Last Update 07 Nov 25

Fair value Increased 2.33%KFH: Rising Discount Rate And Profit Margin Erosion Will Pressure Valuation

Analysts have raised their price target for Kuwait Finance House K.S.C.P. from KWD 0.68 to KWD 0.70. They attribute this change to incremental improvements in expected fair value and ongoing optimism regarding the bank’s financial outlook.

What's in the News

- NCR Atleos Corporation and Kuwait Finance House have launched conversational AI-powered avatars at bank branches, delivering real-time, personalized customer assistance and setting a new standard in digital banking experience (Client Announcements).

- The board of Kuwait Finance House is scheduled to meet on October 9, 2025, to review and approve the interim financial results for the nine months ending September 30, 2025 (Board Meeting).

- Mr. Abdulkarim Abdullah Abdulkarim Alsamdan has been appointed as Group Chief Financial Officer of Kuwait Finance House, effective August 17, 2025, after receiving approval from the Central Bank of Kuwait (Executive Changes: CFO).

Valuation Changes

- Fair Value Estimate has risen slightly, moving from KWD 0.684 to KWD 0.700.

- Discount Rate has edged up from 20.03 percent to 20.07 percent.

- Revenue Growth Projections have been revised minimally higher, remaining at 4.95 percent.

- Net Profit Margin has decreased marginally, remaining at 38.53 percent.

- Future P/E Ratio has increased from 27.73x to 28.41x.

Key Takeaways

- Expectations for strong loan growth and fee income may be too high, given potential volatility in regional infrastructure spending and uncertain investment pipelines.

- Confidence in competitive advantage from digital transformation and deposit base could be challenged by execution risks and fintech competition, possibly impacting net margins.

- Strong operational resilience, digital innovation, and expanded international presence position KFH for sustained growth, diversified revenues, and robust financial stability amidst favorable regional trends.

Catalysts

About Kuwait Finance House K.S.C.P- Provides Islamic banking products and services in the Middle East, Europe, and internationally.

- Investors may be excessively optimistic about KFH's ability to capitalize on strong project momentum in Kuwait and the wider GCC-assuming continued government infrastructure spending and economic diversification will ensure robust loan growth and rising fee-based income, even though regional growth and investment pipeline could be volatile, impacting future revenue.

- There is an expectation that KFH's digital transformation-highlighted by initiatives like the AI-powered virtual assistant and enhanced digital onboarding-will deliver a decisive competitive edge in customer acquisition and operational efficiency, but execution risk remains if digital-first competitors accelerate, potentially putting net margin forecasts at risk.

- Current valuation may rely on uninterrupted benefit from KFH's large pool of low-cost CASA deposits and a growing regional deposit base; however, increasing competition from fintechs and alternative Shariah-compliant platforms could erode this advantage and pressure funding costs, ultimately threatening net interest margins.

- Investors might be overestimating the ongoing positive impact of KFH's international expansion and post-merger integration synergies, assuming seamless operational unification and cross-market growth will offset local market slowdowns; integration challenges or underperformance in key geographies such as Turkey could constrain earnings growth.

- The market appears to be pricing in a sustained improvement in non-interest revenue streams through Sharia-compliant financial innovation and cross-border digital financial services, but intensifying regulatory and pricing pressure in Islamic banking could limit future net margin expansion and dampen profit growth.

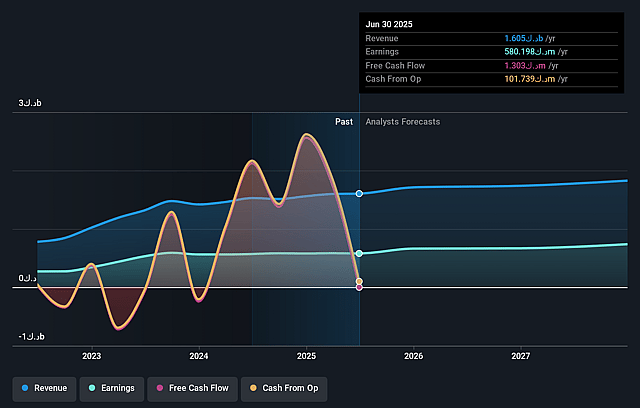

Kuwait Finance House K.S.C.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kuwait Finance House K.S.C.P's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 36.1% today to 41.9% in 3 years time.

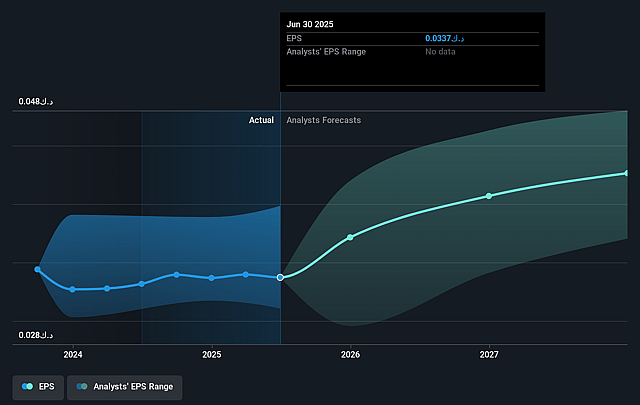

- Analysts expect earnings to reach KWD 786.0 million (and earnings per share of KWD 0.04) by about September 2028, up from KWD 580.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as KWD650 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.5x on those 2028 earnings, up from 22.7x today. This future PE is greater than the current PE for the KW Banks industry at 23.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.66%, as per the Simply Wall St company report.

Kuwait Finance House K.S.C.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- KFH's continued strong financial performance, highlighted by solid operating income growth (6.4%), expanding net financing income (8.7%), and improving cost-to-income ratios, signals operational resilience and market leadership, which, if sustained in coming years, may support revenue and earnings growth.

- The group's substantial capital adequacy ratio (18.01%) and high provision coverage (253% for nonperforming financing) provide a robust buffer against credit shocks and regulatory tightening, suggesting that KFH is well-positioned to maintain financial stability and protect net margins.

- Accelerated digital transformation-including the launch of Kuwait's first AI-powered virtual bank assistant and significant enhancements to the KFH online app-augments operational efficiency, broadens customer acquisition channels, and potentially supports fee-based income growth, thereby bolstering future revenue and profitability.

- Successful execution of integration strategies following the acquisition and rebranding of Ahli United Bank Bahrain, alongside expanded synergies across international operations (Turkey, Egypt, UK), increases business scale and diversifies revenue streams, thereby reducing reliance on Kuwait and supporting long-term earnings stability.

- Ongoing regional economic momentum-exemplified by a surge in awarded infrastructure contracts (+37.5% YoY), government reforms to unlock private sector growth, and increased access to Sharia-compliant housing finance-creates sustained credit demand, supporting KFH's loan book growth, asset expansion, and strengthening its potential to achieve above-average net profit and operating income over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of KWD0.664 for Kuwait Finance House K.S.C.P based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KWD0.8, and the most bearish reporting a price target of just KWD0.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be KWD1.9 billion, earnings will come to KWD786.0 million, and it would be trading on a PE ratio of 25.5x, assuming you use a discount rate of 20.7%.

- Given the current share price of KWD0.77, the analyst price target of KWD0.66 is 15.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.