Key Takeaways

- Reliance on facility-based solutions and mature markets exposes Arjo to pricing pressure, limited growth, and margin compression amid shifting care models and economic constraints.

- Slow adaptation to digital health innovations and mounting competitive threats risk product obsolescence, market share loss, and persistent profitability challenges.

- Robust North American growth, rising orders, cost efficiencies, successful pricing, and expanding recurring revenues strengthen earnings and support long-term business resilience.

Catalysts

About Arjo- Develops and sells medical devices and solutions for patients for clinical and financial outcomes for healthcare in Europe, Asia, Latin America, Africa, and Pacific.

- As healthcare budgets and government spending face rising pressures, hospitals and care facilities may further reduce reimbursement rates and limit capital investments, directly constraining Arjo's ability to achieve sustainable revenue growth in its core patient handling and mobility equipment segments.

- The accelerating shift toward home-based care and outpatient services threatens to structurally decrease demand for capital-intensive, facility-based solutions, risking meaningful long-term revenue stagnation as Arjo's portfolio remains predominantly geared toward institutional settings.

- With heavy dependence on mature markets such as North America and Europe, where population aging is offset by cost containment policies and slower economic growth, Arjo faces continued pricing pressure that is likely to compress net margins and hinder meaningful top-line expansion.

- If Arjo fails to keep pace with rapid technological advancements and innovation in connected, digital health, and remote monitoring, it risks product obsolescence and market share erosion, ultimately depressing future revenue and profitability.

- Industry-wide threats from increased market consolidation, aggressive pricing from larger medtech competitors, and proliferation of low-cost copycat products from emerging markets may erode Arjo's pricing power and profitability, resulting in lower earnings growth and sustained margin pressure over the coming years.

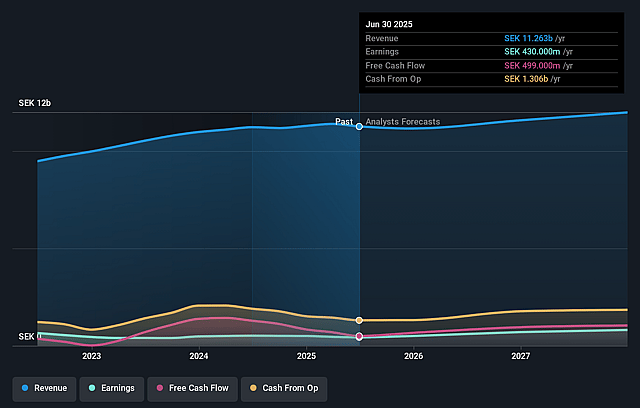

Arjo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Arjo compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Arjo's revenue will grow by 2.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.8% today to 7.1% in 3 years time.

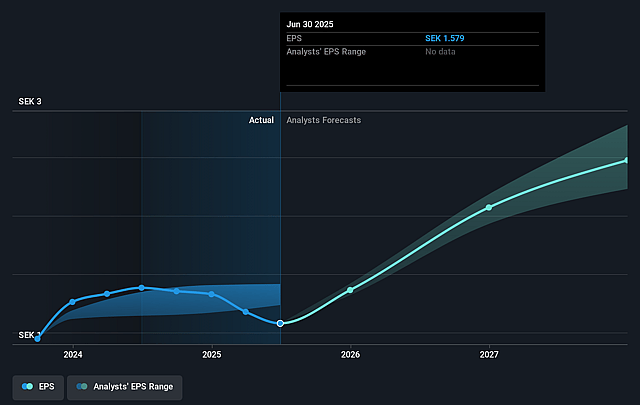

- The bearish analysts expect earnings to reach SEK 852.2 million (and earnings per share of SEK 3.14) by about August 2028, up from SEK 430.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, down from 22.1x today. This future PE is lower than the current PE for the SE Medical Equipment industry at 54.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.8%, as per the Simply Wall St company report.

Arjo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong organic growth in North America, particularly the United States with over 12% sales growth and no one-off effects, indicates robust demand and operational strength in a key market, which could support higher revenues and earnings in the coming years.

- Back-to-back quarters of rising order intake and a significantly larger order book versus the prior year suggest sustained future sales growth, directly supporting revenue and earnings stability.

- Ongoing cost efficiency measures across the value chain are showing tangible results, with the company now targeting flat operating expenses as a percentage of sales for the full year, which could lead to higher net margins and improved profitability over time.

- Successful introduction of price increases in the U.S. is already helping to offset increased tariffs, with management expressing confidence in their ability to fully compensate for cost headwinds, reducing risk to margins and supporting stable earnings.

- Consistent growth in service and rental business, expansion of patient handling solutions, and successful new product launches point to an evolving business model with higher recurring revenues, which can underpin long-term earnings and revenue resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Arjo is SEK32.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arjo's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK45.0, and the most bearish reporting a price target of just SEK32.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK12.1 billion, earnings will come to SEK852.2 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 6.8%.

- Given the current share price of SEK34.92, the bearish analyst price target of SEK32.0 is 9.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Arjo?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.