Last Update 22 Sep 25

Fair value Increased 20%Upgrades to consensus revenue growth forecasts from 1.7% to 5.6% per annum and a higher expected future P/E multiple have driven the Analyst Price Target for Nickel Asia up from ₱3.22 to ₱3.85.

What's in the News

- Board approved the establishment of a new wholly-owned real estate subsidiary with PHP 1 billion authorized capital; initial subscription of PHP 250 million.

- Approved additional funding for the Cawag Solar Power Project.

- Board considered and accepted a director’s resignation and appointed a new director.

Valuation Changes

Summary of Valuation Changes for Nickel Asia

- The Consensus Analyst Price Target has significantly risen from ₱3.22 to ₱3.85.

- The Consensus Revenue Growth forecasts for Nickel Asia has significantly risen from 1.7% per annum to 5.6% per annum.

- The Future P/E for Nickel Asia has significantly risen from 17.32x to 19.28x.

Key Takeaways

- Expansion into renewable energy and downstream processing aims to diversify revenue and improve margins, while divestments free up capital for growth initiatives.

- Tight nickel supply and increasing global demand are expected to sustain high prices, supporting revenue growth and stable long-term cash flow.

- One-time gains, weaker nickel prices, higher taxes and costs, and renewable project risks threaten long-term profitability and consistent earnings growth for Nickel Asia.

Catalysts

About Nickel Asia- Engages in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines.

- Ongoing global acceleration of electric vehicle adoption and increased green infrastructure spending is expected to sustain and grow demand for battery-grade nickel, which supports expectations for higher realized nickel prices and stronger revenue growth for Nickel Asia.

- Tight supply of raw nickel ore, especially due to restrictions in Indonesia, continues to support elevated export prices for saprolite ore; as global supply chains seek reliable nickel sources, this pricing strength is likely to boost revenues and EBITDA margins over the coming years.

- Expansion into downstream processing (HPAL investments) and the company's significant growth pipeline in renewable energy (with solar capacity targeted to reach 1GW+ by 2028) are poised to diversify and expand revenue streams while supporting improved net margins as new projects scale up.

- Preparation and development of new mining areas indicate a focus on maintaining or expanding production capacity, leveraging the company's low-cost reserve base, which should help ensure stable cash flows and protect net earnings over the long term despite weather-related and cost-inflation headwinds.

- Divestment of loss-generating equity stakes (e.g., Coral Bay, THPAL) has freed up capital for core business and high-growth initiatives, improving bottom-line performance and potentially driving higher ROIC and stronger net income going forward.

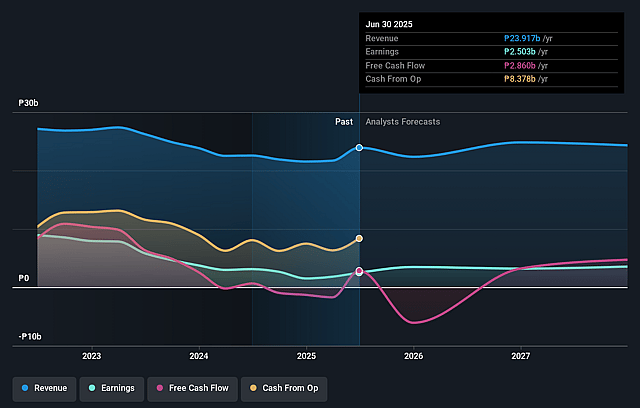

Nickel Asia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nickel Asia's revenue will grow by 1.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.5% today to 14.8% in 3 years time.

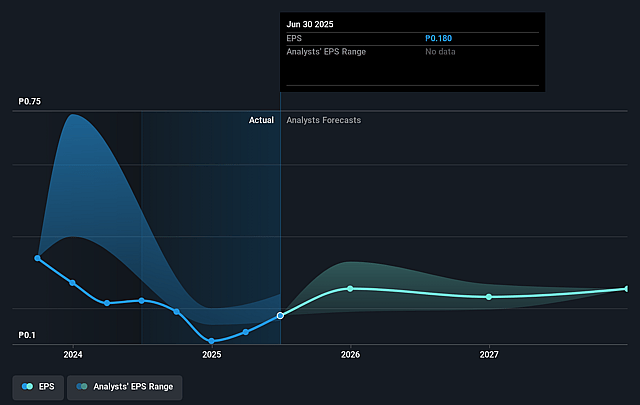

- Analysts expect earnings to reach ₱3.7 billion (and earnings per share of ₱0.25) by about September 2028, up from ₱2.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, down from 19.0x today. This future PE is greater than the current PE for the PH Metals and Mining industry at 13.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.89%, as per the Simply Wall St company report.

Nickel Asia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's significant earnings improvement was driven in part by a one-time gain from the sale of its equity stake in Coral Bay and THPAL, which is non-recurring, so comparable growth in net income is unlikely without repeat extraordinary items-this poses downside risk to future net income and reported earnings growth.

- Downward trends in global nickel LME prices due to oversupply, combined with a 7% decline in saprolite ore export volumes-exacerbated by adverse weather and operational disruptions-suggest risks of softer realized nickel prices and potentially reduced revenues for Nickel Asia over the long term.

- The new fiscal regime, specifically increased royalties outside mineral reservations and the introduction of a windfall profit tax, is expected to have a direct negative impact of approximately 3% on consolidated net income, creating persistent margin pressure and lowering long-term earnings.

- Rising mining costs from both expansion into new areas (which requires additional development and equipment depreciation) and increased operational difficulties tied to unfavorable weather, indicate higher cost inflation that could erode EBITDA margins and put pressure on overall profitability in future periods.

- Although the company is investing heavily in solar and renewable energy projects, there are execution and operational risks related to project delays, tariff fluctuations, and integration, which could impede timely capacity realization and create uncertainty for the diversification of revenue streams and long-term growth projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₱3.217 for Nickel Asia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱4.4, and the most bearish reporting a price target of just ₱2.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₱25.1 billion, earnings will come to ₱3.7 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 12.9%.

- Given the current share price of ₱3.41, the analyst price target of ₱3.22 is 6.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nickel Asia?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.