Key Takeaways

- Technological changes, recycling trends, and evolving battery chemistry threaten long-term demand for AMG's core materials, risking revenue and asset utilization.

- Geopolitical tensions, resource nationalism, and commodity price swings heighten earnings volatility and may compress margins amid heavy ongoing investment.

- Strategic global expansion in refining, battery materials, and recycling strengthens AMG's position in critical supply chains, fostering steady revenue, margin growth, and order visibility.

Catalysts

About AMG Critical Materials- Develops, produces, and sells energy storage materials.

- Anticipated technological shifts in battery chemistry or large-scale substitution away from lithium or vanadium could significantly erode long-term demand for AMG's production base, leading to structural revenue decline and potential asset underutilization.

- Ongoing geopolitical risks and the rise of resource nationalism may disrupt supply chains, introduce new regulatory hurdles, and inflate costs for cross-border projects, all of which threaten to erode net margins and undermine future earnings predictability.

- Heavy capital expenditure required for ongoing expansion in lithium and chrome refining, alongside the ramp-up of new facilities, exposes AMG to material downside risk if projected demand growth falters or if pricing pressure intensifies, leading to lower return on capital and strained free cash flow for several years.

- Heightened exposure to commodity price volatility, particularly for lithium, vanadium, and antimony, leaves AMG's earnings profile vulnerable to periods of oversupply and cyclical price weakness, which can rapidly compress net margins and reduce profitability despite recent strong quarters.

- Accelerating adoption of circular economy practices, increased recycling rates, and decarbonization policies-especially in key markets-could suppress long-term demand for primary critical materials production, ultimately decreasing AMG's total addressable market, constraining revenue growth, and putting downward pressure on EBITDA over the coming decade.

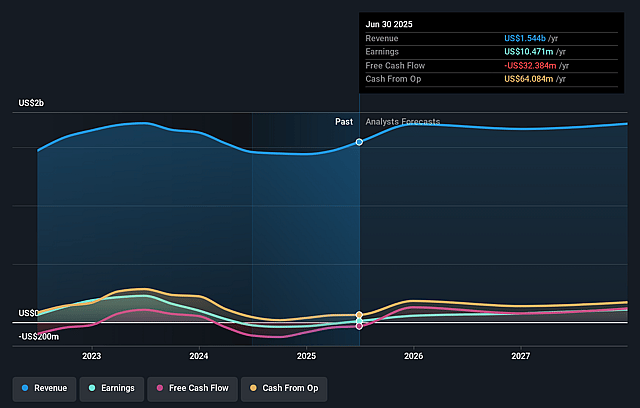

AMG Critical Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on AMG Critical Materials compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming AMG Critical Materials's revenue will decrease by 0.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.7% today to 8.3% in 3 years time.

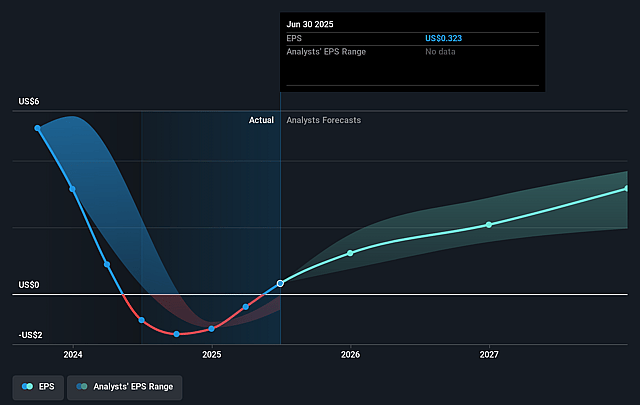

- The bearish analysts expect earnings to reach $132.2 million (and earnings per share of $2.69) by about September 2028, up from $10.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.6x on those 2028 earnings, down from 98.8x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 9.8x.

- Analysts expect the number of shares outstanding to decline by 1.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

AMG Critical Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growing global focus on energy transition, electrification, and regional supply chain security is driving sustained and government-supported demand for critical materials such as lithium, vanadium, antimony, and chrome, which form the core of AMG's product portfolio and are highlighted as experiencing robust, multi-regional demand-potentially supporting long-term revenue and reducing demand risk.

- AMG is strategically expanding and investing in critical material refining in the US, EU, and Middle East, which aligns closely with industrial policies, government incentives, and regulatory requirements promoting domestic self-sufficiency; this enhances AMG's competitive positioning and underpins long-term customer contracts, likely contributing to stable or growing revenues.

- The continued ramp-up of AMG's battery-grade lithium hydroxide production and further investment in European and Brazilian lithium assets positions AMG at the center of European and global battery supply chains, a sector with multi-year secular growth projected to drive higher top-line sales and improved margins.

- AMG's high-and rising-engineering order backlog, particularly in its Technologies segment, suggests robust multi-year customer commitments across aerospace, energy, and industrial markets; this order visibility increases near

- and mid-term earnings predictability and could support upward pressure on net margins.

- AMG is expanding its recycling and spent catalyst processing businesses in the US, Europe, and Middle East, leveraging proprietary technology to create high-margin, circular-economy revenue streams poised to benefit from structural tailwinds around ESG, resource efficiency, and environmental regulations, supporting margin resilience and long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for AMG Critical Materials is €20.22, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AMG Critical Materials's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €32.06, and the most bearish reporting a price target of just €20.22.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $132.2 million, and it would be trading on a PE ratio of 6.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of €27.54, the bearish analyst price target of €20.22 is 36.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.