Key Takeaways

- Aggressive investment in AI, network infrastructure, and security is set to secure dominant regional market share, stronger brand trust, and premium B2B opportunities.

- Upcoming shifts in mobile subscriber strategy and regulatory changes position the company for accelerated revenue growth and long-term margin expansion.

- Mounting competitive, demographic, regulatory, and technological pressures threaten profitability, while heavy domestic reliance and costly investments strain SK Telecom's resilience and long-term growth prospects.

Catalysts

About SK Telecom- Engages in the provision of wireless telecommunication services in South Korea.

- While analyst consensus expects operational improvements to drive margin expansion for SK Telecom, the company's aggressive post-incident security reinvestment and customer assurance measures position it for a dramatic restoration of subscriber trust and accelerated market share recovery, implying a faster-than-expected rebound in both revenue and net income margins.

- Analysts broadly agree the AI infrastructure buildout will drive new revenue, but the scale of the Ulsan hyperscale AI data center partnership with AWS-combined with significant first-mover advantages and expected government support for national AI initiatives-could establish SK Telecom as the dominant regional AI compute provider, far surpassing current revenue and earnings expectations from AI by 2030.

- SK Telecom's rare opportunity to regain over 1 million churned mobile subscribers, with the elimination of handset subsidy regulation and highly personalized win-back marketing, could create a near-term spike in ARPU and drive outsized growth in both top-line revenue and customer lifetime value.

- The company's integration across telecom, cloud, and sovereign AI capability through exclusive government projects positions it at the heart of Korea's digital transformation, ensuring long-term prioritization in national tech infrastructure contracts and premium B2B platform opportunities-translating into sustained higher-margin revenue.

- The exponential growth in connected devices, IoT, and data traffic-coupled with SK Telecom's leadership in 5G and imminent 6G commercial rollouts-sets the stage for unprecedented demand-driven pricing power and recurring revenue uplift across both core and adjacent digital services, supporting substantial long-term earnings growth.

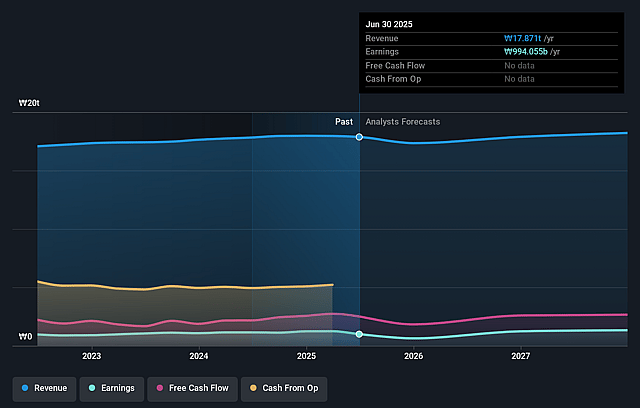

SK Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SK Telecom compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SK Telecom's revenue will grow by 4.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.6% today to 8.1% in 3 years time.

- The bullish analysts expect earnings to reach ₩1660.7 billion (and earnings per share of ₩7724.27) by about September 2028, up from ₩994.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 11.7x today. This future PE is lower than the current PE for the GB Wireless Telecom industry at 18.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

SK Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The large-scale cybersecurity incident resulted in significant subscriber loss, sustained negative publicity, costly customer assurances, and regulatory scrutiny, creating immediate downside risk to revenue, net income, and potentially long-term brand trust in a market already experiencing high competition and price sensitivity.

- Demographic decline and market maturity in South Korea mean the shrinking population and market saturation are likely to result in persistent downward pressure on SK Telecom's wireless service revenues and Average Revenue Per User, challenging sustained growth and profit margins.

- Substantial and ongoing investments in cybersecurity, customer compensation, and next-generation infrastructure such as AI data centers and 5G/6G, combined with unproven returns from nascent AI initiatives, risk eroding free cash flow and return on invested capital over the long term.

- SK Telecom's heavy reliance on its domestic market, coupled with limited international presence, heightens exposure to domestic regulatory changes, technological disruption from alternatives like satellite connectivity, and evolving consumer demands, increasing volatility in earnings and reducing resilience against local market downturns.

- The proliferation of flexible, app-driven, no-contract plans offered by competitors, and growing adoption of over-the-top media and messaging services, threaten to further commoditize SK Telecom's traditional offerings, leading to reduced pricing power, margin compression, and potential decline in core service revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SK Telecom is ₩77937.56, which represents two standard deviations above the consensus price target of ₩61146.15. This valuation is based on what can be assumed as the expectations of SK Telecom's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩78000.0, and the most bearish reporting a price target of just ₩42000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩20601.2 billion, earnings will come to ₩1660.7 billion, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of ₩54800.0, the bullish analyst price target of ₩77937.56 is 29.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.