Key Takeaways

- Robust order growth, transformative product launches, and strategic global expansion position Arjo for sustained revenue outperformance and higher gross margins.

- Structural healthcare trends and disciplined cost controls support long-term demand, improved profitability, and resilience against market and macroeconomic risks.

- Margin and earnings quality are threatened by rising costs, competitive pricing pressure, changing healthcare models, sustainability compliance needs, and intensified competition from lower-cost manufacturers.

Catalysts

About Arjo- Develops and sells medical devices and solutions for patients for clinical and financial outcomes for healthcare in Europe, Asia, Latin America, Africa, and Pacific.

- Analyst consensus expects strong order intake in North America to translate into steady future revenue growth, but notably underappreciates the strength and persistence of double-digit organic sales growth-over 12% in the U.S.-backed by a multi-quarter build-up in the order book and a newly refocused sales organization, which together suggest the potential for multi-year outperformance in top-line growth as large orders are delivered and market share is gained.

- While analysts broadly cite product launches as a positive, the market is underestimating just how transformative the recent ramp-up of next-gen patient handling products and systems could be; heightened customer adoption, particularly in high-growth categories like Patient Handling and connected care, could sharply accelerate average selling prices and support structurally higher gross margins.

- Arjo's global footprint is poised to unlock significant upside, as strong double-digit sales growth in emerging markets such as India-noted at 40%-and strategic investments in new infrastructure (e.g., the new Sydney distribution center and France office) position the company for outsized gains in underpenetrated regions, driving faster international revenue diversification and smoothing cyclicality risk.

- The underlying demand for Arjo's products is being structurally elevated by the sustained increase in global healthcare spending and the accelerating needs of an aging population, which together represent a multi-decade tailwind for both volume and pricing; this lifts the ceiling for long-term revenue growth above current market expectations.

- Moves to consolidate cost efficiency-combining restructuring, OpEx discipline, and automation across the supply chain-are not only offsetting inflationary and tariff headwinds but, with seasonally improving cash flows and a push towards an 80% cash conversion target, are setting the stage for sustained improvements in net margins and robust earnings compounding.

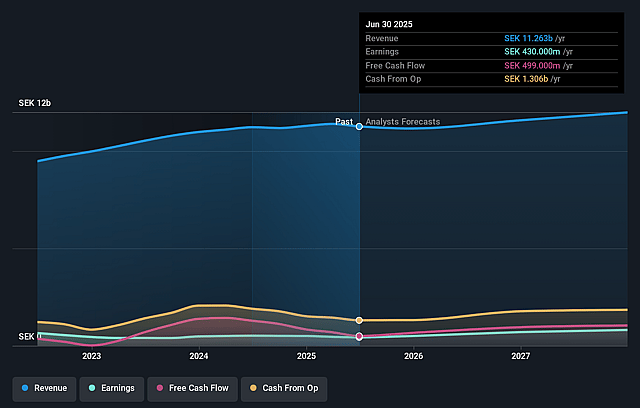

Arjo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Arjo compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Arjo's revenue will grow by 3.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.8% today to 8.4% in 3 years time.

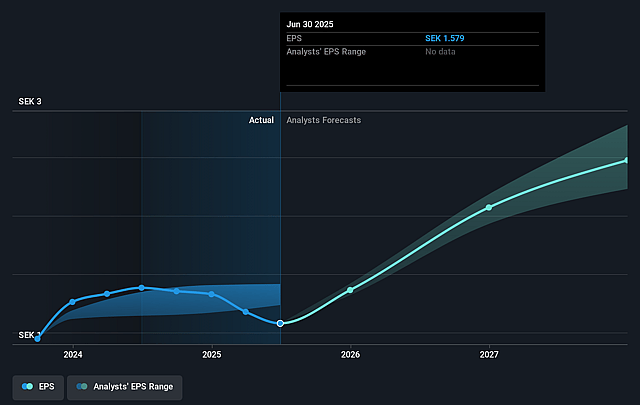

- The bullish analysts expect earnings to reach SEK 1.0 billion (and earnings per share of SEK 3.81) by about September 2028, up from SEK 430.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, down from 21.3x today. This future PE is lower than the current PE for the SE Medical Equipment industry at 50.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.73%, as per the Simply Wall St company report.

Arjo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing and potentially intensifying U.S. tariffs, especially on products from the Dominican Republic, directly increase Arjo's cost of goods sold, and management's ability to offset this with price increases is uncertain due to competitive pressures, which threatens sustained gross margin and earnings power.

- Persistent pressure on public health budgets in key developed markets such as the United Kingdom, where delayed public tenders and weaker-than-expected sales are already evident, raises concerns about long-term demand and the stability of Arjo's core revenue streams.

- The shift toward home-based and preventative healthcare models could reduce the addressable market for Arjo's facility-focused equipment, putting its traditional capital sales and service revenue under structural threat.

- Rising investment requirements for compliance with sustainability regulations, such as the costs related to product lifecycle management and manufacturing upgrades, may require higher capex, pressuring both net margins and free cash flow generation.

- Heightened competition from lower-cost manufacturers and the commoditization of medical equipment risks causing price erosion and margin compression, particularly in segments like patient handling where Arjo currently enjoys growth, potentially undermining earnings quality over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Arjo is SEK45.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arjo's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK45.0, and the most bearish reporting a price target of just SEK32.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK12.4 billion, earnings will come to SEK1.0 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.7%.

- Given the current share price of SEK33.62, the bullish analyst price target of SEK45.0 is 25.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Arjo?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.