6, the bearish analyst price target of SEK93.0 is 15.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.