Key Takeaways

- Expansion in Patient Handling, rental, and new markets supports revenue growth and reduces reliance on mature regions.

- Demographic shifts and cost efficiency measures strengthen stable, recurring earnings and improve margins.

- Dependence on mature markets, operational volatility, tariff exposure, and limited pricing power threaten Arjo's growth, profitability, and cash flow stability.

Catalysts

About Arjo- Develops and sells medical devices and solutions for patients for clinical and financial outcomes for healthcare in Europe, Asia, Latin America, Africa, and Pacific.

- Strong order intake and a significantly larger order book, especially in core segments like Patient Handling and key growth geographies (notably North America and emerging Asian markets), position the company to deliver higher organic sales growth in the coming quarters-supporting top-line revenue expansion.

- The ongoing demographic shift toward aging populations and increased prevalence of chronic diseases is structurally expanding demand for Arjo's products and services, which underpins long-term revenue growth beyond short-term cycles.

- Expansion and momentum in rental and service lines are driving stable, recurring revenues and higher margins, and are expected to be further boosted by the shift toward care outside hospitals and more home/community healthcare settings-supporting both margin expansion and earnings stability.

- Internal cost efficiency measures, supply chain improvements, and selective price increases (particularly in the U.S. to offset tariff impacts) are expected to mitigate external cost headwinds, leading to improved net margins and stronger operating leverage over time.

- New product launches in high-growth categories (e.g., Patient Handling) and targeted expansion efforts in underpenetrated regions (APAC, Middle East) are diversifying the revenue base and reducing dependence on mature, slower-growth European markets, supporting sustainable multi-year earnings growth.

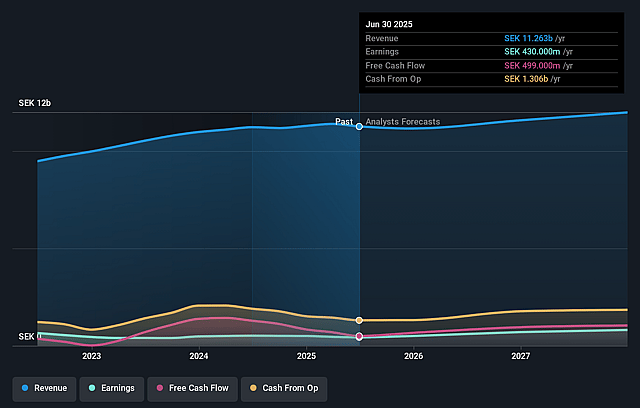

Arjo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arjo's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.8% today to 7.7% in 3 years time.

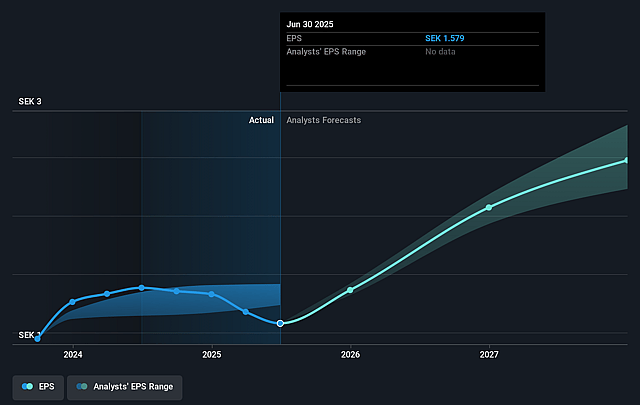

- Analysts expect earnings to reach SEK 944.0 million (and earnings per share of SEK 2.97) by about September 2028, up from SEK 430.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, down from 21.2x today. This future PE is lower than the current PE for the SE Medical Equipment industry at 49.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.84%, as per the Simply Wall St company report.

Arjo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing exposure to U.S. tariffs and currency headwinds significantly impacted gross margin and EBITDA in Q2 2025, and while management expects mitigation through price increases, continued or escalating tariff pressures could further erode profitability and net margins if price increases cannot fully offset cost inflation.

- Sluggish and even declining net sales growth in Western Europe and Rest of the World (especially tensions in key markets like the U.K. and delayed orders due to NHS reorganizations) highlight Arjo's significant exposure to mature, slow-growing regions, posing risks to top-line revenue growth and limiting broader geographic diversification.

- Elevated levels of restructuring and nonrecurring items in H1 2025 (due to operational changes, management turnover, and market strategy adjustments in China) may indicate continued operational execution risk and cost volatility, potentially weighing on earnings predictability and overall profitability.

- Increased inventory and working capital requirements linked to new product launches and a larger order book have contributed to weaker operating cash flow and cash conversion (46.7% in Q2 2025 versus 69.7% last year), raising concerns over Arjo's ability to efficiently manage cash and finance growth without increasing debt, especially if order fulfillment is delayed or sales momentum slows.

- The company's ability to pass on higher costs via price increases is described as "sensitive," risking market share losses if competitors do not follow suit-this points to potential pricing power limitations in key markets, which could negatively affect both revenue growth and gross margins over the long term if competitive pressures intensify.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK37.5 for Arjo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK45.0, and the most bearish reporting a price target of just SEK32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK12.3 billion, earnings will come to SEK944.0 million, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of SEK33.5, the analyst price target of SEK37.5 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.