Key Takeaways

- Rapid operational improvements and strong demand from both wind and smart infrastructure segments could drive significant earnings and margin upside, surpassing market expectations.

- Strategic restructuring, digitalization, and new technology launches position TKH for higher profitability, enhanced cash flow, and sustained long-term growth across multiple verticals.

- Operational inefficiencies, exposure to cyclical sectors, high transition costs, global trade headwinds, and legacy product risks threaten TKH Group's margins, cash flow, and market share.

Catalysts

About TKH Group- Develops and delivers smart vision, smart manufacturing, and smart connectivity systems in the Netherlands, rest of Europe, Asia, North America, and internationally.

- Analyst consensus expects TKH's operational turnaround at the Eemshaven connectivity plant to drive margin normalization, but given recent progress-ramping from 10% to 80% productivity in just two quarters and management's confidence in meeting long-length cable demands for all upcoming projects-the plant could rapidly surpass historical margin levels, leading to a sharper-than-expected step change in segment EBITDA and earnings by 2026.

- While analysts broadly highlight a strong order book fueled by the offshore wind sector, they may be underestimating the scale of demand from ongoing smart infrastructure and onshore electrification efforts across Europe, as regulatory and permitting hurdles are now largely resolved; this positions TKH to potentially reach full utilization or "sold out" status ahead of schedule, unlocking significant operating leverage and sustained revenue acceleration.

- TKH's Smart Vision segment-already posting over 12% organic turnover growth and 35% EBITDA growth-has only begun to penetrate high-growth verticals such as defense, battery manufacturing, and high-end logistics, with management noting deepening customer adoption, premium pricing, and robust project pipelines. This dynamic points to substantial upside in both topline growth and group margin mix as vision technology expands globally.

- The group's strategic restructuring and digitalization initiatives, notably the consolidation of fiber optic operations to Poland and focused cost takeout, set up a rapid inflection from loss-making to profitability in these activities during the second half of 2025, with management guiding for breakeven and the potential for accretive divestments, which could drive a material improvement in net margins and cash flow generation versus market expectations.

- Early-stage success and near-term rollout of the proprietary UNIXX tire production system signal entry into a multi-year replacement cycle for conventional tire manufacturing, supported by automaker demand for high-end, sustainable solutions. If adoption extends beyond initial deployments, TKH could unlock a new, higher-margin growth engine, structurally lifting long-term earnings power beyond current forecasts.

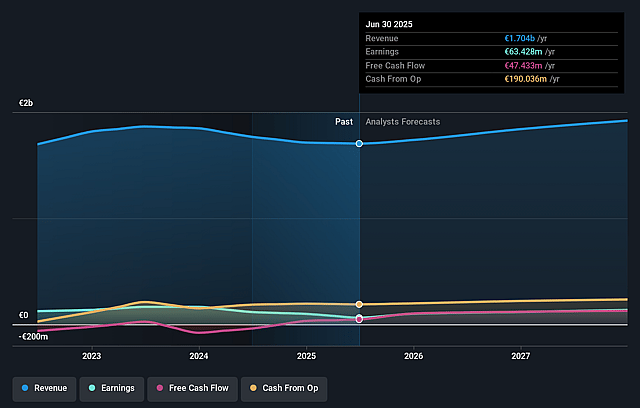

TKH Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TKH Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TKH Group's revenue will grow by 5.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.7% today to 8.8% in 3 years time.

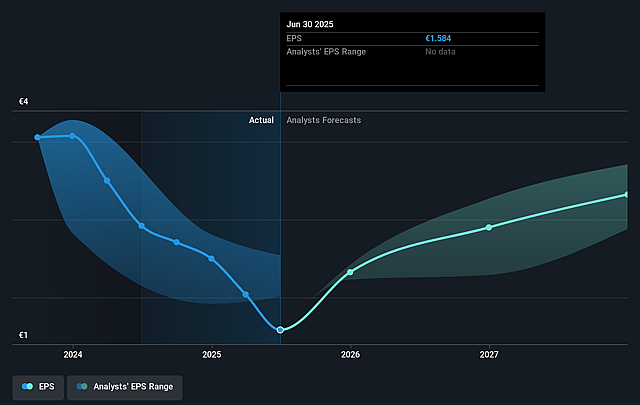

- The bullish analysts expect earnings to reach €177.1 million (and earnings per share of €4.19) by about September 2028, up from €63.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.9x on those 2028 earnings, down from 21.4x today. This future PE is about the same as the current PE for the GB Electrical industry at 14.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.16%, as per the Simply Wall St company report.

TKH Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent production issues and operational inefficiencies, especially in the Eemshaven plant, have not only led to substantial margin decline in Smart Connectivity-from 10% to just 1% in three years-but also highlight the risk that scaling up new, technologically advanced plants could continue to depress net margins and earnings if not fully resolved.

- TKH Group's heavy dependence on cyclical sectors like construction, automotive, and tire manufacturing exposes it to macroeconomic slowdowns and sector-specific headwinds; with current Tier 1 customers slowing CapEx due to trade uncertainty and ongoing weak automotive volumes, revenues and profitability could remain under pressure if headwinds persist or worsen.

- The ongoing transition to digitalization and plant automation is accompanied by restructuring costs, consolidations, and asset write-downs, while high capital expenditure and R&D requirements risk limiting free cash flow and net margin improvements if efficiency gains or revenue growth from new technologies are slower than expected.

- Global trends towards nearshoring and economic nationalism, combined with rising trade barriers and tariffs in key international markets, increase cost pressures, create regulatory complexity, and can impact export volumes, particularly as over half of TKH's revenues come from outside the Netherlands; this may erode revenue and compress margins if the company cannot fully pass on increased costs to customers.

- Legacy product lines, especially in traditional cable and fiber optics, face ongoing commoditization, price pressures, and risk of technological obsolescence, while new competitors are investing heavily in local manufacturing in Asia and North America; this competitive landscape, together with increasing ESG and sustainability requirements, threatens both TKH's market share and profitability by squeezing revenue streams and increasing compliance costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TKH Group is €53.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of TKH Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €53.5, and the most bearish reporting a price target of just €34.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €2.0 billion, earnings will come to €177.1 million, and it would be trading on a PE ratio of 14.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of €34.02, the bullish analyst price target of €53.5 is 36.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.