Last Update05 Sep 25

With both the discount rate and future P/E ratio for SK Telecom remaining effectively unchanged, analysts see no meaningful shift in valuation, as reflected in the stable consensus price target of ₩61,146.

What's in the News

- SK Telecom lowered its 2025 earnings guidance, forecasting operating revenue of KRW 17.0 trillion and an operating profit decline versus 2024, factoring in a KRW 500 billion customer appreciation package following a cybersecurity incident.

- The company has resumed new mobile service subscriptions after completing USIM card replacements for most affected customers and securing adequate inventory.

- Reported a TWD 359 million impairment loss on property, equipment, and intangible assets for Q1 2025.

Valuation Changes

Summary of Valuation Changes for SK Telecom

- The Consensus Analyst Price Target remained effectively unchanged, at ₩61146.

- The Discount Rate for SK Telecom remained effectively unchanged, moving only marginally from 7.09% to 7.04%.

- The Future P/E for SK Telecom remained effectively unchanged, moving only marginally from 11.90x to 11.88x.

Key Takeaways

- Growth in AI, cloud, and data demand positions SK Telecom for expanded margins and new revenue streams through premium services and advanced connectivity infrastructure.

- Strategic partnerships, regulatory support, and emphasis on cybersecurity enable stronger brand reputation, B2B diversification, and more stable revenue amid evolving digital trends.

- Persistent customer churn, costly cybersecurity fallout, and competitive pricing pressures threaten recovery of margins, even as risky AI and data center investments aim to offset legacy business declines.

Catalysts

About SK Telecom- Engages in the provision of wireless telecommunication services in South Korea.

- The rapid proliferation of AI and data-driven applications is driving robust demand for hyperscale data centers and advanced connectivity infrastructure, positioning SK Telecom to benefit from long-term secular growth in AI computing and cloud adoption as evidenced by rising AI/data center revenue and the upcoming Ulsan AI Data Center-potentially boosting revenue and expanding operating margins over time.

- Increased adoption of digital consumption, remote work, and streaming is fueling sustained growth in data demand, which enables SK Telecom to sustain and ultimately grow ARPU through premium 5G offerings and network upgrades-supporting top-line growth and margin recovery as the subscriber base stabilizes post-incident.

- Strategic investments and partnerships, such as collaboration with AWS on AI data infrastructure and SK Telecom's involvement in sovereign AI projects, are expected to unlock new high-margin B2B and enterprise opportunities, accelerating revenue diversification and supporting long-term earnings expansion.

- Execution of the Information Protection Innovation Plan-including significant investment in cybersecurity and customer assurance programs-is set to restore customer trust and strengthen brand reputation, aiding in subscriber recovery and stabilizing revenue streams by minimizing future churn risk.

- Regulatory tailwinds-including strong government backing for AI and digital infrastructure in South Korea-should facilitate capital investment, enhance competitive positioning, and provide a more supportive environment for long-term revenue and EPS growth in SK Telecom's core and emerging businesses.

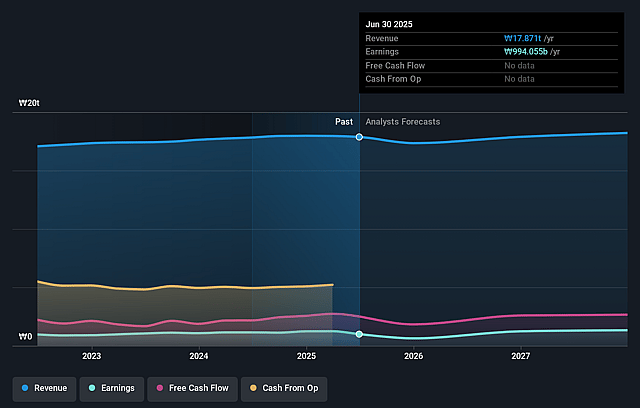

SK Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SK Telecom's revenue will grow by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.6% today to 7.3% in 3 years time.

- Analysts expect earnings to reach ₩1344.4 billion (and earnings per share of ₩6240.44) by about September 2028, up from ₩994.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩1513.0 billion in earnings, and the most bearish expecting ₩1120.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from 11.7x today. This future PE is lower than the current PE for the GB Wireless Telecom industry at 18.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.09%, as per the Simply Wall St company report.

SK Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant cybersecurity incident has led to subscriber losses, lower revenues, and higher one-off costs, and there is a risk that ongoing investments in information protection and customer incentives (e.g., heavy tariff discounts, compensation programs, USIM replacements) could create a prolonged drag on net margins and earnings if customer trust and the subscriber base are slow to recover.

- The large-scale investment into information protection (₩700 billion over five years) and substantial new AI/data center CapEx, alongside only partial offset from new AI business revenues, could strain free cash flow and challenge the company's ability to maintain both high dividend payouts and margin expansion, directly impacting net income and shareholder returns.

- The notable net loss of MNO subscribers (handset subscriber base shrinking by 750,000) and declining 5G, broadband, and IPTV users following the incident highlight the risk that sustained customer churn and slow market share recovery could depress long-term core telecom revenues and ARPU, particularly in a highly saturated and competitive South Korean market.

- Continuing dependence on customer-facing promotions (e.g., heavy discounts, restored membership benefits, newly allowed handset subsidies) to win back users may pressure operating margins, especially if competitive responses from other telcos or the abolition of the handset subsidy law trigger additional industry-wide price competition, impairing profitability.

- While the AI and data center businesses promise growth, there is execution risk: delays, underperformance, or failure to scale these new revenue streams could leave SK Telecom exposed to a structural decline in high-margin legacy businesses and regulatory challenges, with slow replacement of lost earnings from telecom operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩61146.154 for SK Telecom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩78000.0, and the most bearish reporting a price target of just ₩42000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩18463.4 billion, earnings will come to ₩1344.4 billion, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.1%.

- Given the current share price of ₩54400.0, the analyst price target of ₩61146.15 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.