Key Takeaways

- Heavy reliance on aging legacy franchises and demographic headwinds are constraining user growth, raising risks of stagnant engagement and diminished profitability.

- Cost pressures, weak global expansion, and high competition in new segments are expected to suppress margins and limit long-term earnings growth.

- Strategic franchise expansion, accelerated new title launches, operational efficiencies, and mobile market entry underpin revenue growth, improved profitability, and reduced reliance on legacy markets or titles.

Catalysts

About NCSOFT- Develops and publishes online games worldwide.

- The global gaming market is facing aging demographics and increased regulatory scrutiny, particularly in core Asian markets where NCSOFT is expanding legacy IPs like Lineage M and Lineage 2M. These shifts could limit long-term user base growth and severely constrain monetization, putting both revenue expansion and future earnings at risk.

- NCSOFT remains heavily dependent on legacy MMORPG franchises, with Lineage titles repeatedly cited as key revenue drivers. This concentration heightens vulnerability to franchise fatigue and stagnating user engagement, likely resulting in stagnating or declining recurring revenues and diminished operating leverage over time.

- Despite hyped plans for international launches and multiple new titles, the company's track record of global expansion and new IP development outside East Asia is weak. Increasing competition from global leaders and innovative indie studios is set to further erode NCSOFT's potential market share, likely suppressing revenue growth and pressuring margins.

- The push into mobile casual gaming and inorganic diversification involves high uncertainty, especially as NCSOFT is entering a fiercely competitive, trend-sensitive space with no prior success. ROIC could deteriorate as user acquisition costs and content production costs rise faster than revenue, threatening bottom line results and long-term profitability.

- Industry-wide inflation, rising labor costs, and variable global exchange rates are already weighing on costs, as highlighted by increased labor and marketing expenses. Combined with persistent high R&D and marketing spend, these operational pressures are likely to result in sustained net margin compression and lower future earnings potential.

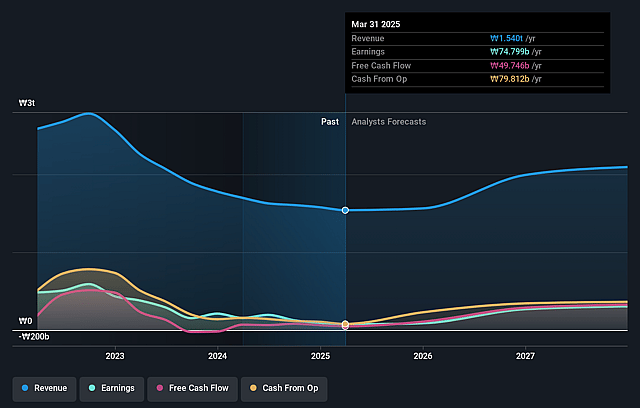

NCSOFT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on NCSOFT compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming NCSOFT's revenue will grow by 3.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -2.0% today to 10.0% in 3 years time.

- The bearish analysts expect earnings to reach ₩174.1 billion (and earnings per share of ₩13097.68) by about September 2028, up from ₩-31.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, up from -117.5x today. This future PE is greater than the current PE for the KR Entertainment industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 2.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.45%, as per the Simply Wall St company report.

NCSOFT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong momentum in both PC and mobile game sales, combined with the successful regional expansion of existing franchises such as Lineage2M and plans for further launches in China and Southeast Asia, could drive robust revenue growth and geographic diversification, mitigating overreliance on domestic markets and previous franchise fatigue concerns.

- The launch of AION 2 and an extensive pipeline of seven new titles plus four spin-offs throughout 2026, supported by positive community engagement and anticipation, suggests a potential acceleration in both user acquisition and top-line revenue, which could offset legacy IP stagnation and stimulate long-term earnings improvement.

- Implementation of a data-driven, multi-studio development approach with heightened focus on gameplay quality and team accountability is increasing development speed and efficiency, likely to shorten product cycles and improve product success rates, ultimately strengthening net margins and profitability over time.

- Expansion into the global mobile casual games sector, combined with efforts to build internal know-how, integrate AI-driven technologies, and pursue disciplined M&A, positions NCSOFT to access the fast-growing mobile market and diversify revenue streams, potentially lifting operating leverage and earnings resilience.

- Continued optimization of organizational structure, with targeted cost reduction and headcount efficiency drives, demonstrates management commitment to margin expansion, setting the stage for improved profitability even in the face of higher R&D and marketing expenditures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for NCSOFT is ₩146656.52, which represents two standard deviations below the consensus price target of ₩239592.59. This valuation is based on what can be assumed as the expectations of NCSOFT's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩310000.0, and the most bearish reporting a price target of just ₩140000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩1743.0 billion, earnings will come to ₩174.1 billion, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 9.4%.

- Given the current share price of ₩191500.0, the bearish analyst price target of ₩146656.52 is 30.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.