Key Takeaways

- Market-agnostic fleet expansion and diversification into large, high-margin contracts position Fugro for accelerated revenue and profit growth beyond current analyst expectations.

- Unique technology leadership and government partnerships secure privileged access to high-barrier, recurring projects, ensuring robust, resilient multi-year earnings growth.

- Structural industry shifts, digital disruption, and sector concentration expose Fugro to shrinking markets, margin pressure, increased earnings volatility, and heightened capital and technological risks.

Catalysts

About Fugro- Provides geo-data services for the infrastructure, energy, and water industries in Europe, Africa, the Americas, the Asia Pacific, the Middle East, and India.

- Analyst consensus highlights technology integration and geotechnical fleet expansion as supporting higher margins and growth, but these may significantly understate the upside: Fugro's now-completed, market-agnostic fleet expansion-combined with proven asset redeployment into a broadening universe of large-scale, long-duration contracts-is poised to deliver both instant utilization gains and rapid, recurring revenue acceleration, particularly as delayed and new projects in infrastructure, oil and gas, and renewables ramp up in the next 6-12 months.

- While analysts expect margin improvement from technology adoption and cost reductions, the visible annualized savings of €80 to €100 million from a comprehensive, structural cost reduction program-including workforce and supplier optimization-are not yet fully priced in and, when combined with replacement of wind backlog losses by more diversified, higher-margin work, could result in a step-change in net margins and free cash flow well ahead of consensus.

- The sharp increase in data center construction, driven by accelerating AI and digital trends, will necessitate massive energy and resilient infrastructure investments, directly amplifying global demand for Fugro's geo-data, site characterization, and environmental services-offering a durable, multi-year uplift in project pipelines and top-line growth.

- Fugro's early lead and continued investments in remote, uncrewed vessel (USV) and advanced land data tech (such as GroundIQ and the deepwater Blue Dragon drill) give it a first-mover advantage as regulatory and customer pressures heighten for safer, greener, and more cost-efficient operations; this positions Fugro to capture disproportionate share of high-value, recurring, digitally-enabled services, supporting persistent earnings outperformance.

- Governments and corporates are dramatically accelerating spend on coastal defense, subsea infrastructure security, and climate adaptation-areas where Fugro already has multi-modal, turnkey solutions and government partnerships, giving it privileged access to fast-growing, high-barrier projects and enabling robust multi-year backlog visibility that de-risks future revenue, margin, and cash generation beyond market expectations.

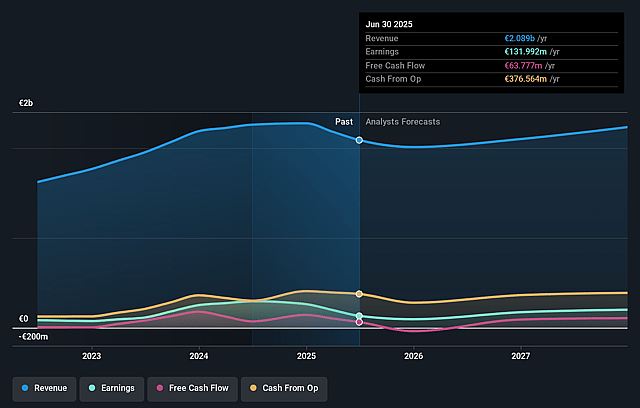

Fugro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fugro compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fugro's revenue will grow by 4.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.3% today to 11.1% in 3 years time.

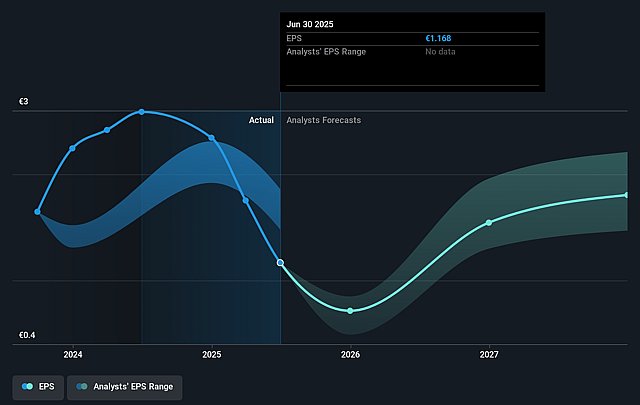

- The bullish analysts expect earnings to reach €267.1 million (and earnings per share of €2.41) by about September 2028, up from €132.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.2x on those 2028 earnings, down from 8.9x today. This future PE is lower than the current PE for the GB Construction industry at 14.2x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.23%, as per the Simply Wall St company report.

Fugro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerated shift towards autonomous and satellite-based survey technologies poses a structural threat to Fugro's traditional geotechnical and offshore survey services, potentially shrinking its long-term addressable market and risking future declines in revenue and market share.

- Persistent pricing pressures and commoditization in geo-data collection, driven by digital disruption and agile, tech-enabled competitors (especially those leveraging AI and machine learning for subsurface analysis), could erode Fugro's competitive edge and compress margins, thereby limiting long-term profitability and ability to maintain healthy net earnings.

- Heavy reliance on the oil and gas sector-and the shift in backlog composition away from renewables toward more oil and gas and infrastructure work-exposes Fugro to the secular decline of fossil fuel investments, increasing earnings volatility and reducing visibility on multi-year revenue growth.

- The capital-intensive nature of Fugro's business, highlighted by high and sustained levels of investment in vessels, equipment, and fleet upgrades, combined with the risk of asset obsolescence as new technologies emerge, may pressure net margins through rising depreciation costs and increased capital risk, especially if revenue growth falters.

- Ongoing operational and industry headwinds in core end-markets-including decelerating offshore wind investments, regulatory risk in major regions, and slow growth or recessionary trends in global infrastructure and construction-threaten to undermine future revenue streams and make earnings more cyclical and unpredictable over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fugro is €15.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fugro's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.0, and the most bearish reporting a price target of just €10.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €2.4 billion, earnings will come to €267.1 million, and it would be trading on a PE ratio of 7.2x, assuming you use a discount rate of 7.2%.

- Given the current share price of €10.6, the bullish analyst price target of €15.0 is 29.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.