Key Takeaways

- Rapid expansion through new game launches, global market entry, and structural innovation positions NCSOFT for sustained growth and margin improvement.

- Diversified revenue streams from mobile gaming, cross-platform strategies, and integrated IP scaling enhance long-term market reach and earnings predictability.

- Reliance on legacy IPs, slow mobile adaptation, rising costs, and outdated business models undermine NCSOFT's growth prospects and long-term revenue stability amid evolving industry dynamics.

Catalysts

About NCSOFT- Develops and publishes online games worldwide.

- While analysts broadly agree on the upside from new global titles and regional launches, they may be underestimating the impact-a record seven new game launches spaced quarterly in 2026 across core, legacy, and spin-off titles, combined with entry into China and Southeast Asia, positions NCSOFT for a dramatic acceleration in revenue and user growth, potentially surpassing sales guidance.

- The consensus sees investments in targeted IP genres and marketing strategies supporting margin improvement, but NCSOFT's rapid operational transformation-including AI-driven publishing and analytics, multi-studio independence, and game quality filters-sets the stage for a structural uplift in net margins and earnings sustainability as cost discipline and scalable development compound over time.

- NCSOFT's proactive push into the global mobile casual gaming ecosystem, with expert leadership, AI/data-centric user acquisition, and a robust M&A pipeline, unlocks access to the world's fastest-growing and most profitable gaming segment, meaningfully expanding the company's addressable market and recurring revenue streams beyond what legacy-focused forecasts capture.

- Leveraging trends of digital transformation and expanding online gaming demographics, NCSOFT's transition towards lighter, long-tail business models focused on retention and cross-platform engagement will drive higher lifetime value per user, ultimately lifting both top-line growth and the predictability of earnings.

- The company's strategy to scale IPs across gaming, streaming, and merchandise, tightly integrated with esports and community features, positions NCSOFT to become a dominant global entertainment brand, multiplying monetization vectors and supporting premium revenue and margin profiles in the long run.

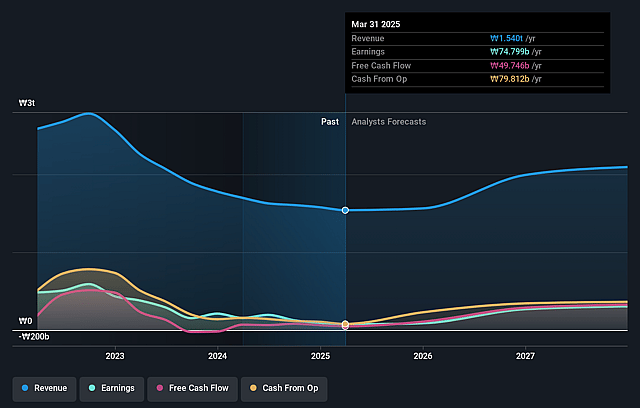

NCSOFT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NCSOFT compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NCSOFT's revenue will grow by 22.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -2.0% today to 23.2% in 3 years time.

- The bullish analysts expect earnings to reach ₩654.5 billion (and earnings per share of ₩30921.75) by about September 2028, up from ₩-31.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, up from -123.0x today. This future PE is lower than the current PE for the KR Entertainment industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 2.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.48%, as per the Simply Wall St company report.

NCSOFT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NCSOFT remains heavily reliant on aging legacy IPs like Lineage for its core earnings, with minimal evidence that new franchises or global hits are driving substantial user acquisition, jeopardizing long-term revenue stability if legacy titles decline in popularity or face regulatory hurdles.

- Despite strategic emphasis on expanding regionally and launching new games, the company's slow adaptation in the competitive mobile game market and unproven expertise in mobile casual genres expose it to significant risk of missing out on the largest and fastest-growing part of the gaming industry, threatening both revenue growth and market share.

- Operating costs, particularly labor and marketing expenses, continue to rise as NCSOFT pursues AAA-quality standards and global expansion, while efficiency gains through headcount optimization may be offset by the need for ongoing high investment in talent and compliance with data privacy regulations, placing sustained pressure on net margins.

- The company faces persistent negative perception and user skepticism over its monetization models, with specific concerns raised about the balance between user experience and profitability for new titles like AION 2; if monetization alienates players or fails regulatory scrutiny, this could materially drag on long-term user engagement and recurring earnings.

- As major platform holders tighten revenue sharing and as consumer preferences shift toward live-service and user-generated content, NCSOFT's traditional MMO-centric and publisher-dependent business model may prove increasingly obsolete, further eroding margins and hampering the company's ability to sustain profit growth in the face of global industry consolidation and intensifying competition.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NCSOFT is ₩310000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NCSOFT's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩310000.0, and the most bearish reporting a price target of just ₩140000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩2824.7 billion, earnings will come to ₩654.5 billion, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 9.5%.

- Given the current share price of ₩200500.0, the bullish analyst price target of ₩310000.0 is 35.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.