Key Takeaways

- Ongoing operational challenges, rising labor costs, and aggressive competition are likely to put sustained pressure on TKH's margins and revenue growth.

- Restructuring efforts in digitalization and fiber operations may not achieve lasting profitability due to industry overcapacity and regulatory headwinds.

- Expanding innovation, operational efficiency, and geographic reach positions TKH for sustained margin growth and diversification, leveraging rising global demand for smart, sustainable technologies.

Catalysts

About TKH Group- Develops and delivers smart vision, smart manufacturing, and smart connectivity systems in the Netherlands, rest of Europe, Asia, North America, and internationally.

- The complexity and operational unpredictability of TKH's Eemshaven cable plant continues to weigh heavily on margins, with past high-profile project delays revealing a steep learning curve; any further execution errors or difficulty ramping up to full productivity will risk ongoing cost overruns and inefficiency, further eroding operating margins and net earnings.

- Despite management's confidence, the transition to more complex, longer-length projects-especially those expected in late 2026 and 2027-still pose significant operational and technological risk; even minor production errors can disrupt output, impair capacity utilization, and lead to costly contract penalties, which would pressure both revenue growth and free cash flow generation.

- Employee and wage inflation pressures in Europe, exacerbated by regional labor shortages and the company's still-heavy exposure to Western European operating expense, will likely drive up costs faster than top-line growth, compressing net margins over the medium to long term.

- Increasing global competition and commoditization in connectivity and cabling-particularly from aggressive Asian entrants investing in new low-cost capacity-threatens TKH's ability to sustain pricing or market share in its core segments, posing a risk to top-line growth and making premium margin restoration improbable.

- The restructuring of legacy digitalization and fiber-optic operations, including plant consolidations and asset impairments, may still fail to restore sustainable profitability in these units due to persistent industry overcapacity, slow demand recovery, and structural regulatory cost increases, suggesting future EBITDA and return on capital will remain subdued even as reported cost savings materialize.

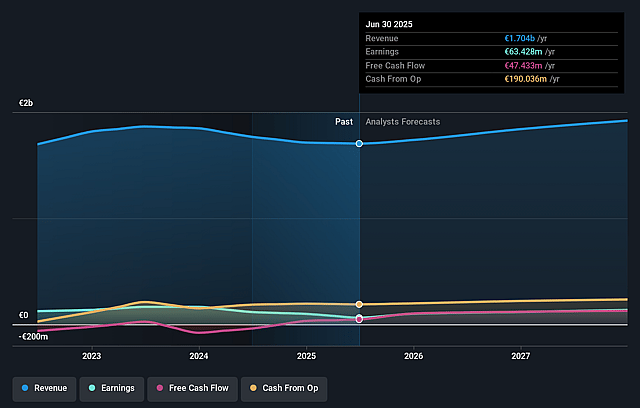

TKH Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on TKH Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming TKH Group's revenue will grow by 3.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.7% today to 6.8% in 3 years time.

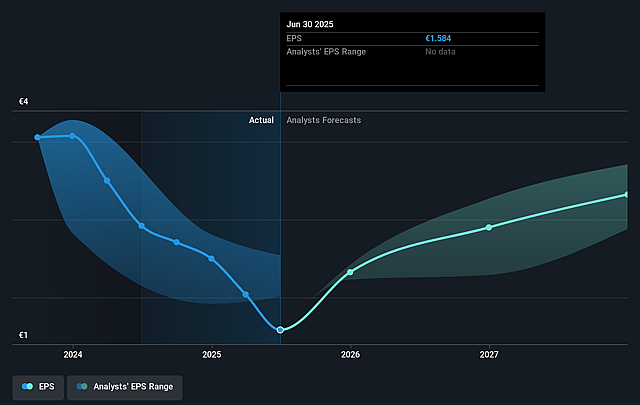

- The bearish analysts expect earnings to reach €129.9 million (and earnings per share of €3.26) by about September 2028, up from €63.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, down from 21.3x today. This future PE is lower than the current PE for the GB Electrical industry at 14.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

TKH Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acceleration of digitalization, automation, and electrification across multiple sectors creates a long-term secular tailwind for TKH, with rising global demand supporting potential organic revenue growth and sustained higher operating margins.

- Significant operational improvements and learning curve progress at new manufacturing facilities-especially at Eemshaven, now approaching 80% productivity-enable TKH to increase output and margins, with management expressing strong confidence in their capacity to execute future, simpler projects successfully, paving the way for margin recovery and earnings growth.

- High ongoing investment in R&D and proprietary technology platforms positions TKH to launch innovative solutions for growing markets (machine vision, e-mobility, smart connectivity), which supports pricing power, competitive differentiation, and a path to sustainably higher gross margins and earnings.

- Strategic expansion beyond the Dutch market into high-growth European regions (such as the UK, Ireland, Germany, and Scandinavia) and strong uptake in onshore energy cables provide revenue diversification and create opportunities for more resilient top-line growth.

- Increasing demand for smart infrastructure, sustainability solutions, and security technologies-accompanied by TKH's focus on high-margin vision and security segments-point to significant long-term upside for revenue and profit, especially as urbanization, regulatory requirements, and energy transition initiatives continue to expand the addressable market.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for TKH Group is €34.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of TKH Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €53.5, and the most bearish reporting a price target of just €34.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €1.9 billion, earnings will come to €129.9 million, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of €33.84, the bearish analyst price target of €34.0 is 0.5% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.