Key Takeaways

- Early leadership in energy transition infrastructure and strategic positioning amid rising buffer inventories enable Vopak to command premium pricing and stronger recurring revenues.

- Disciplined portfolio management and digitalization drive operational efficiency, margin expansion, and faster earnings growth versus peers.

- Structural declines in fossil fuels, regulatory pressures, and slow uptake for new energy storage risk underutilization, higher costs, and weaker revenue growth for Vopak.

Catalysts

About Koninklijke Vopak- An independent tank storage company, stores and handles liquid chemicals, gases, and oil products to the energy and manufacturing markets worldwide.

- While analyst consensus recognizes Vopak's investments in energy transition infrastructure as a driver for future growth, the scale and early-mover advantage of Vopak's €1.4 billion equity commitment (out of a €2 billion ambition) is likely being underestimated-these assets should command premium utilization and margins as global demand for ammonia, hydrogen, and biofuels accelerates, directly lifting revenue and long-term EBITDA well beyond consensus forecasts.

- Analysts broadly agree that high growth in industrial and gas terminals will enhance Vopak's footprint in key regions, but the company's rapid portfolio ramp-up in Asia, Middle East, and Canada-coupled with high occupancy rates over 90%-suggests that terminal capacity constraints could enable Vopak to exercise significant pricing power, materially boosting net margins and cash flows as global trade in energy and chemicals intensifies.

- Surging geopolitical instability is leading to a structural increase in buffer inventories worldwide, and Vopak's global network is strategically poised to capture this shift, driving both higher occupancy rates and allowing for premium pricing-translating directly into stronger recurring revenues and more resilient earnings than the market currently anticipates.

- The company's rapid asset divestiture and reinvestment cycle, together with a disciplined capital allocation framework and active share repurchases, is setting up for accelerated growth in return-on-invested-capital and per-share earnings-much faster than peers and potentially surprising the market with higher EPS upside.

- Advanced digitalization and automation investments are already reducing operational costs and enhancing safety, positioning Vopak to outperform on operating margins and deliver sustained free cash flow growth over the next decade as it leverages technological leadership across its terminal network.

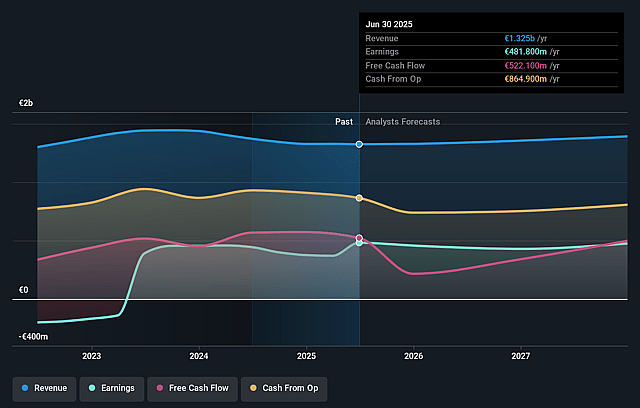

Koninklijke Vopak Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Koninklijke Vopak compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Koninklijke Vopak's revenue will grow by 2.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 36.4% today to 36.9% in 3 years time.

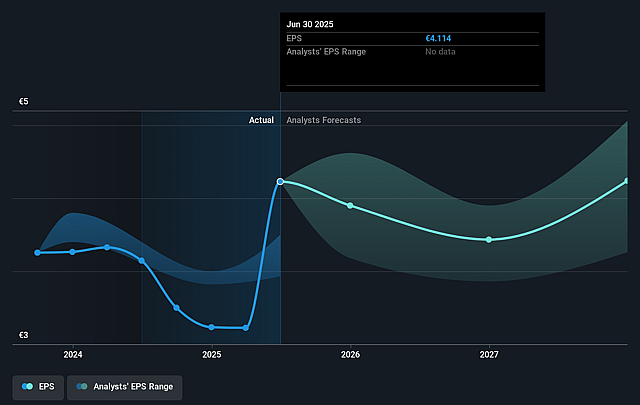

- The bullish analysts expect earnings to reach €521.9 million (and earnings per share of €4.52) by about September 2028, up from €481.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from 9.7x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 9.9x.

- Analysts expect the number of shares outstanding to decline by 3.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.87%, as per the Simply Wall St company report.

Koninklijke Vopak Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Vopak's heavy reliance on fossil fuel and chemical storage exposes it to long-term structural declines in these sectors due to the global energy transition away from oil and chemicals, which could lead to underutilized assets and suppress future revenues and occupancy rates.

- Regulatory actions and decarbonization policies are likely to accelerate, resulting in higher costs for compliance and operations, potentially eroding Vopak's net margins and lowering the value of legacy fossil fuel storage assets over time.

- High capital expenditures are required to repurpose infrastructure for new energy carriers, such as hydrogen or ammonia, with Vopak projecting at least €4 billion in proportional growth CapEx to 2030; execution delays, slow uptake, or cost overruns on these projects may strain free cash flow and reduce future earnings.

- Weakness in the chemicals market, as openly acknowledged in the call, combined with the ongoing trend of overcapacity and eroding demand from key customers, could lead to declining occupancy and throughput, further weighing on revenue growth.

- Shifting global trade flows, supply chain localization, and the potential for industry consolidation may reduce demand for transshipment and hub storage, intensifying price competition and negatively impacting Vopak's profitability and revenue generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Koninklijke Vopak is €59.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Koninklijke Vopak's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €59.0, and the most bearish reporting a price target of just €40.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €1.4 billion, earnings will come to €521.9 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 5.9%.

- Given the current share price of €40.42, the bullish analyst price target of €59.0 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.