Key Takeaways

- Heavy dependence on major cloud vendors and shifting partner incentives threaten Crayon's intermediary margins, earnings stability, and long-term profitability.

- Increased automation, regulatory fragmentation, and fierce competition erode pricing power and raise operating costs, risking lower organic growth and higher client churn.

- Growing demand for cloud and AI services, strategic partnerships, and a planned major merger collectively position Crayon for resilient, profitable, and diversified international expansion.

Catalysts

About Crayon Group Holding- Operates as an information technology (IT) consultancy company in the Nordics, Europe, the Asia-Pacific, the Middle East and Africa, and the United States.

- Structural reliance on major hyperscale vendors such as Microsoft, AWS, and Google exposes Crayon to increased risk from evolving direct-to-customer strategies and incentive restructuring. As hyperscalers consolidate their partner ecosystems and tighten incentive structures-as already evidenced by Microsoft's EA to CSP transition-Crayon's intermediary margins are at heightened risk of compression, threatening long-term gross profitability.

- The continued acceleration of automation and AI expertise within enterprises may reduce reliance on external advisors and consultants. As more companies internalize cloud cost management and software asset optimization, demand for Crayon's core services could materially decline, ultimately resulting in lower organic revenue growth and limiting the company's ability to sustainably expand its addressable market.

- Dependence on a concentrated set of vendor relationships increases exposure to abrupt changes in vendor priorities or partnership terms. Should key partners reduce strategic incentives or further prioritize direct sales, Crayon's net margins and overall earnings would be directly pressured over time, especially as incentive payouts remain volatile and unpredictable.

- Growing regulatory fragmentation and heightened requirements for data sovereignty and compliance in different markets will likely raise operational complexity and drive persistent increases in compliance and related operating costs. This may erode operating margins, particularly as Crayon seeks international expansion and must continually invest to meet disparate legal requirements across geographies.

- Ongoing industry commoditization and intensified competition from both global IT consultancies and specialized local providers are expected to undermine Crayon's pricing power and customer retention. Over the longer term, this could result in a downward trend in revenue per client and increase customer churn, making it increasingly difficult for Crayon to maintain stable top-line growth and robust net margins.

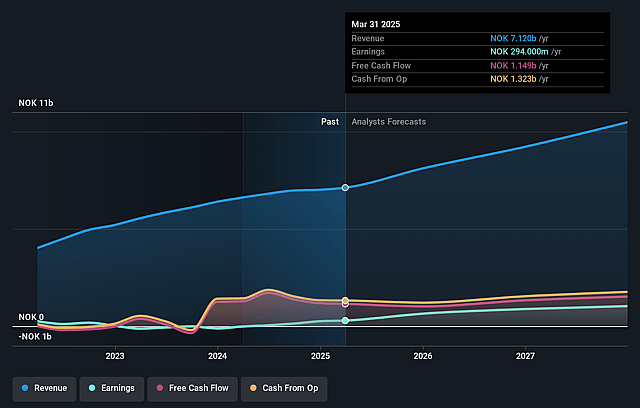

Crayon Group Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Crayon Group Holding compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Crayon Group Holding's revenue will grow by 15.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.1% today to 10.4% in 3 years time.

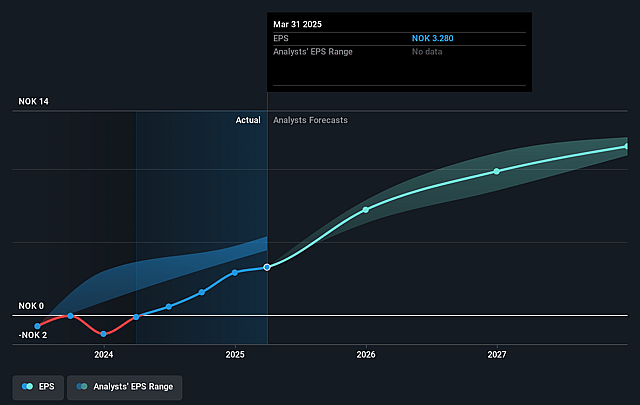

- The bearish analysts expect earnings to reach NOK 1.1 billion (and earnings per share of NOK 12.82) by about July 2028, up from NOK 294.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.9x on those 2028 earnings, down from 43.8x today. This future PE is lower than the current PE for the NO Software industry at 43.5x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.98%, as per the Simply Wall St company report.

Crayon Group Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global acceleration of digital transformation and rising enterprise demand for cloud solutions have resulted in strong international growth for Crayon, including double-digit growth in Europe, APAC, EMEA, and the US, which could support sustained topline revenue growth in future years.

- Increasing adoption of AI and cloud-based services by enterprises has driven high growth in Crayon's Consulting and Service businesses, especially with a 71% growth in Consulting and meaningful long-term demand for advisory offerings, which could improve recurring revenues and profit stability.

- The consolidation of Microsoft's CSP partner ecosystem is making scale, technical expertise, and multi-cloud service capabilities more valuable, positioning Crayon as a prioritized strategic partner; this may support future margin expansion and enhanced gross profit from higher-value technical engagements.

- Crayon's geographic revenue diversification and ongoing investments in talent have enabled resilience against macroeconomic and regional volatility, which could help maintain or increase profit margins and deliver stronger-than-expected earnings even in challenging markets.

- The planned merger with SoftwareOne and a resulting position as one of the world's largest Microsoft partners may unlock new cross-selling opportunities and efficiency synergies, accelerating both revenue growth and net margin improvements over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Crayon Group Holding is NOK112.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Crayon Group Holding's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK160.0, and the most bearish reporting a price target of just NOK112.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be NOK11.1 billion, earnings will come to NOK1.1 billion, and it would be trading on a PE ratio of 10.9x, assuming you use a discount rate of 8.0%.

- Given the current share price of NOK144.0, the bearish analyst price target of NOK112.0 is 28.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.