Key Takeaways

- Shrinking demand in offshore wind and client adoption of autonomous tech threaten Fugro's market share and future revenue growth.

- Ongoing high investment and regulatory pressures risk continual margin volatility, weaker profitability, and increased challenges from innovative competitors.

- Flexible asset allocation, cost reductions, and strategic tech investments are driving improved margins, diversified growth, revenue stability, and industry leadership despite changing sector dynamics.

Catalysts

About Fugro- Provides geo-data services for the infrastructure, energy, and water industries in Europe, Africa, the Americas, the Asia Pacific, the Middle East, and India.

- The sustained and accelerating contraction in offshore wind markets, particularly in the U.S. and Europe, severely undermines Fugro's future growth prospects by eroding its largest secular demand driver; ongoing recalibration and regulatory uncertainty in wind will likely result in multi-year pressure on revenue and backlog composition.

- Structural shifts in client preferences, driven by advancements in autonomous survey and remote sensing technologies, are enabling customers to internalize more geo-data acquisition and analysis, which will erode Fugro's long-term market share and limit top line revenue growth potential.

- The heavy, ongoing investment in proprietary vessels, robotics, and uncrewed surface vessels-amid revenue headwinds and a high-fixed-cost operating structure-risks depressingly low free cash flow, elevated net leverage, and persistent margin volatility if demand does not fully rebound as projected.

- Greater regulatory scrutiny and rising compliance costs associated with stricter environmental regulations for offshore operations will place persistent downward pressure on EBIT margins and profitability, while also increasing the risk of project delays and cancellations in Fugro's core markets.

- Intensifying competition from both traditional industry players and nimble tech-driven start-ups-including satellite data providers and drone-based survey operations-threatens to further compress pricing and margins across Fugro's geotechnical and asset integrity services, undermining long-term EPS growth.

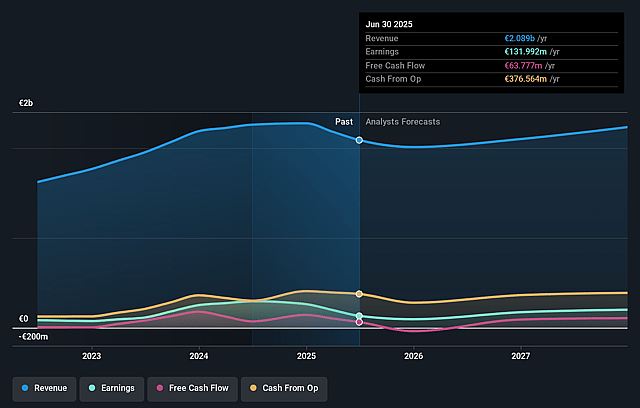

Fugro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Fugro compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Fugro's revenue will decrease by 0.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.3% today to 7.2% in 3 years time.

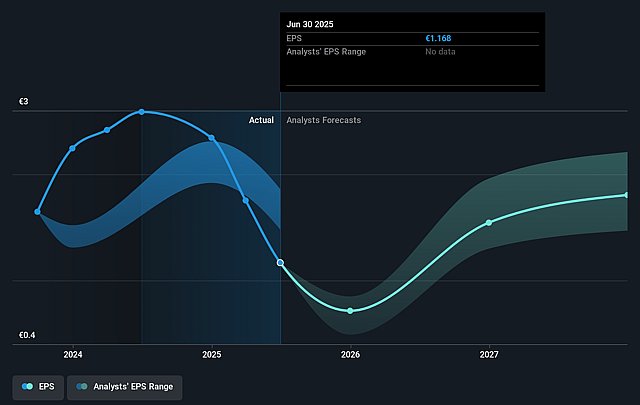

- The bearish analysts expect earnings to reach €150.2 million (and earnings per share of €1.31) by about September 2028, up from €132.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, down from 9.6x today. This future PE is lower than the current PE for the GB Construction industry at 13.5x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

Fugro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fugro's ability to reallocate assets and personnel between markets has enabled a rapid pivot from renewables to oil and gas and infrastructure projects, and strong recent contract wins-including multi-year, large-scale projects with Eni Indonesia and Petrobras Brazil-are increasing revenue visibility and will support both top-line recovery and earnings stability.

- The introduction of an €80–100 million structural cost reduction program and successful refinancings are expected to yield significant improvement in net margins and free cash flow, particularly as these cost savings take full effect in the second half and beyond.

- Long-term secular trends, such as growing global energy demand (driven by infrastructure for a growing population and data centers supporting AI and digitalization), will underpin steady expansion of Fugro's core segment revenues and buffer against individual sector downturns.

- Fugro's ongoing investment in proprietary technology-including autonomous vessels, advanced robotics, and new geophysical and geotechnical solutions-positions the company at the forefront of its industry and is likely to support a long-term improvement in operating margins, thanks to both efficiency gains and the potential for higher-margin, differentiated service offerings.

- A robust backlog of €1.5 billion-now more diversified across end markets and regions-demonstrates resilience in Fugro's business model, improves revenue visibility, and reduces cyclicality, with new management in key regions expected to further optimize execution and margin conversion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Fugro is €10.32, which represents two standard deviations below the consensus price target of €13.67. This valuation is based on what can be assumed as the expectations of Fugro's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.0, and the most bearish reporting a price target of just €10.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €2.1 billion, earnings will come to €150.2 million, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 7.3%.

- Given the current share price of €11.49, the bearish analyst price target of €10.32 is 11.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.