Key Takeaways

- Accelerated synergy realization and digital innovation are set to boost profitability, deepen efficiency, and expand KFH's market leadership in high-growth Islamic banking segments.

- Strategic expansion and strong deposit base uniquely position KFH to capture rising demand from regional investments and global Sharia-compliant banking growth.

- Heavy sector concentration, rising costs, digital competition, and capital pressures make future earnings vulnerable to market downturns, regulatory changes, and slow digital transformation.

Catalysts

About Kuwait Finance House K.S.C.P- Provides Islamic banking products and services in the Middle East, Europe, and internationally.

- Analyst consensus expects synergy realization from the Ahli United Bank integration in 2025, but current momentum in group-wide operational centralization and rebranding could deliver significantly larger and faster cost and revenue synergies-driving sustained double-digit net profit growth and meaningfully higher net margins from 2025 onwards.

- While broader expectations center on single-digit loan growth and moderate margin improvement, KFH's aggressive regional expansion, successful anchoring of CASA deposits exceeding 45%, and clear leadership in digital Islamic banking position it for outsized share gains in high-growth GCC markets, amplifying revenue growth and supporting above-peer returns on equity.

- KFH is uniquely positioned to capitalize on the projected multi-trillion dollar expansion in Islamic banking by leveraging its established pan-GCC and international presence, leading to structural gains in fee, commission, and investment income as Sharia-compliant banking adoption accelerates globally.

- The Group's successful early adoption of open banking and rollout of AI-powered digital services like 'Fahad' will not only broaden the customer base-especially among the underpenetrated youth-but will also drive substantial operational efficiencies that lower the cost-to-income ratio and improve profitability at scale.

- With Kuwait and GCC governments sharply ramping up infrastructure, housing, and energy investments, and new legal reforms (including the mortgage law) expected to unlock massive demand for housing finance and project funding, KFH's established dominance in large syndications and Islamic project finance will deliver structurally higher, recurring loan growth-firmly supporting top-line revenue and long-term earnings stability.

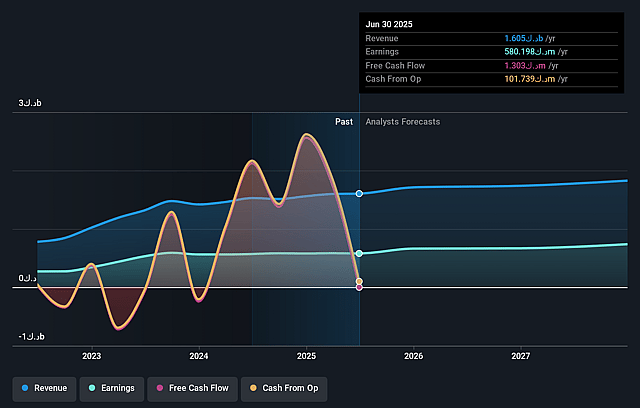

Kuwait Finance House K.S.C.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Kuwait Finance House K.S.C.P compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Kuwait Finance House K.S.C.P's revenue will grow by 6.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 36.1% today to 46.0% in 3 years time.

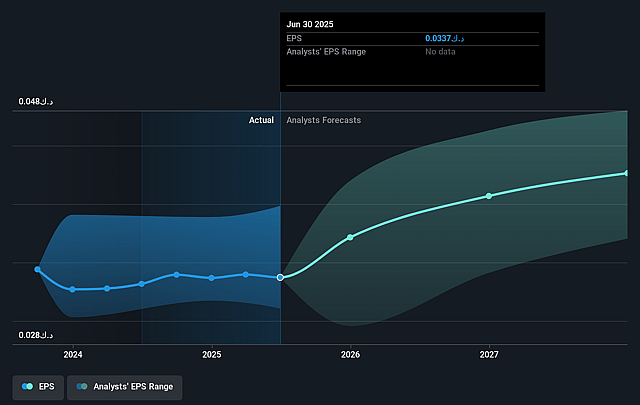

- The bullish analysts expect earnings to reach KWD 897.6 million (and earnings per share of KWD 0.05) by about August 2028, up from KWD 580.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.8x on those 2028 earnings, up from 23.9x today. This future PE is greater than the current PE for the KW Banks industry at 24.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.66%, as per the Simply Wall St company report.

Kuwait Finance House K.S.C.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has experienced increased operating expenses and a rise in total impairment charges, with provision charges and taxes partly offsetting growth in profits, suggesting that future earnings could be constrained if macroeconomic volatility or credit losses increase further and lead to higher provisioning requirements.

- KFH's continued reliance on strong loan book growth and its significant exposure to the local real estate and corporate finance sectors create concentration risks, which could result in increased default rates and higher loan loss provisions in the event of a property market downturn, negatively impacting future net earnings.

- Although KFH highlights digital innovation, it faces the risk that global acceleration in fintech and digital banking adoption could erode its market share if its digital transformation efforts fall behind competitors, potentially limiting future revenue growth and reducing fee-based income streams.

- The bank's expanding international footprint and cross-border strategy are vulnerable to heightened geopolitical instability in the Middle East and tighter regulatory scrutiny on cross-border flows, both of which could elevate compliance costs, deter international business, and compress profit margins over time.

- The decrease in CET1 and capital adequacy ratios amid asset growth could pressure the company's ability to absorb future shocks, especially as rising global interest rate volatility and competition from both conventional and non-bank financial institutions in the region may contribute to margin compression and more volatile earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Kuwait Finance House K.S.C.P is KWD0.8, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kuwait Finance House K.S.C.P's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KWD0.8, and the most bearish reporting a price target of just KWD0.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be KWD1.9 billion, earnings will come to KWD897.6 million, and it would be trading on a PE ratio of 26.8x, assuming you use a discount rate of 20.7%.

- Given the current share price of KWD0.81, the bullish analyst price target of KWD0.8 is 1.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.