Catalysts

About Nickel Asia

Nickel Asia is a Philippine based natural resources and energy company focused on nickel mining, renewable power generation and early stage gold and copper exploration.

What are the underlying business or industry changes driving this perspective?

- Accelerating ramp up of the high grade Manicani mine is expected to lift export volumes by close to 30% while commanding an estimated 10% to 15% price premium. This positions mining revenues and EBITDA for outsized growth even if benchmark nickel metal prices remain subdued.

- Structural tightness in raw nickel ore supply from Indonesia and the Philippines, underpinned by stricter environmental permitting and shorter quota periods, is supporting elevated ore prices that have already decoupled from weak LME nickel and could sustain robust top line and margin expansion over the medium term.

- Rapid buildout of solar generation capacity, with targeted gross capacity of about 1,100 megawatts by 2027 versus earlier guidance for 2030, should meaningfully increase recurring power revenues and stabilize consolidated earnings through long term power supply agreements.

- Disciplined project returns in renewables, with grid connected solar projects pursued at or above 12% project IRR and largely funded through project finance and EPI specific equity, supports value accretive growth in net income while preserving Nickel Asia’s strong balance sheet and capacity to sustain generous dividends.

- Advancing gold and copper exploration with confirmed high grade intercepts and a goal to publish JORC or PMRC compliant reserves within two to three years introduces a potential new long duration revenue stream that could materially enhance long term earnings power and asset value relative to the current share price.

Assumptions

This narrative explores a more optimistic perspective on Nickel Asia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

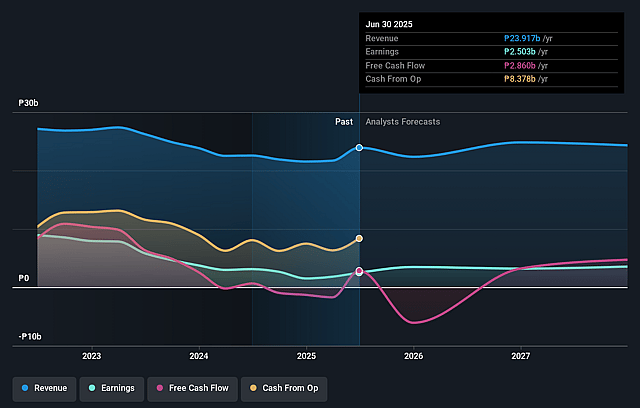

- The bullish analysts are assuming Nickel Asia's revenue will remain fairly flat over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 15.3% today to 12.5% in 3 years time.

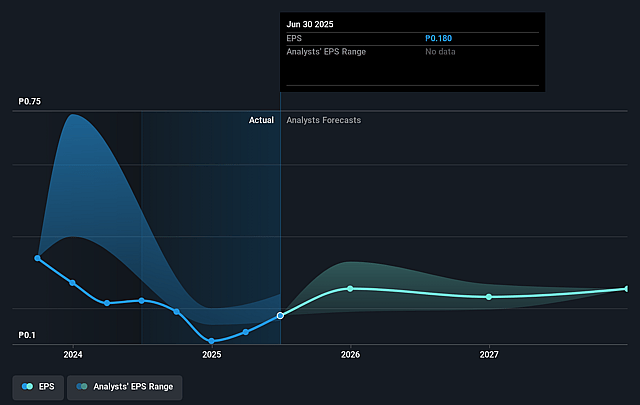

- The bullish analysts expect earnings to reach ₱3.4 billion (and earnings per share of ₱0.25) by about December 2028, down from ₱4.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, up from 12.1x today. This future PE is greater than the current PE for the PH Metals and Mining industry at 9.9x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.89%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The current strength in saprolite ore prices is being driven by temporary tightness in raw ore supply while the broader nickel market remains in global oversupply. If Indonesian permitting or quota policies ease or additional supply comes online, ore prices could fall back in line with weak LME nickel, compressing mining revenue and net income margins over the long term.

- The Manicani mine is expected to ramp from about 0.5 million wet metric tons to 3 million wet metric tons and become the highest grade contributor. Any delays in permits, environmental disruption, community pushback or grade underperformance would undermine the planned 30 percent volume uplift and price premium, limiting future revenue growth and EBITDA expansion.

- Renewable energy projects require very large and sustained capital expenditure with significant reliance on project finance and PSA tariffs. Prolonged weakness in power prices, regulatory changes to tariffs or cost overruns and delays on Leyte, Botolan, Cawag and Nazareno could result in lower than targeted 12 percent project IRRs and weaker long term earnings and return on equity.

- The gold and copper exploration program is still at an early stage with only promising drill intercepts and a long dated development horizon beyond 2030. If subsequent drilling fails to delineate commercially viable JORC or PMRC compliant reserves, the exploration spend will not translate into producing assets, reducing future diversification benefits and limiting longer term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Nickel Asia is ₱4.4, which represents up to two standard deviations above the consensus price target of ₱3.85. This valuation is based on what can be assumed as the expectations of Nickel Asia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱4.4, and the most bearish reporting a price target of just ₱3.15.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be ₱27.3 billion, earnings will come to ₱3.4 billion, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₱3.6, the analyst price target of ₱4.4 is 18.2% higher. Despite analysts expecting the underlying business to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nickel Asia?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.