Last Update 12 Nov 25

Fair value Increased 2.58%A036570: Profit Margins Are Expected To Improve Amid Balanced Outlook

Analysts have raised their price target for NCSOFT from ₩239,592.59 to ₩245,769.23. This change is attributed to improved profit margin forecasts and a slightly lower discount rate, even though revenue growth expectations have moderated.

Valuation Changes

- Fair Value: Increased from ₩239,592.59 to ₩245,769.23, reflecting a modest upward adjustment.

- Discount Rate: Decreased slightly from 9.45% to 9.38%, indicating a marginally lower risk premium.

- Revenue Growth: Lowered from 14.13% to 13.65%, signaling slightly tempered growth expectations.

- Net Profit Margin: Risen modestly from 22.02% to 22.55%, suggesting improved profitability forecasts.

- Future P/E: Edged up from 10.50x to 10.63x, indicating a marginal increase in the projected price-to-earnings ratio.

Key Takeaways

- Expansion into new regions and platforms, along with AI-driven game enhancements, is broadening the customer base and diversifying revenue streams.

- Cost optimization and a shift to player-focused monetization strategies are improving profitability and supporting long-term earnings stability.

- Heavy reliance on legacy franchises, rising costs, and uncertain new title success create earnings volatility as NCSOFT faces tough competition, expansion risks, and monetization challenges.

Catalysts

About NCSOFT- Develops and publishes online games worldwide.

- Ongoing global digital adoption and increased smartphone penetration are expanding NCSOFT's total addressable market, as evidenced by strategic regional expansions of key titles (Lineage 2M into Southeast Asia and upcoming launches in China and Taiwan), which is likely to boost revenue growth and stabilize earnings through geographic diversification.

- Investment in immersive experiences, including next-generation MMORPGs and AI-driven ecosystem development (e.g., enhanced live ops for mobile casual games), positions NCSOFT to capture new audiences and drive higher ARPU, supporting sustainable top-line and margin expansion.

- Launch schedule of seven new titles and four spin-offs in 2026, in addition to high-profile releases like AION 2, provides multiple catalysts for recurring revenue and growth, especially as management pivots to lighter monetization models focused on user retention and long-term player engagement.

- Proactive cost optimization (including workforce streamlining and AI-enabled development efficiencies) is expected to improve operating leverage and net margins, especially as legacy IPs alone are currently profitable and new releases scale up.

- The push into mobile casual gaming-leveraging both internal AI/data capabilities and strategic M&A-aligns with global trends toward mass-market, cross-platform entertainment, creating new monetization avenues and incremental revenue streams beyond NCSOFT's traditional core franchises.

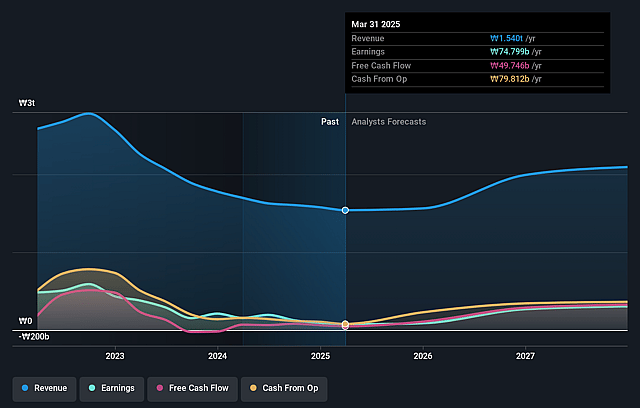

NCSOFT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NCSOFT's revenue will grow by 14.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.0% today to 22.0% in 3 years time.

- Analysts expect earnings to reach ₩508.7 billion (and earnings per share of ₩13856.91) by about September 2028, up from ₩-31.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.5x on those 2028 earnings, up from -117.5x today. This future PE is lower than the current PE for the KR Entertainment industry at 16.0x.

- Analysts expect the number of shares outstanding to decline by 2.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.45%, as per the Simply Wall St company report.

NCSOFT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy dependence on aging IPs-such as the Lineage and AION franchises-remains a key risk, as any failure of new titles to replicate their success or sustain player engagement could result in revenue stagnation or decline, negatively impacting long-term revenue streams.

- Ongoing global and regional expansion plans, particularly in highly competitive or unfamiliar markets (like mobile casual and Southeast Asia), carry significant execution risk and may result in higher user acquisition and marketing costs, putting pressure on net margins and increasing the volatility of earnings.

- Rising development and marketing expenses, evidenced by the substantial increases in operating and labor costs, could compress profitability-especially if new titles underperform or if delays and cancellations (such as the recent TACTAN drop) become more frequent, leading to earnings risk.

- Intensifying competition in the global gaming market-especially in the mobile casual segment which NCSOFT is newly entering-presents challenges in differentiating its products and capturing market share, potentially leading to reduced revenues, higher acquisition costs, and unpredictable returns on investment.

- Negative or uncertain user perception of in-game monetization models (as shown by user concerns around AION 2's business model) may limit player retention and spending, undermining efforts to build long-term, sustainable revenue streams and affecting both revenue and operating profit.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩239592.593 for NCSOFT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩310000.0, and the most bearish reporting a price target of just ₩140000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩2310.2 billion, earnings will come to ₩508.7 billion, and it would be trading on a PE ratio of 10.5x, assuming you use a discount rate of 9.4%.

- Given the current share price of ₩191500.0, the analyst price target of ₩239592.59 is 20.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.