Last Update 21 Dec 25

Fair value Decreased 14%KFH: Future Earnings Multiple Compression Will Likely Outweigh AI Branch Avatar Upside

Analysts have modestly lowered their 12 month price target for Kuwait Finance House K.S.C.P., reflecting slightly softer assumptions for fair value, revenue growth and future earnings multiples while largely maintaining their profit margin outlook.

What's in the News

- Kuwait Finance House is collaborating with NCR Atleos to roll out AI powered video avatars at in branch kiosks, providing real time, personalized support and the ability to escalate to live agents when needed (Client Announcements)

- The Atleos partnership includes AI driven speech analytics and automated quality management, allowing KFH to track customer sentiment, categorize topics, and optimize service quality across its network (Client Announcements)

- KFH is positioning itself as a digital transformation leader in Kuwait by using AI avatars to improve operational efficiency, reduce branch costs, and free human staff to focus on more complex customer needs (Client Announcements)

- The Board of Directors has scheduled a meeting on October 9, 2025 to review and approve interim financial results for the nine months ended September 30, 2025 (Board Meeting)

Valuation Changes

- Fair Value Estimate was reduced modestly from KWD 0.271 to KWD 0.234 per share, implying a slightly lower central valuation scenario.

- The Discount Rate eased slightly from 20.78 percent to 20.09 percent, reflecting a marginally lower perceived risk or cost of equity.

- Revenue Growth was trimmed from 3.64 percent to 3.16 percent, indicating a more cautious view on top line expansion.

- The Net Profit Margin was essentially unchanged, moving fractionally from 38.55 percent to 38.46 percent, signaling a stable profitability outlook.

- The Future P/E was lowered meaningfully from 11.94x to 10.01x, pointing to a more conservative multiple applied to forward earnings.

Key Takeaways

- Overreliance on hydrocarbon-focused markets and regional loan exposure threatens asset quality and revenue as energy transitions accelerate and economic shocks persist.

- Increased digital competition, integration risks from recent mergers, and rising regulatory costs could erode market share, elevate expenses, and compress future profitability.

- Robust digital transformation, regional expansion, and strategic integration efforts are driving operational efficiency, earnings diversification, and strong long-term growth prospects.

Catalysts

About Kuwait Finance House K.S.C.P- Provides Islamic banking products and services in the Middle East, Europe, and internationally.

- Kuwait Finance House faces heightened long-term risk from Kuwait's concentrated dependence on hydrocarbons, as the global push towards renewable energy and declining fossil fuel demand threaten to suppress economic GDP growth, ultimately undermining credit demand, loan book expansion, and fee-generating activities in the years ahead, which could dampen both revenue and net earnings.

- Intensifying digital disruption across the Middle East, with agile fintechs and non-bank Islamic finance providers scaling up customer acquisition, places KFH at serious risk of losing market share and eroding its traditional customer deposit base if it fails to continuously innovate and respond nimbly, creating persistent downward pressure on core revenues and profitability.

- Despite KFH's claims of successful integration, significant ongoing merger risks from the union with Ahli United Bank-including cultural alignment, process harmonization, and systems integration-could result in sustained operational inefficiencies and elevated costs, which may compress future net margins and suppress return on equity over the long term.

- The bank's loan book remains heavily exposed to Kuwait and Turkey, particularly in the real estate and corporate segments, which not only increases susceptibility to region-specific economic shocks but also raises the likelihood of higher impairment charges and reduced asset quality, ultimately weighing on the company's net profits.

- Expected tightening in regional regulatory requirements, including tougher capital and Shariah compliance standards, will likely drive up compliance and capital buffer costs for KFH, constraining future earnings growth and potentially diminishing shareholder returns as elevated expenses persist.

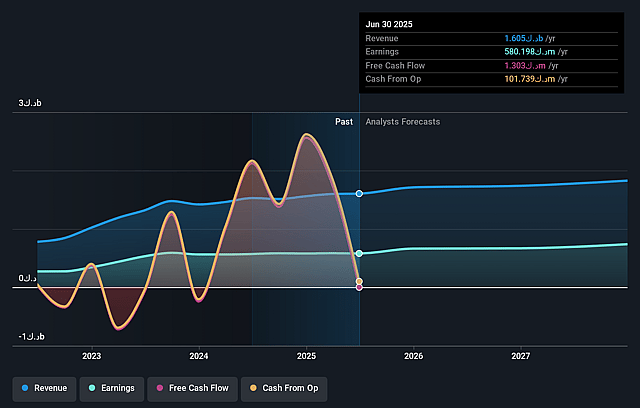

Kuwait Finance House K.S.C.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kuwait Finance House K.S.C.P compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kuwait Finance House K.S.C.P's revenue will grow by 3.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 36.1% today to 38.5% in 3 years time.

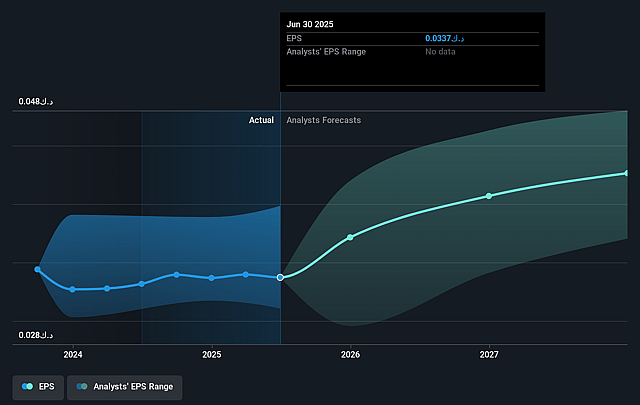

- The bearish analysts expect earnings to reach KWD 688.7 million (and earnings per share of KWD 0.04) by about September 2028, up from KWD 580.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, down from 23.6x today. This future PE is lower than the current PE for the KW Banks industry at 24.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.78%, as per the Simply Wall St company report.

Kuwait Finance House K.S.C.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kuwait Finance House's market capitalization grew by nearly 23 percent to 14.4 billion Kuwaiti Dinar, highlighting robust investor confidence in its strategy, which could signal sustained or rising share prices as capital inflows and market interest support valuation.

- The bank demonstrated strong growth in core financials, with net financing income, total operating income, and net operating income each increasing by over 6 percent compared to the prior year, signaling ongoing revenue and earnings momentum that contradicts share price decline expectations.

- Accelerated digital transformation initiatives, such as the launch of Kuwait's first AI-powered virtual bank assistant and one of the region's most comprehensive digital banking apps, position KFH to improve operational efficiency and expand its customer base, likely enhancing future profit margins and topline.

- Expansion across regional and international markets, successful integration of recent acquisitions, and rebranding initiatives are driving operational synergies and diversification, lowering earnings volatility and opening new revenue streams that support long-term earnings growth.

- KFH's strong capital position, with an 18.01 percent capital adequacy ratio and high NPL provision coverage of 253 percent, provides resilience and strategic flexibility for further investment and growth, reducing downside risk to earnings and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kuwait Finance House K.S.C.P is KWD0.27, which represents two standard deviations below the consensus price target of KWD0.66. This valuation is based on what can be assumed as the expectations of Kuwait Finance House K.S.C.P's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KWD0.8, and the most bearish reporting a price target of just KWD0.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be KWD1.8 billion, earnings will come to KWD688.7 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 20.8%.

- Given the current share price of KWD0.8, the bearish analyst price target of KWD0.27 is 193.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Kuwait Finance House K.S.C.P?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.