Key Takeaways

- Accelerating APAC and MEA growth, combined with scaling AI and consulting investments, position Crayon for outsized, diversified revenue and faster-than-expected margin expansion.

- Strong expertise in cloud and compliance, alongside operational efficiencies, supports resilient and growing revenue streams, driving superior earnings and market share gains.

- Reliance on key vendor partnerships, regulatory pressures, industry commoditization, talent costs, and direct-to-consumer shifts threaten Crayon's margins, revenue growth, and long-term profitability.

Catalysts

About Crayon Group Holding- Operates as an information technology (IT) consultancy company in the Nordics, Europe, the Asia-Pacific, the Middle East and Africa, and the United States.

- While analyst consensus sees international expansion, especially into key developed markets, as a moderate growth lever, this significantly underestimates the synergistic impact of Crayon's rapid APAC and MEA expansion, which is poised to unlock even faster-than-expected topline growth and revenue diversification thanks to accelerating cloud adoption in these underpenetrated regions.

- Analysts broadly agree that integrating cloud hyperscalers and boosting value-added services should gradually lift margins, but the major ongoing investments in AI, automation, and next-gen consulting (as evidenced by rapid headcount growth and high double-digit consulting growth) position Crayon to achieve a step-change in net margins much sooner, as recurring higher-margin revenue streams reach scale ahead of market expectations.

- The accelerating shift to complex, multi-cloud and AI-driven enterprise environments globally is set to multiply the demand for Crayon's deep software asset management expertise, which will drive robust, highly resilient revenue streams as organizations require ongoing advisory and optimization support.

- Crayon's ability to deliver sustained improvements in net working capital and operating leverage, demonstrated by a dramatic reduction in factoring and best-ever negative net working capital, is laying a foundation for materially greater earnings growth and cash flow generation than currently reflected in valuation.

- As regulatory demands increase on cloud compliance and digital spend transparency, Crayon's established position as a trusted multi-vendor advisor, coupled with consolidation among cloud resellers, is likely to see the company capture outsized market share at increasingly attractive margins, expanding both gross and net profit well ahead of peer averages.

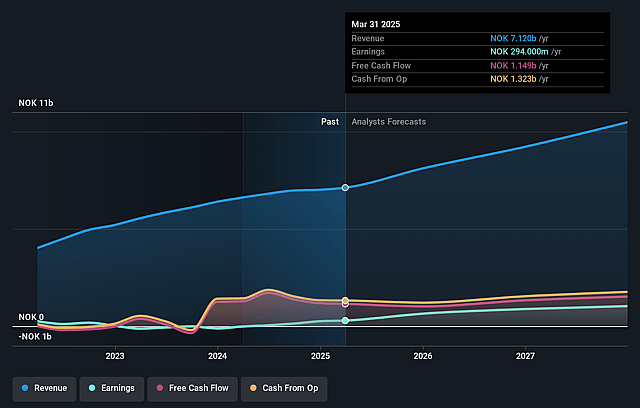

Crayon Group Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Crayon Group Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Crayon Group Holding's revenue will grow by 16.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.1% today to 11.3% in 3 years time.

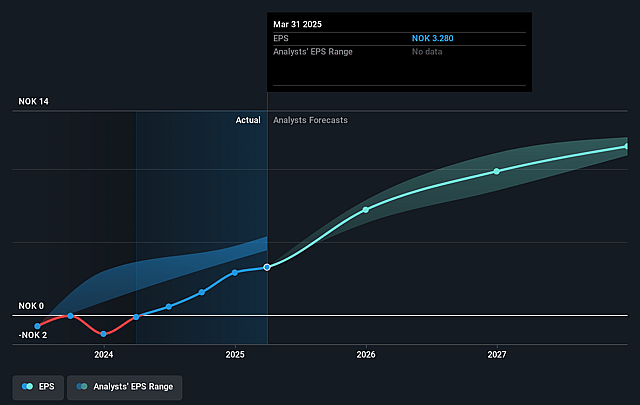

- The bullish analysts expect earnings to reach NOK 1.3 billion (and earnings per share of NOK 14.15) by about July 2028, up from NOK 294.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, down from 43.8x today. This future PE is lower than the current PE for the NO Software industry at 43.6x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Crayon Group Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased regulatory scrutiny and tightening data privacy laws, along with growing regulatory complexity around security and compliance, could drive up Crayon's costs to serve clients and constrain its ability to leverage data, thereby reducing its future revenue growth and pressuring profit margins.

- The company's heavy dependence on Microsoft and a small number of key software vendor relationships exposes it to unfavorable partnership renegotiations or incentive structure changes, which could significantly impact topline revenues and EBITDA margins in the long run.

- Ongoing technology commoditization and increased price competition in cloud and software resale are likely to compress margins for Crayon's consulting and channel businesses, undermining its ability to grow revenue and net profits as cloud solutions become increasingly standardized.

- The industry's accelerated shift toward direct-to-consumer software sales by major vendors, as well as the proliferation of automated AI-powered license management systems, threatens to erode the addressable market for intermediaries like Crayon, leading to potential long-term declines in consulting revenue and gross profit.

- Elevated costs of recruiting and retaining specialized talent, coupled with Crayon's rapid headcount growth and high reliance on consulting-led revenue, may increase operating costs faster than the company can raise prices or improve productivity, ultimately squeezing net margins and earnings over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Crayon Group Holding is NOK160.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Crayon Group Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK160.0, and the most bearish reporting a price target of just NOK112.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NOK11.2 billion, earnings will come to NOK1.3 billion, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of NOK144.0, the bullish analyst price target of NOK160.0 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.