Key Takeaways

- Accelerating energy transition and regulatory pressures threaten Vopak's legacy asset values, utilization rates, and long-term profitability.

- High investment needs, ESG-driven funding risks, and persistent overcapacity further constrain cash flow, margins, and future growth prospects.

- Accelerating investment in energy transition infrastructure and a diversified global portfolio underpin stable revenue streams and position Vopak for resilient long-term growth.

Catalysts

About Koninklijke Vopak- An independent tank storage company, stores and handles liquid chemicals, gases, and oil products to the energy and manufacturing markets worldwide.

- The global shift to renewable energy and electrification is expected to accelerate, reducing long-term demand for Vopak's traditional oil, gas, and chemical storage, which will likely lead to structural declines in terminal utilization rates and put sustained pressure on revenue growth through to 2030 and beyond.

- Regulatory tightening and decarbonization policies are set to increasingly target hydrocarbon infrastructure, raising the risk of future asset impairments and costly write-downs for Vopak's oil-focused terminals. This will compress margins and depress long-run earnings as legacy assets lose value faster than the company's energy transition investments can compensate.

- Vopak's capital expenditure requirements for sustaining and repurposing aging infrastructure are expected to remain high, while cash generation from legacy terminals may decline. The result will be downward pressure on net margins and free cash flow, threatening the company's ability to sustain dividend growth and shareholder returns.

- The vulnerability to ESG-driven capital flight and stakeholder pressure is increasing. As global investors and customers continue to pivot away from fossil fuel-linked companies, Vopak could face a higher cost of capital and reduced access to growth funding, ultimately limiting expansion prospects and eroding long-term earnings power.

- Overbuilding of global storage capacity – especially in key industrial and oil hubs – in response to past energy volatility is likely to keep utilization rates and pricing under pressure, while rising decommissioning costs for older terminals will further diminish profitability and create a drag on future net income.

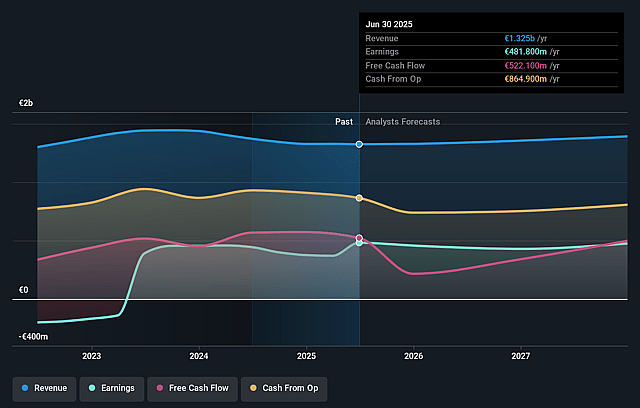

Koninklijke Vopak Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Koninklijke Vopak compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Koninklijke Vopak's revenue will grow by 2.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 36.4% today to 29.4% in 3 years time.

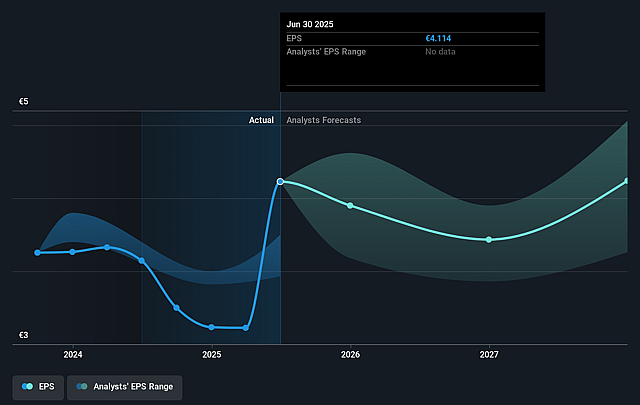

- The bearish analysts expect earnings to reach €413.7 million (and earnings per share of €3.62) by about August 2028, down from €481.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, up from 9.9x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 9.9x.

- Analysts expect the number of shares outstanding to decline by 4.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.76%, as per the Simply Wall St company report.

Koninklijke Vopak Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust demand for energy, chemicals, and gas storage is driving high terminal occupancy rates of above 90 percent, indicating resilient and recurring revenue streams that may support long-term revenue growth rather than a decline.

- Significant and accelerating investments in energy transition infrastructure, such as hydrogen and ammonia terminals, position Vopak to capitalize on new revenue sources as global decarbonization trends progress, helping offset potential declines in traditional oil and gas storage demand and supporting future earnings.

- A well-diversified global portfolio, including a strong presence in growth markets like India and ongoing expansions in Asia and North America, helps reduce geographic and customer concentration risk while underpinning stable or growing cash flows and net margins.

- Vopak maintains a strong capital allocation framework with a long history of annual dividend payments and share buybacks, signaling healthy cash flow and management confidence in future earnings and shareholder returns.

- The company's strategy of entering into long-term take-or-pay contracts for gas and industrial terminals provides predictable cash flows and shields margins against short-term volatility, likely supporting consistent or growing net income in the years ahead.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Koninklijke Vopak is €40.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Koninklijke Vopak's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €59.0, and the most bearish reporting a price target of just €40.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €1.4 billion, earnings will come to €413.7 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 5.8%.

- Given the current share price of €41.5, the bearish analyst price target of €40.0 is 3.8% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.