Last Update 10 Dec 25

A181710 Share Repurchases And New Game Release Will Support Future Stability

Analysts have raised their price target on NHN to ₩30,975, a modest upward revision supported by a slightly higher long term discount rate and valuation assumptions that reflect stable revenue growth and profit margin expectations.

What's in the News

- The Board of Directors authorized a new share repurchase plan on October 23, 2025, indicating confidence in NHN's valuation and capital position (Key Developments).

- NHN launched a share buyback program to repurchase up to 478,784 shares by January 23, 2026, with the stated aim of enhancing shareholder value and stabilizing the stock price (Key Developments).

- The company reported holding 2,500,233 treasury shares available for dividend distribution as of October 22, 2025, highlighting balance sheet flexibility for capital returns (Key Developments).

- NHN announced its first official game adaptation of the anime [OSHI NO KO], titled [OSHI NO KO] Match Star, which is scheduled for global release in 2026 alongside the anime's third season (Key Developments).

Valuation Changes

- Fair Value Estimate is unchanged at ₩30,975 per share, indicating no revision to the intrinsic value assessment.

- The Discount Rate has risen slightly from 9.94 percent to about 10.03 percent, reflecting a modestly higher required return.

- Revenue Growth is effectively unchanged around 7.88 percent, signaling stable long term top line expectations.

- The Net Profit Margin is effectively unchanged at roughly 5.40 percent, suggesting consistent profitability assumptions.

- The Future P/E has risen marginally from about 7.12x to 7.14x, indicating a slightly higher valuation multiple on forward earnings.

Key Takeaways

- Expansion in games, cloud, and AI-driven platforms positions NHN for stronger growth and improved operating margins through scale and high-margin, recurring revenues.

- Streamlining underperforming divisions and strengthening digital payment offerings are expected to enhance earnings quality and drive sustainable, profitable growth.

- Heavy reliance on the domestic market, weak performance in key segments, and unprofitable ventures heighten risks to revenue stability and long-term profitability amid persistent margin pressures.

Catalysts

About NHN- An IT company, provides gaming, payment, entertainment, IT, and advertisement solutions in South Korea and internationally.

- Upcoming launches and positive user engagement in new and existing games-such as Darkest Days, ABYSSDIA, and Project STAR-indicate the potential for NHN to capture a larger share of the expanding digital entertainment market, which is likely to drive higher revenue growth and improve operating margins through increased scale.

- NHN Cloud's focus on managed private cloud services and government-led AI projects positions the company to capitalize on the growing enterprise demand for cloud and AI infrastructure, unlocking recurring and high-margin revenue streams that could bolster long-term earnings.

- Streamlining and restructuring of loss-making or low-margin businesses (notably within PAYCO and commerce/content divisions) are expected to yield a bottom-line improvement of at least ₩15–20 billion, enhancing overall net margins and earnings quality.

- The continued growth in digital payment transaction volume, particularly via PAYCO's expansion into corporate welfare and fintech solutions, aligns with rising digital transactions and supports recurring payment revenues, with a likely positive impact on revenue and margins as losses are curtailed.

- NHN's shift toward higher-value technology offerings (including collaboration tools with AI features and penetration of public/financial sector accounts via Dooray) leverages accelerating digitalization trends, setting the stage for sustainable revenue and margin growth through platform differentiation and enterprise adoption.

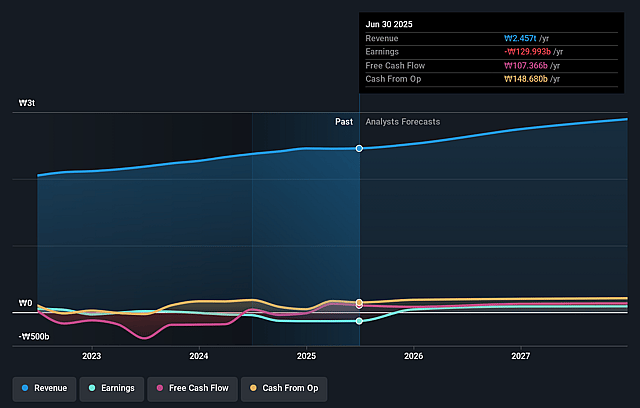

NHN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NHN's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -5.3% today to 3.2% in 3 years time.

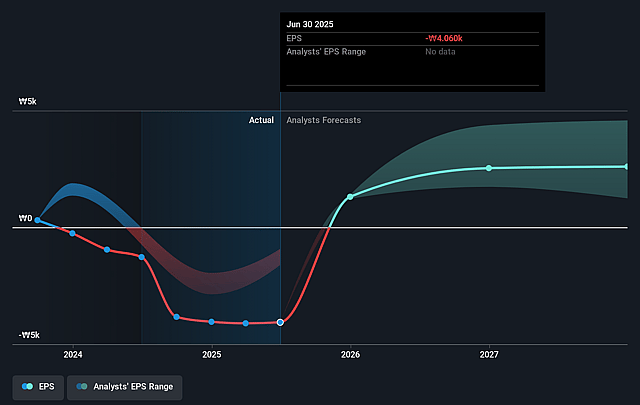

- Analysts expect earnings to reach ₩95.0 billion (and earnings per share of ₩2605.79) by about September 2028, up from ₩-130.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩143.0 billion in earnings, and the most bearish expecting ₩40.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, up from -6.1x today. This future PE is lower than the current PE for the KR Entertainment industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 1.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.35%, as per the Simply Wall St company report.

NHN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NHN's consolidated revenue fell by 0.7% year-over-year and 6.8% quarter-over-quarter in Q1 2025, with Games, Payment, and Other businesses experiencing ongoing or sequential declines-raising a risk that secular stagnation in core segments could pressure long-term revenue growth.

- NHN remains highly dependent on the domestic South Korean market, making it vulnerable to local economic downturns and regulatory shifts, which could introduce significant revenue volatility and concentration risk if international expansion efforts do not accelerate.

- Despite cost-cutting and streamlining, loss-making businesses like PAYCO and commerce/content still hinder profitability, and management acknowledges uncertainty regarding the timing and scale of bottom-line improvements, threatening future net margins and earnings stability.

- Increasing labor, marketing, and ongoing restructuring expenses, along with higher commission costs, signal that margin pressures from both competitive dynamics and business model transitions could persist or worsen, impacting operating profit margins and EBITDA.

- The tech/cloud division's Q1 revenue dropped sharply quarter-over-quarter (down 10.9%), and while government-led AI and cloud projects provide some upside, the high dependence on uncertain public sector contracts and aggressive competition from larger players may limit sustainable, recurring revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩27777.778 for NHN based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩36000.0, and the most bearish reporting a price target of just ₩20000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩3009.6 billion, earnings will come to ₩95.0 billion, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 10.3%.

- Given the current share price of ₩24800.0, the analyst price target of ₩27777.78 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on NHN?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.