Key Takeaways

- Prolonged subscriber losses, regulatory pressures, and heavy capital spending threaten revenue growth, margin stability, and long-term profitability.

- Relying on AI and cloud for growth entails significant execution risk if legacy revenues decline faster than new business segments can scale.

- Strong AI-driven growth, government backing, strategic investment, and promotional flexibility are steering SK Telecom toward diversification, profitability, and recovery from declining legacy telecom revenues.

Catalysts

About SK Telecom- Engages in the provision of wireless telecommunication services in South Korea.

- The sharp decline in SK Telecom's mobile and broadband subscriber base, following the cybersecurity incident and resulting suspension of new subscriber sign-ups, may mark the start of prolonged top-line stagnation, especially considering Korea's aging and shrinking population that will likely drive continued erosion in the total addressable subscriber market and further reduce revenues over the coming years.

- Restoring customer trust after such a high-profile cybersecurity failure will require significant, sustained investment, as evidenced by the ₩700 billion long-term security program; this intensifying regulatory pressure around data privacy and information protection will not only increase compliance costs, but also heighten scrutiny and the risk of punitive government intervention, depressing net margins and future operating income.

- SK Telecom's escalating capital expenditures-across both new information protection systems and ambitious AI data center projects-poses a structural risk to free cash flow and return on invested capital, because ongoing spending for network upgrades alongside next-generation infrastructure could outpace incremental growth, particularly if diversification efforts in AI and cloud prove slow or insufficient, thereby weighing down long-term profitability.

- The commoditization of wireless connectivity, combined with rising competition from MVNOs and new tech entrants, will sustain downward pressure on ARPU and market share, especially as efforts to win back churned subscribers increasingly depend on costly pricing discounts and subsidies, resulting in persistent margin compression and lower earnings resilience.

- Heightened reliance on new business streams such as AI and cloud, while strategically important, will be accompanied by execution risk-if SK Telecom fails to scale these segments sufficiently, it will remain overexposed to declining legacy services, and the market's expectation for rapid, profitable growth from these emerging areas may not materialize, leading to disappointing future returns.

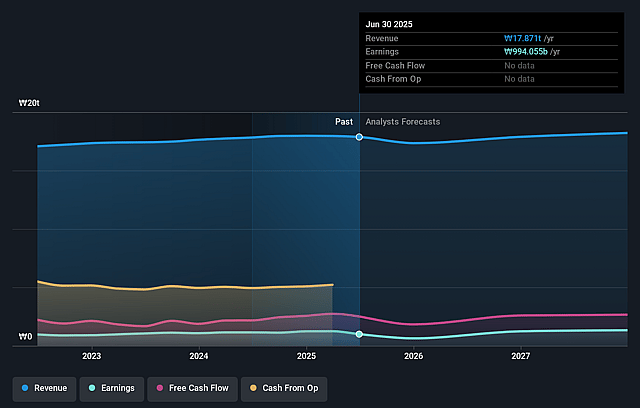

SK Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SK Telecom compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SK Telecom's revenue will decrease by 0.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.6% today to 6.9% in 3 years time.

- The bearish analysts expect earnings to reach ₩1230.0 billion (and earnings per share of ₩5719.29) by about September 2028, up from ₩994.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, down from 11.7x today. This future PE is lower than the current PE for the GB Wireless Telecom industry at 18.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

SK Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The AI business is experiencing strong growth, with year-on-year revenue increases of 13.9 percent for AI, 13.3 percent for data centers, and 15.3 percent for B2B AI solutions, all pointing toward expanding higher-margin opportunities that can offset declining legacy telecom revenues and improve overall earnings trajectory in the long term.

- SK Telecom has announced a large-scale, hyperscale AI data center project in partnership with AWS and SK Group affiliates, targeting over 300 megawatts of capacity by 2030 and expecting annual data center sales of approximately ₩1 trillion, which signals meaningful diversification of revenue streams and enhanced long-term profitability.

- The company has received significant government support, being entrusted as a core participant in national AI model initiatives and foundation model development, which may bring substantial policy and contract benefits, supporting both top-line growth and long-term earnings stability.

- There is ongoing investment in cutting-edge security and information protection, totaling ₩700 billion over five years, which is positioned not only to restore customer trust but also to establish best-in-class infrastructure, potentially reducing future risk-related expenses and supporting sustained core customer base and net margin recovery.

- With the abolition of the handset subsidy law and greater marketing autonomy, SK Telecom is implementing targeted customer win-back strategies and flexible promotions, which together with the restoration of benefits for returning subscribers can accelerate subscriber recovery and support revenue stabilization and future growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SK Telecom is ₩44354.74, which represents two standard deviations below the consensus price target of ₩61146.15. This valuation is based on what can be assumed as the expectations of SK Telecom's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩78000.0, and the most bearish reporting a price target of just ₩42000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩17765.1 billion, earnings will come to ₩1230.0 billion, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 7.0%.

- Given the current share price of ₩54800.0, the bearish analyst price target of ₩44354.74 is 23.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.