Key Takeaways

- Recovery in lithium prices and rising demand for green metals could drive significant profit margin expansion beyond analyst expectations.

- Strategic alignment with regional policies and early moves in battery recycling position AMG for stable, long-term growth and potential regulatory advantages.

- Heavy dependence on volatile commodity markets, operational hurdles, and threats from recycled materials present significant risks to stability and long-term profit growth.

Catalysts

About AMG Critical Materials- Develops, produces, and sells energy storage materials.

- While analyst consensus sees lithium market stabilization and higher volumes from the Brazilian and Bitterfeld assets, these views understate the potential for significant margin expansion and outsized EBITDA growth when lithium prices inevitably recover, given AMG's proven ability to remain profitable even at current depressed price levels.

- The consensus also credits strong order intake and backlog in AMG Technologies, yet it may overlook the step-change in segment profitability possible if premium pricing for green or specialty metals accelerates as Western governments tighten ESG and traceability requirements, potentially leading to higher sustained net margins.

- AMG's rapid progress expanding domestically-controlled refining of critical metals (lithium, vanadium, chrome) in the US and EU aligns directly with regional industrial policy and nearshoring trends, positioning the company to benefit disproportionately from subsidies, grants, and long-term off-take contracts, which could enhance multi-year revenue visibility and cash flow stability.

- The early investments and partnerships in lithium mining and spent catalyst recycling across Europe, the Middle East, and North America position AMG to capture a dominant share in high-growth, ESG-driven battery material recycling-a market forecast to outpace primary supply growth-supporting future revenue and margin expansion.

- Ongoing, high-level discussions with US and EU policymakers could unlock further public-private funding, regulatory incentives, and accelerated permitting for future expansions, providing asymmetric upside to both earnings growth and strategic valuation as supply chain security becomes a defining investment theme.

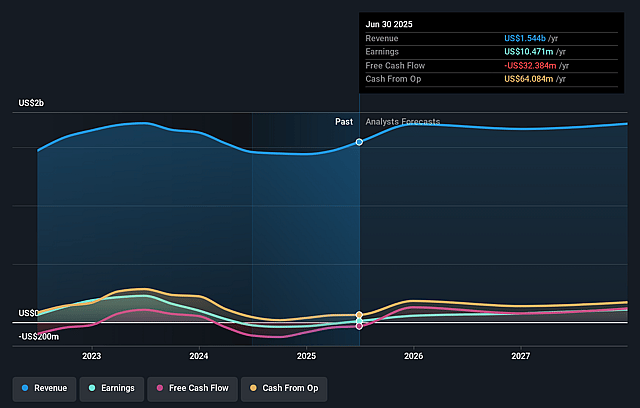

AMG Critical Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AMG Critical Materials compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AMG Critical Materials's revenue will grow by 7.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.7% today to 8.4% in 3 years time.

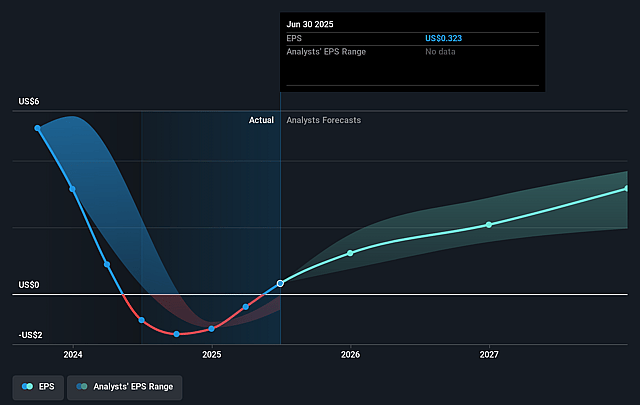

- The bullish analysts expect earnings to reach $160.1 million (and earnings per share of $5.09) by about September 2028, up from $10.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.6x on those 2028 earnings, down from 97.0x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 10.3x.

- Analysts expect the number of shares outstanding to decline by 1.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

AMG Critical Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AMG remains heavily exposed to cyclical commodity markets, as seen in the recent revenue declines in the lithium and vanadium segments due to lower prices and volumes, which could lead to unpredictable swings in revenue and earnings if commodity price softness persists or intensifies over the long term.

- The text highlights ongoing operational challenges, including equipment failures in the Brazilian lithium plant and supply issues in vanadium, underscoring risks of cost overruns and delays in major capex projects, which could result in higher debt and prolonged pressure on net margins.

- AMG's strategy centers on primary production of specialty metals, yet global decarbonization trends and circular economy policies threaten to shift demand toward recycled alternatives, potentially eroding the long-term growth trajectory of revenues from virgin critical materials.

- While expansion into new geographies such as the Middle East and deepened involvement in US/EU supply chains provide opportunities, they also expose AMG to heightened geopolitical and regulatory risks, including tariffs, resource nationalism, and ESG-driven compliance costs, which could depress margins and restrict future business development.

- The surge in AMG Technologies' EBITDA this quarter was significantly boosted by a one-off inventory effect in antimony, raising concerns about the persistence of these profit levels should market dynamics normalize, potentially resulting in volatility and unsustainable net income performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AMG Critical Materials is €32.06, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AMG Critical Materials's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €32.06, and the most bearish reporting a price target of just €20.22.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $160.1 million, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of €26.9, the bullish analyst price target of €32.06 is 16.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.